Question: Feedback great will be left on correct answer. thanks QUESTION 7 *) Sam and LaVerne, a married couple filing a joint tax return, had taxable

Feedback great will be left on correct answer. thanks

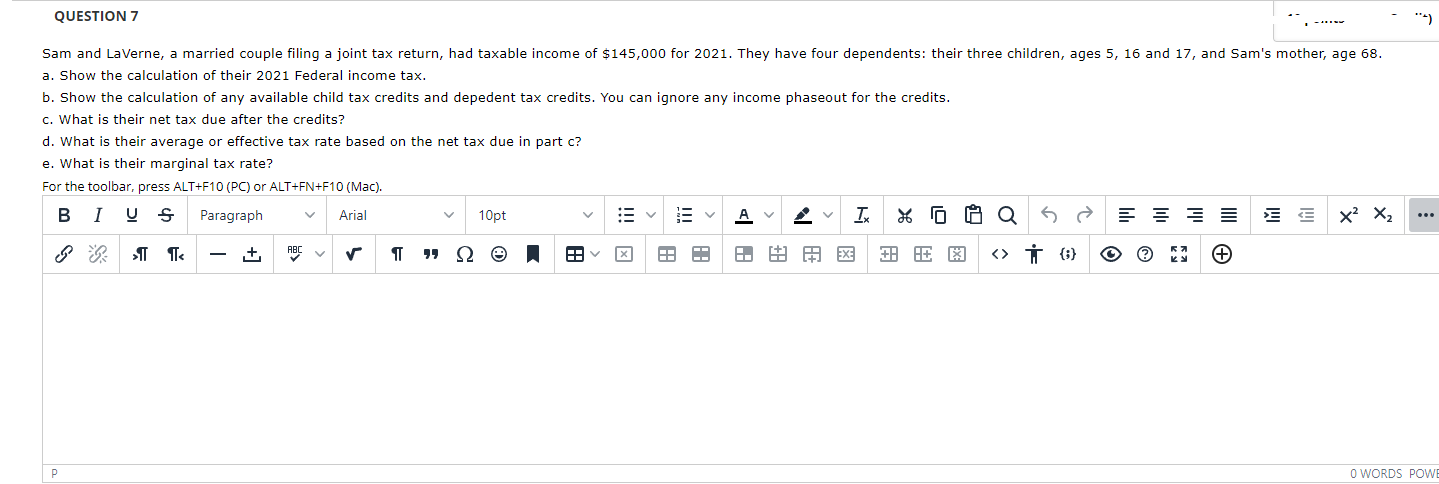

QUESTION 7 *) Sam and LaVerne, a married couple filing a joint tax return, had taxable income of $145,000 for 2021. They have four dependents: their three children, ages 5, 16 and 17, and Sam's mother, age 68. a. Show the calculation of their 2021 Federal income tax. b. Show the calculation of any available child tax credits and depedent tax credits. You can ignore any income phaseout for the credits. c. What is their net tax due after the credits? d. What is their average or effective tax rate based on the net tax due in part c? e. What is their marginal tax rate? For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). B 1 U S Paragraph Arial 10pt TK Q = = X2 X2 > I + ABC T 2 e A, A A A EX () # O WORDS POWE QUESTION 7 *) Sam and LaVerne, a married couple filing a joint tax return, had taxable income of $145,000 for 2021. They have four dependents: their three children, ages 5, 16 and 17, and Sam's mother, age 68. a. Show the calculation of their 2021 Federal income tax. b. Show the calculation of any available child tax credits and depedent tax credits. You can ignore any income phaseout for the credits. c. What is their net tax due after the credits? d. What is their average or effective tax rate based on the net tax due in part c? e. What is their marginal tax rate? For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). B 1 U S Paragraph Arial 10pt TK Q = = X2 X2 > I + ABC T 2 e A, A A A EX () # O WORDS POWE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts