Question: Fed announced a decrease interest rate and let's assume it's mainly driven by real interest rate. Assume investors in market becomes less risk averse. What

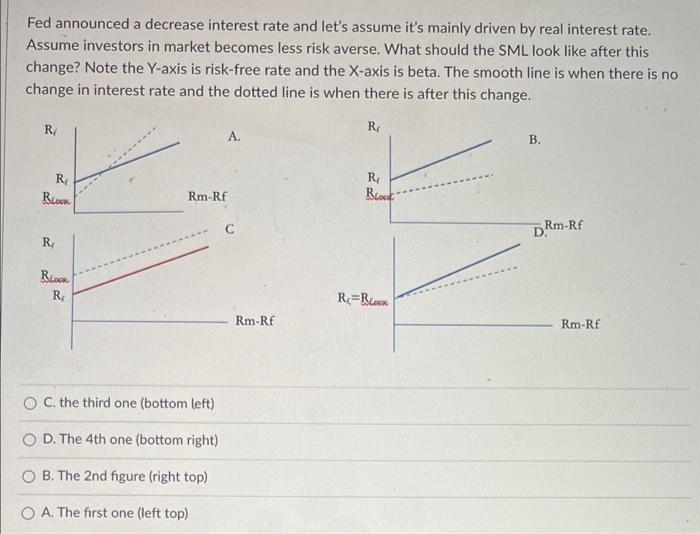

Fed announced a decrease interest rate and let's assume it's mainly driven by real interest rate. Assume investors in market becomes less risk averse. What should the SML look like after this change? Note the Y-axis is risk-free rate and the X-axis is beta. The smooth line is when there is no change in interest rate and the dotted line is when there is after this change. R R A. B. R Ri Root Ru Rm-Rf D.Rm-Rf R R.com R R=R. Rm-Rf Rm-RE O C. the third one (bottom left) D. The 4th one (bottom right) B. The 2nd figure (right top) O A. The first one (left top)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts