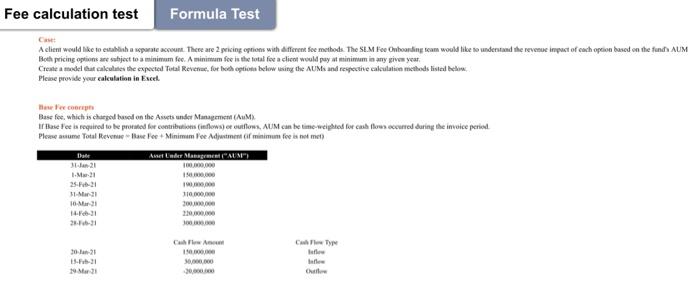

Question: Fee calculation test Formula Test Aelier would like to establish a separate account. There are 2 pricing options with different fee methods. The St. Fee

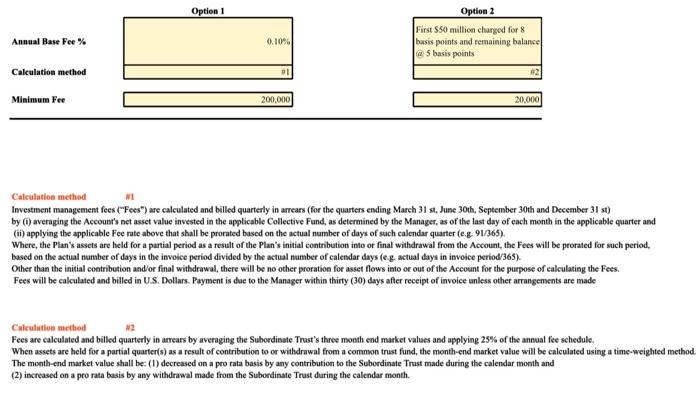

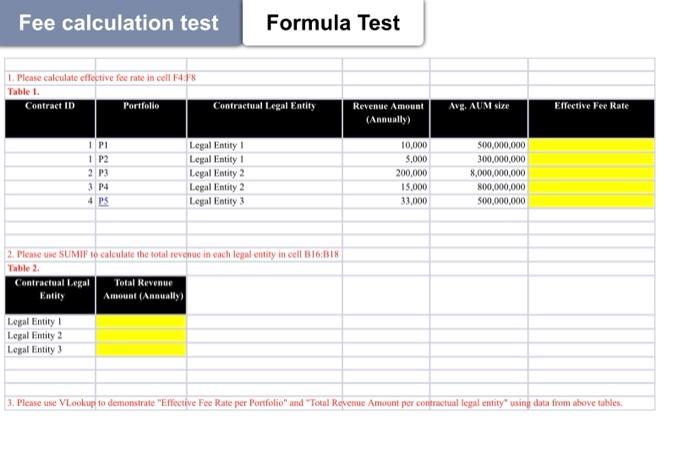

Fee calculation test Formula Test Aelier would like to establish a separate account. There are 2 pricing options with different fee methods. The St. Fee Onboarding team would like to understand the revenue impost of each option based on the funds AUM Both pricing options are subject to a minimum fee. A minimum fe in the total for a client would pay at minimum in any give year Create a model al calculates the expected Total Revenue foto option below in the AUMs and respective calculation methods listed below Please provide your calculation in Excel Base fee. which is charged bused on the Astsundet Management (MX If thee Fee la required to be protsed for contributors (inflows) ee vufow, AUM can be time weighted for cash flow occurred during the invoice period Plewe assume Total Revenue la Fe + Minimimee Adjustment of minimum fe is not met Bali Asset der Menagement CAUMA 100.000 25. 31- M1 10-Mar-21 14.-31 21.7.-31 100,00 110.000 20000,000 Cwley Can we 10.000.000 20 21 11 1921 Option 1 Option 2 First S50 million charged for 8 basis points and remaining balance 5 basis points Annual Base Fee % 0.10% Calculation method 1 2 Minimum Fee 200,000 20,000 N1 Calculation method Investment management fees ("Fees") are calculated and billed quarterly in arrears (for the quarters ending March 31 st, June 30th, September 30th and December 31 st) by averaging the Account's net asset value invested in the applicable Collective Fund, as determined by the Manager, as of the last day of each month in the applicable quarter and (ii) applying the applicable Fee rate above that shall be prorated based on the actual number of days of such calendar quarter (e.g. 91/365). Where, the Plans assets are held for a partial period as a result of the Plan's initial contribution into or final withdrawal from the Account, the Fees will be prorated for such period, based on the actual number of days in the invoice period divided by the actual number of calendar days (eg, actual days in invoice period/365) Other than the initial contribution and/or final withdrawal, there will be no other proration for asset flows into or out of the Account for the purpose of calculating the Fees. Fees will be calculated and billed in U.S. Dollars. Payment is due to the Manager within thirty (30) days after receipt of invoice unless other arrangements are made Calculation method Fees are calculated and billed quarterly in arrears by averaging the Subordinate Trust's three month end market values and applying 25% of the annual fee schedule. When assets are held for a partial quarter(s) as a result of contribution to or withdrawal from a common trust fund, the month-end market value will be calculated using a time-weighted method. The month-end market value shall be: (I) decreased on a pro rata basis by any contribution to the Subordinate Trust made during the calendar month and (2) increased on a pro rata basis by any withdrawal made from the Subordinate Trust during the calendar month Fee calculation test Formula Test 1. Please calculate effective fee rate in cell F4.F8 Table 1 Contract ID Portfolio Contractual Legal Entity Avg. AUM size Revenue Amount (Annually) Effective Fee Rate 1 PI 1 P2 2 P3 3 P4 4 PS Legal Entity 1 Legal Entity 1 Legal Entity 2 Legal Entity 2 Legal Entity 3 10,000 5,000 200,000 15,000 33,000 500,000,000 300,000,000 8,000,000,000 800.000.000 500.000.000 2. Please use SUMIF to calculate the total revenue in each legal entity in cell 16:18 Table 2. Contractual Legal Total Revenue Entity Amount (Anually Legal Entity Legal Entity 2 Legal Entity 3 3. Please use Lookup to demonstrate "Effective Fee Rate per Portfolio" and "Total Revenue Amount per contractual legal entity using data from above tables, Fee calculation test Formula Test Aelier would like to establish a separate account. There are 2 pricing options with different fee methods. The St. Fee Onboarding team would like to understand the revenue impost of each option based on the funds AUM Both pricing options are subject to a minimum fee. A minimum fe in the total for a client would pay at minimum in any give year Create a model al calculates the expected Total Revenue foto option below in the AUMs and respective calculation methods listed below Please provide your calculation in Excel Base fee. which is charged bused on the Astsundet Management (MX If thee Fee la required to be protsed for contributors (inflows) ee vufow, AUM can be time weighted for cash flow occurred during the invoice period Plewe assume Total Revenue la Fe + Minimimee Adjustment of minimum fe is not met Bali Asset der Menagement CAUMA 100.000 25. 31- M1 10-Mar-21 14.-31 21.7.-31 100,00 110.000 20000,000 Cwley Can we 10.000.000 20 21 11 1921 Option 1 Option 2 First S50 million charged for 8 basis points and remaining balance 5 basis points Annual Base Fee % 0.10% Calculation method 1 2 Minimum Fee 200,000 20,000 N1 Calculation method Investment management fees ("Fees") are calculated and billed quarterly in arrears (for the quarters ending March 31 st, June 30th, September 30th and December 31 st) by averaging the Account's net asset value invested in the applicable Collective Fund, as determined by the Manager, as of the last day of each month in the applicable quarter and (ii) applying the applicable Fee rate above that shall be prorated based on the actual number of days of such calendar quarter (e.g. 91/365). Where, the Plans assets are held for a partial period as a result of the Plan's initial contribution into or final withdrawal from the Account, the Fees will be prorated for such period, based on the actual number of days in the invoice period divided by the actual number of calendar days (eg, actual days in invoice period/365) Other than the initial contribution and/or final withdrawal, there will be no other proration for asset flows into or out of the Account for the purpose of calculating the Fees. Fees will be calculated and billed in U.S. Dollars. Payment is due to the Manager within thirty (30) days after receipt of invoice unless other arrangements are made Calculation method Fees are calculated and billed quarterly in arrears by averaging the Subordinate Trust's three month end market values and applying 25% of the annual fee schedule. When assets are held for a partial quarter(s) as a result of contribution to or withdrawal from a common trust fund, the month-end market value will be calculated using a time-weighted method. The month-end market value shall be: (I) decreased on a pro rata basis by any contribution to the Subordinate Trust made during the calendar month and (2) increased on a pro rata basis by any withdrawal made from the Subordinate Trust during the calendar month Fee calculation test Formula Test 1. Please calculate effective fee rate in cell F4.F8 Table 1 Contract ID Portfolio Contractual Legal Entity Avg. AUM size Revenue Amount (Annually) Effective Fee Rate 1 PI 1 P2 2 P3 3 P4 4 PS Legal Entity 1 Legal Entity 1 Legal Entity 2 Legal Entity 2 Legal Entity 3 10,000 5,000 200,000 15,000 33,000 500,000,000 300,000,000 8,000,000,000 800.000.000 500.000.000 2. Please use SUMIF to calculate the total revenue in each legal entity in cell 16:18 Table 2. Contractual Legal Total Revenue Entity Amount (Anually Legal Entity Legal Entity 2 Legal Entity 3 3. Please use Lookup to demonstrate "Effective Fee Rate per Portfolio" and "Total Revenue Amount per contractual legal entity using data from above tables

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts