Question: Federal Security Devices ( FSD ) has introduced a just - in - time production process and is considering adopting lean accounting principles to support

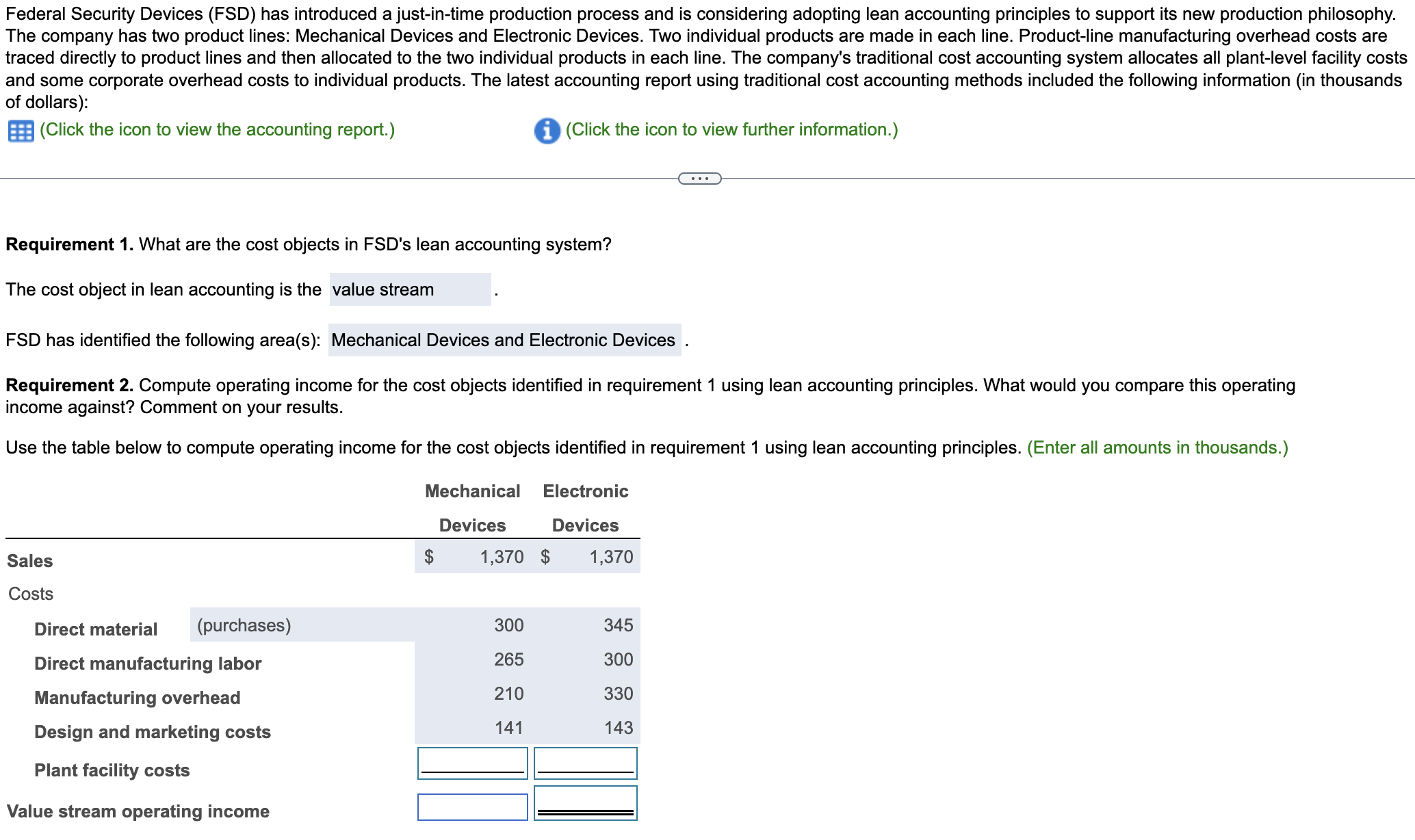

Federal Security Devices FSD has introduced a justintime production process and is considering adopting lean accounting principles to support its new production philosophy. The company has two product lines: Mechanical Devices and Electronic Devices. Two individual products are made in each line. Productline manufacturing overhead costs are traced directly to product lines and then allocated to the two individual products in each line. The company's traditional cost accounting system allocates all plantlevel facility costs and some corporate overhead costs to individual products. The latest accounting report using traditional cost accounting methods included the following information in thousands of dollars:

Click the icon to view the accounting report.

iClick the icon to view further information.

Requirement What are the cost objects in FSDs lean accounting system?

The cost object in lean accounting is the value stream

FSD has identified the following areas: Mechanical Devices and Electronic Devices

Requirement Compute operating income for the cost objects identified in requirement using lean accounting principles. What would you compare this operating income against? Comment on your results.

Use the table below to compute operating income for the cost objects identified in requirement using lean accounting principles. Enter all amounts in thousands.

Value stream operating income

Accounting report in thousands of dollars

More info

FSD has determined that each of the two product lines represents a distinct value stream. It

has also determined that out of the $$$$$ plantlevel

facility costs, product A occupies of the plant's square footage, product B occupies

product C occupies and product D occupies The remaining of square footage

is not being used. Finally, FSD has decided that in order to identify inefficiencies, direct material

should be expensed in the period it is purchased, rather than when the material is used.

According to purchasing records, direct material purchase costs during the period were

as follows:

Can you please help me solve for plant facilities costs and operating income

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock