Answered step by step

Verified Expert Solution

Question

1 Approved Answer

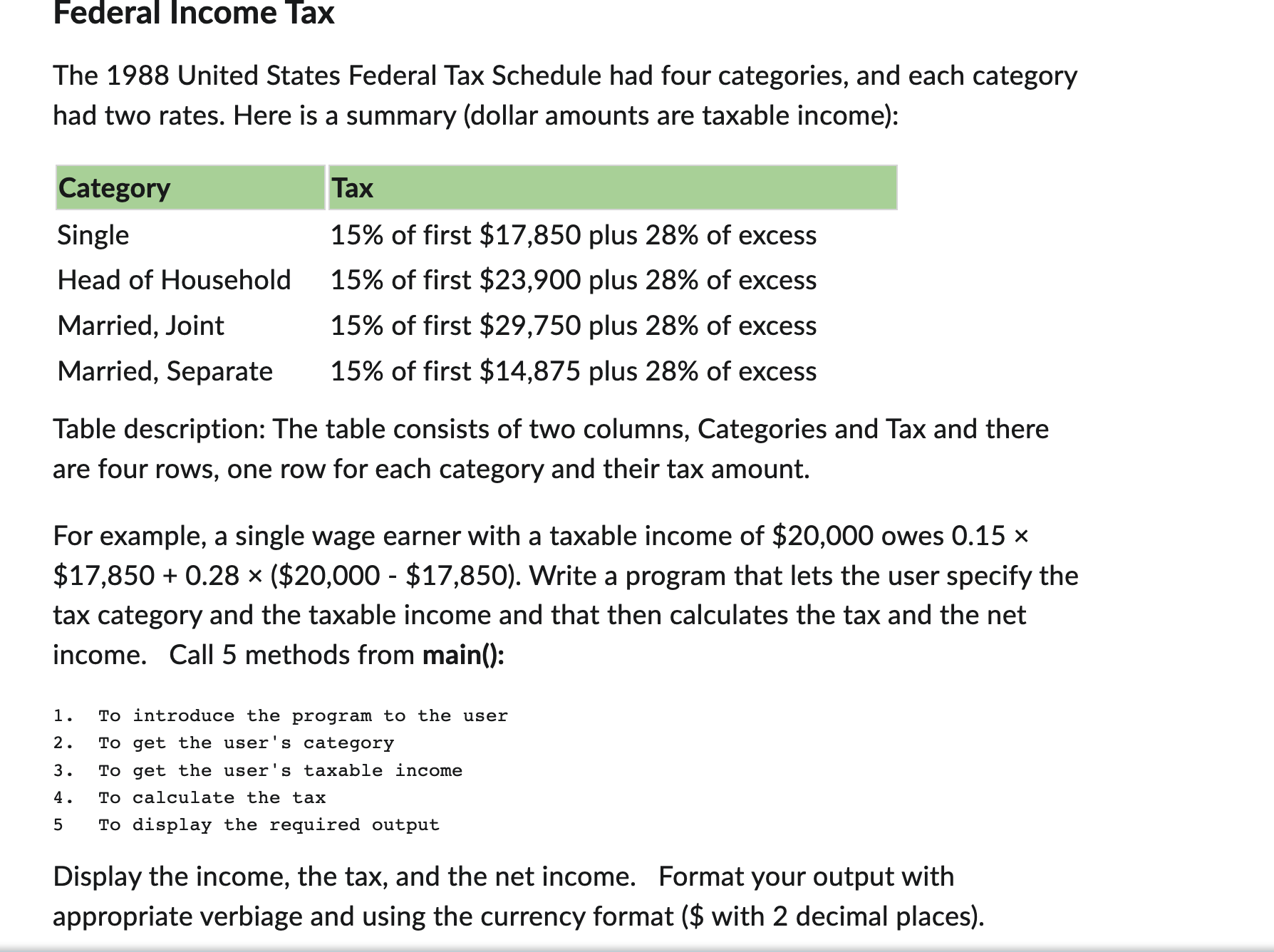

Federal Income Tax The 1988 United States Federal Tax Schedule had four categories, and each category had two rates. Here is a summary (dollar

Federal Income Tax The 1988 United States Federal Tax Schedule had four categories, and each category had two rates. Here is a summary (dollar amounts are taxable income): Category Single Head of Household Married, Joint Married, Separate Tax 15% of first $17,850 plus 28% of excess 15% of first $23,900 plus 28% of excess 15% of first $29,750 plus 28% of excess 15% of first $14,875 plus 28% of excess Table description: The table consists of two columns, Categories and Tax and there are four rows, one row for each category and their tax amount. For example, a single wage earner with a taxable income of $20,000 owes 0.15 $17,850 +0.28 ($20,000 - $17,850). Write a program that lets the user specify the tax category and the taxable income and that then calculates the tax and the net income. Call 5 methods from main(): 1. To introduce the program to the user 2. To get the user's category 3. 4. To calculate the tax 5 To get the user's taxable income To display the required output Display the income, the tax, and the net income. Format your output with appropriate verbiage and using the currency format ($ with 2 decimal places).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Below is an example Java program that calculates the federal income tax based on the given tax ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started