Question: FCF valuation model (like learned in Chapter 8 and used in Chapter 16).: Discount FCF at WACC and back out the equity value from the

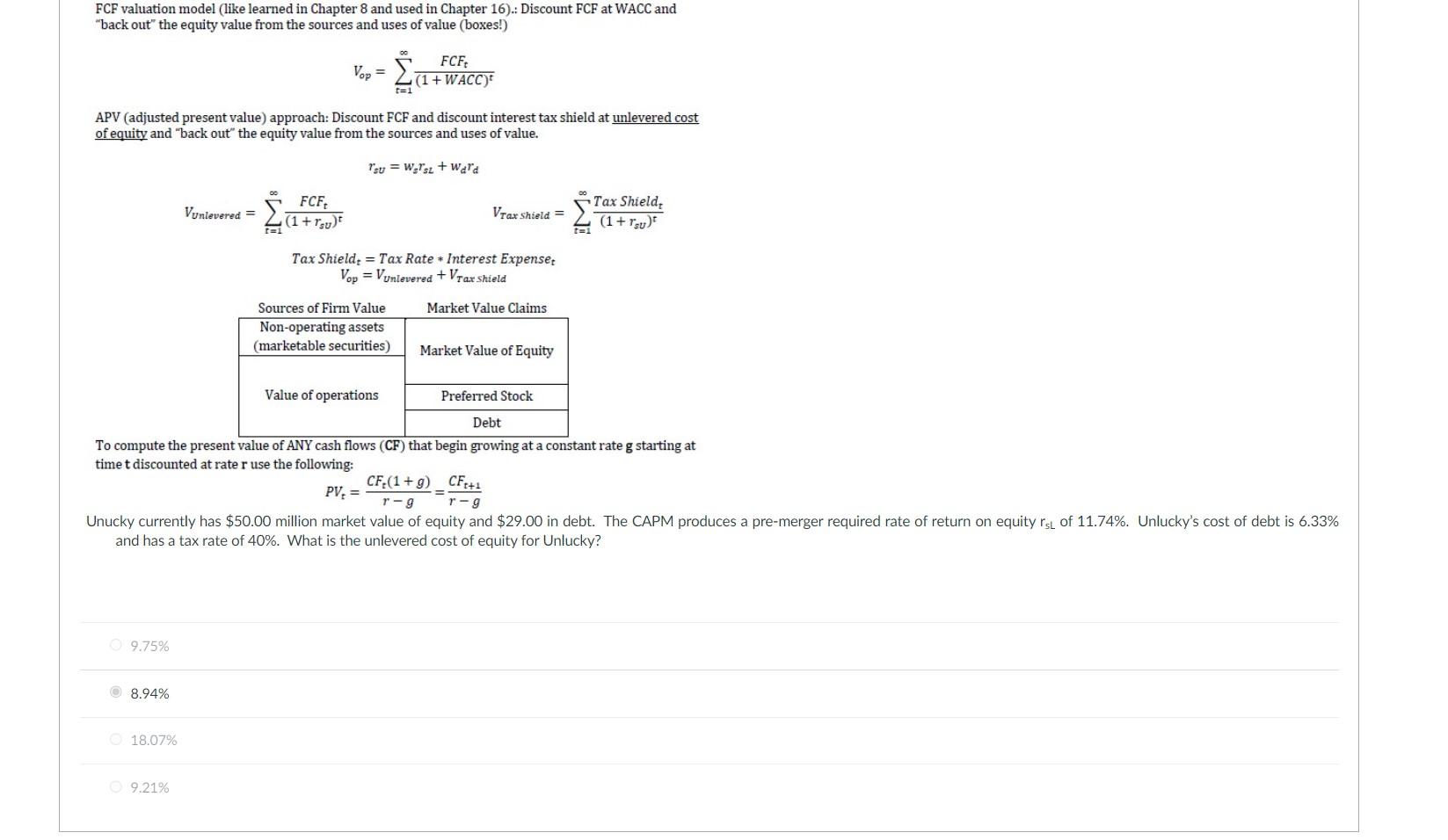

FCF valuation model (like learned in Chapter 8 and used in Chapter 16).: Discount FCF at WACC and "back out" the equity value from the sources and uses of value (boxes!) Vop=t=1(1+WACC)tFCFt APV (adjusted present value) approach: Discount FCF and discount interest tax shield at unlevered cost of equity and "back out" the equity value from the sources and uses of value. rsv=wsrsL+wdrdVUnlevered=t=1(1+rsv)tFCFtVTaxShield=t=1(1+rsv)tTaxShieldtTaxShield=TaxRateInterestExpensetVop=VUnlevered+VTaxShield To compute the present value of ANY cash flows (CF) that begin growing at a constant rate g starting at time t discounted at rate r use the following: PVt=rgCFt(1+g)=rgCFt+1 Unucky currently has $50.00 million market value of equity and $29.00 in debt. The CAPM produc and has a tax rate of 40%. What is the unlevered cost of equity for Unlucky? 9.75% 8.94% 18.07% 9.21%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts