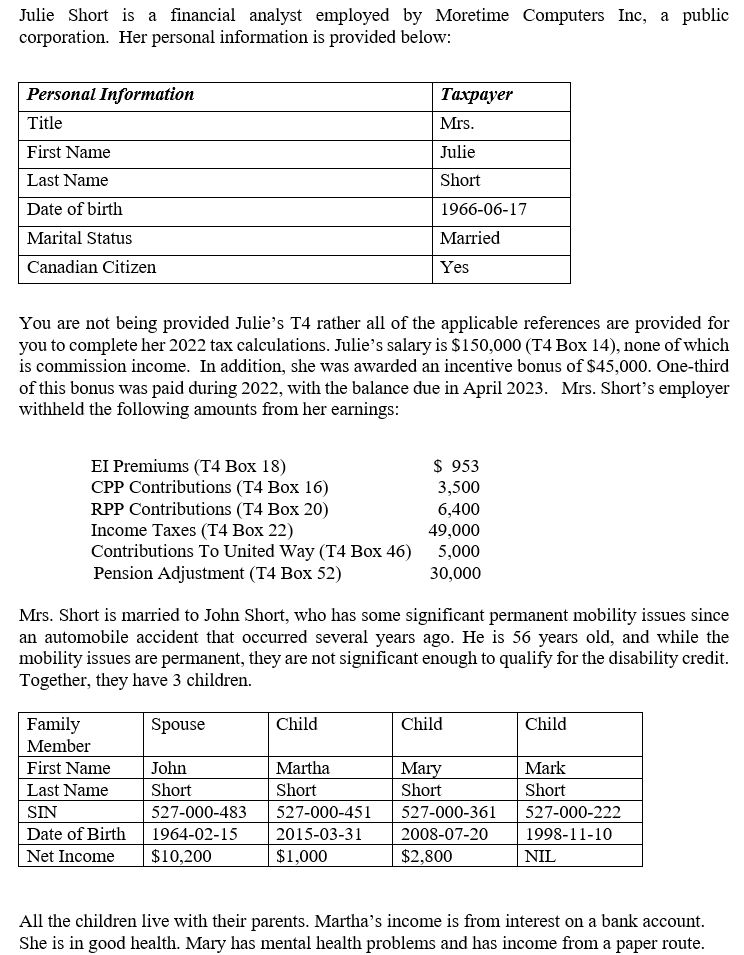

Question: ffffffJulie Short is a nancial analyst employed by Moretime Computers Inc. a public corporation. Her personal information is provided below: Personal Information Tmayer First Name

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock