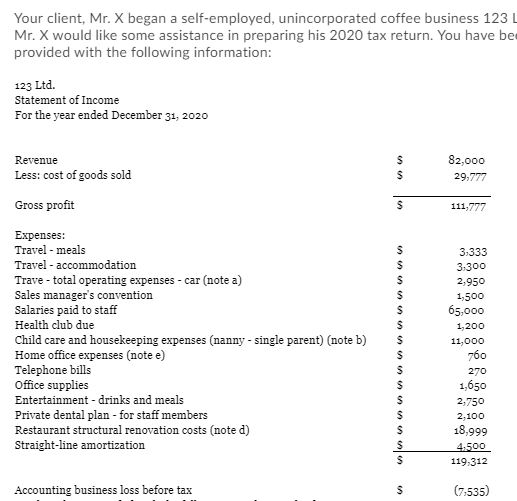

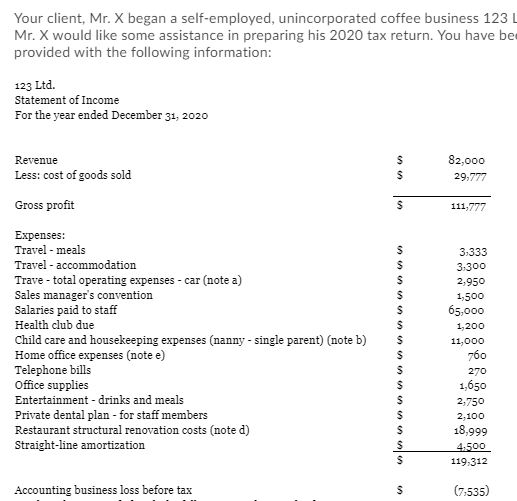

Question: Your client. Mr. X began a self-employed, unincorporated coffee business 123 Mr. X would like some assistance in preparing his 2020 tax return. You

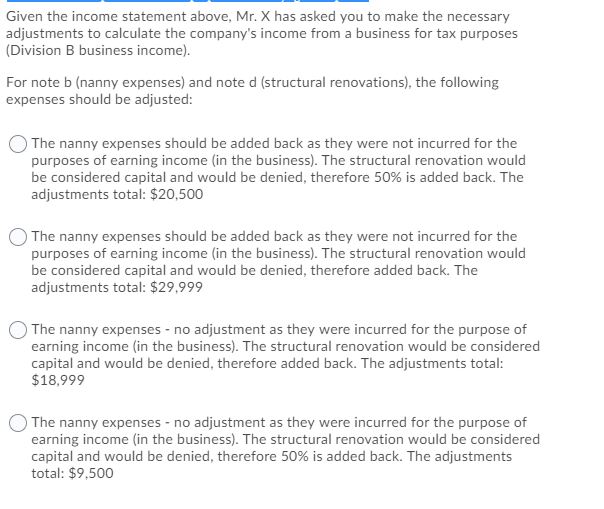

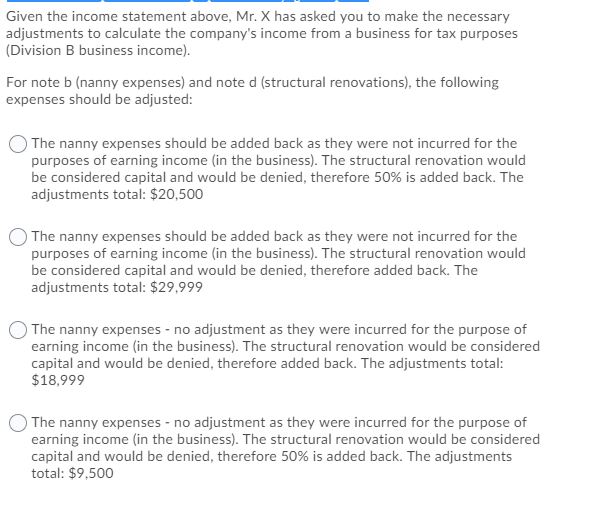

Your client. Mr. X began a self-employed, unincorporated coffee business 123 Mr. X would like some assistance in preparing his 2020 tax return. You have bel provided with the following information: 123 Ltd. Sta tement of Income For the year ended December 31, 2020 Revenue Less: cost of goods sold Gross profit Travel - meals Travel - accommodation Trave - total operating expenses - car (note a) Sales manager' s convention Salaries paid to staff Health club due Child care and housekeeping expenses (nanny - single parent) (note b) Home office expenses (note e) Telephone bills Offc:e supplies Entertainment - drinks and meals Private dental plan - for staf members Restaurant structural rencvation costs (note d) Straight-line amortizatio n Accounting business loss before tax 2,950 1,500 65,000 1, 200 1,650 2,750 18 , 119,312 (7,535)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts