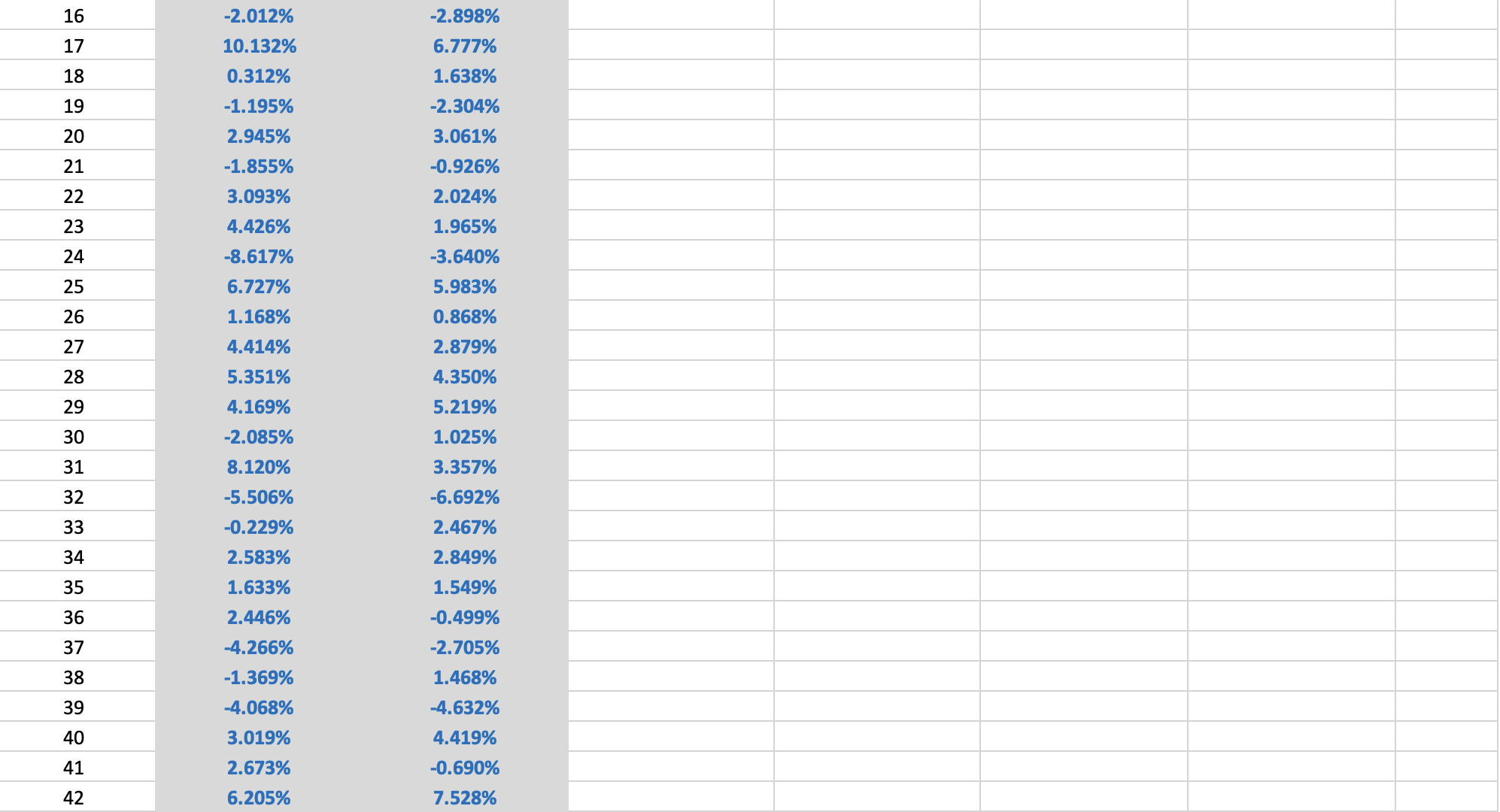

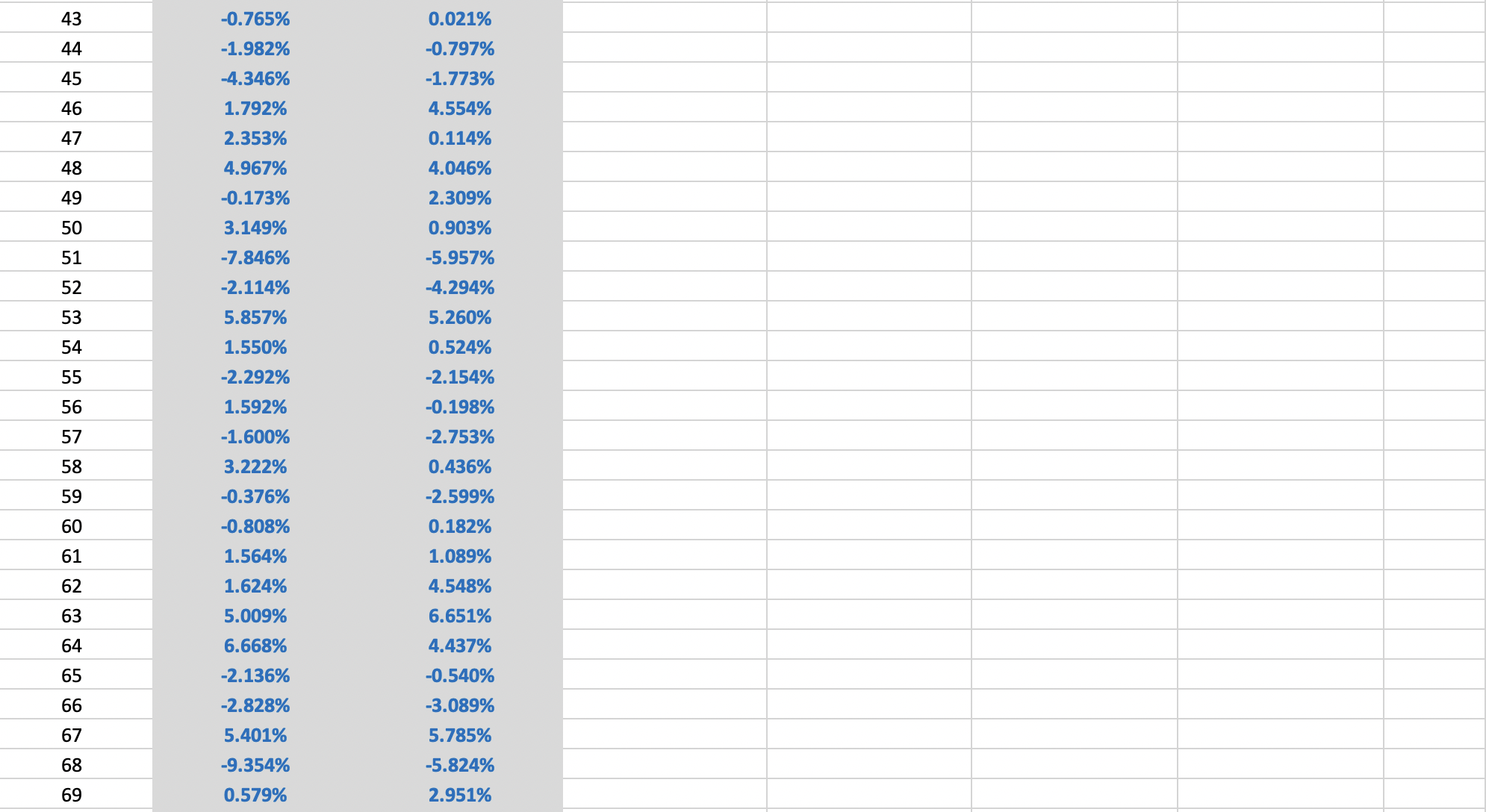

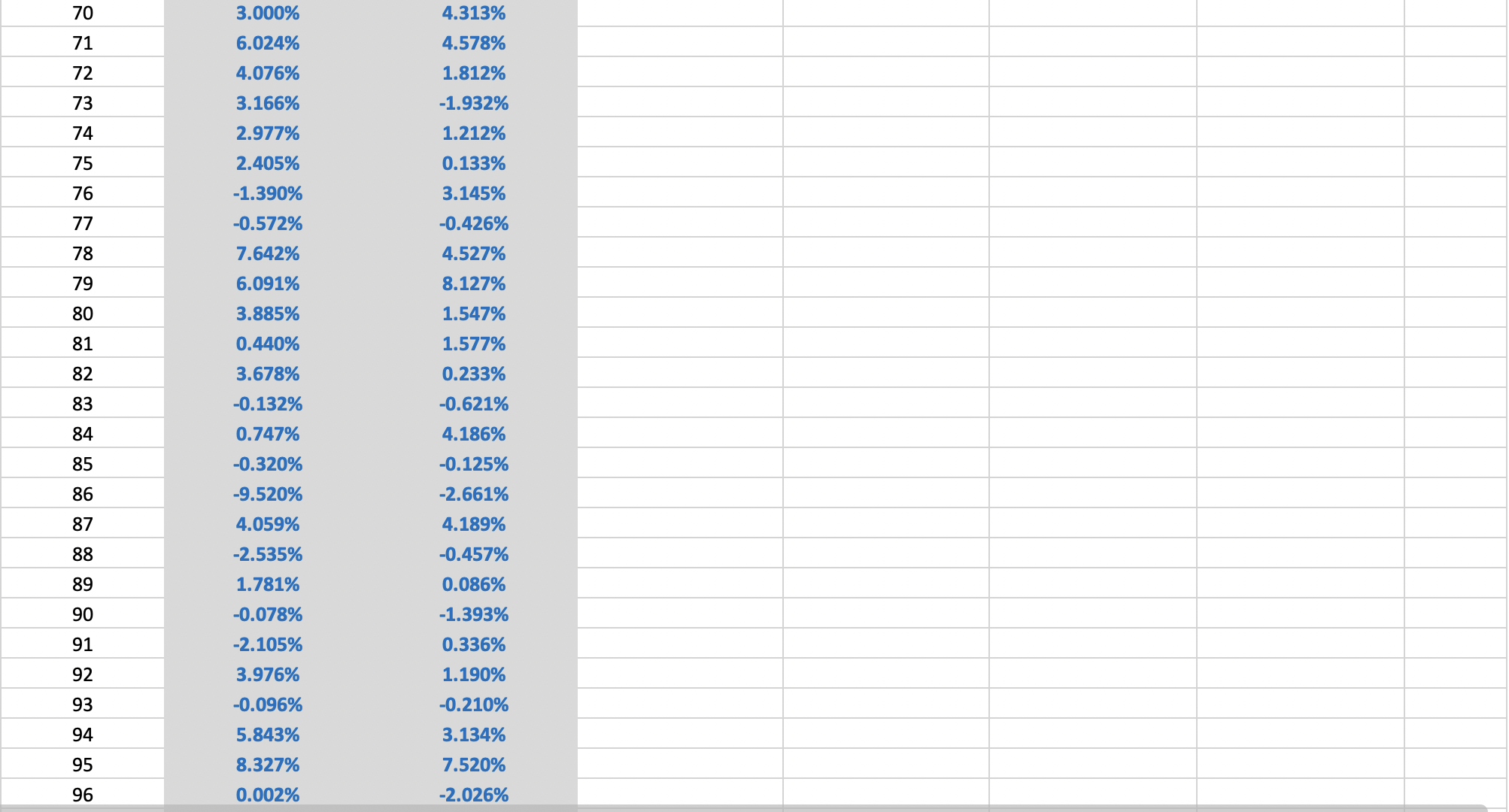

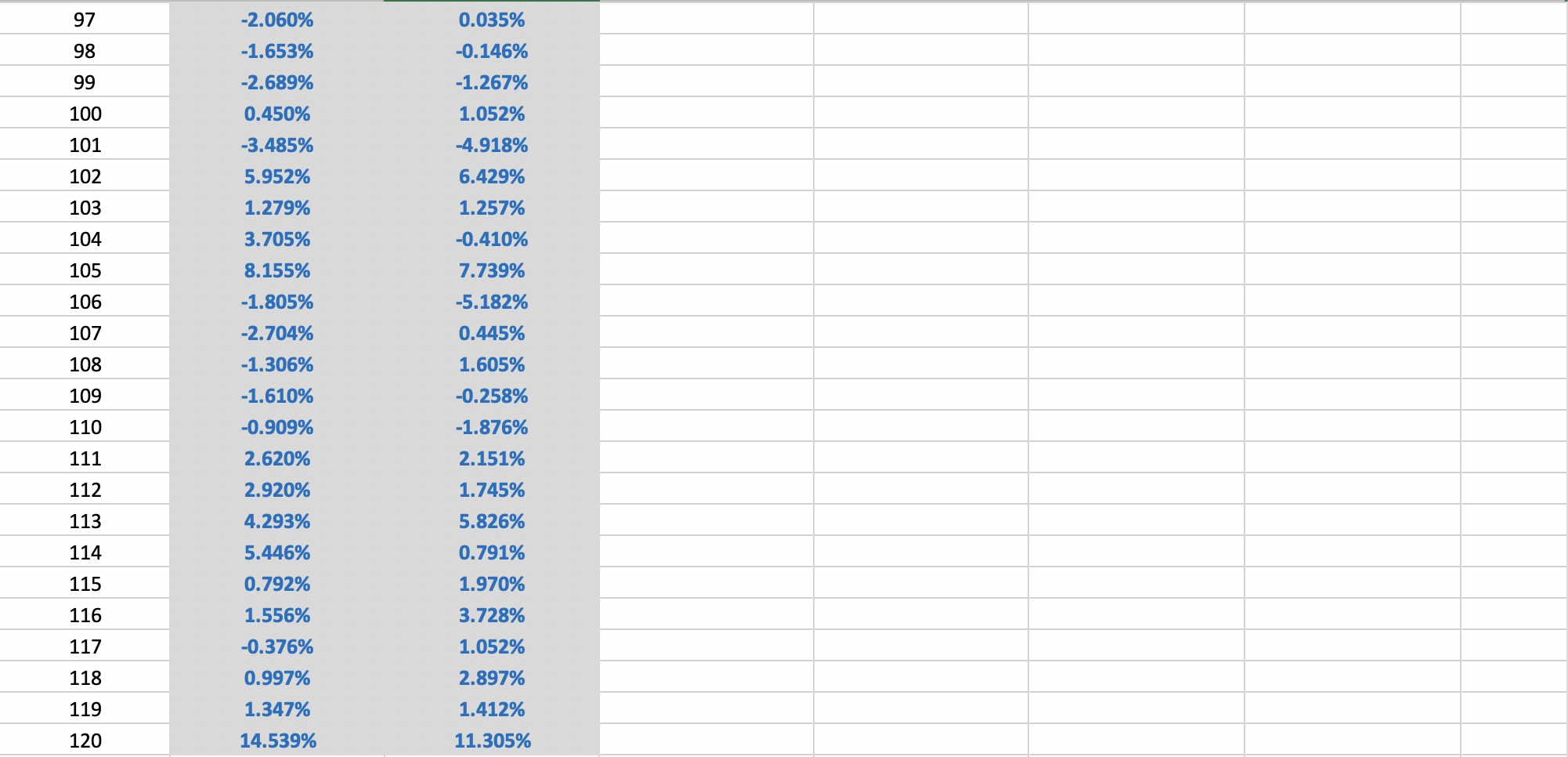

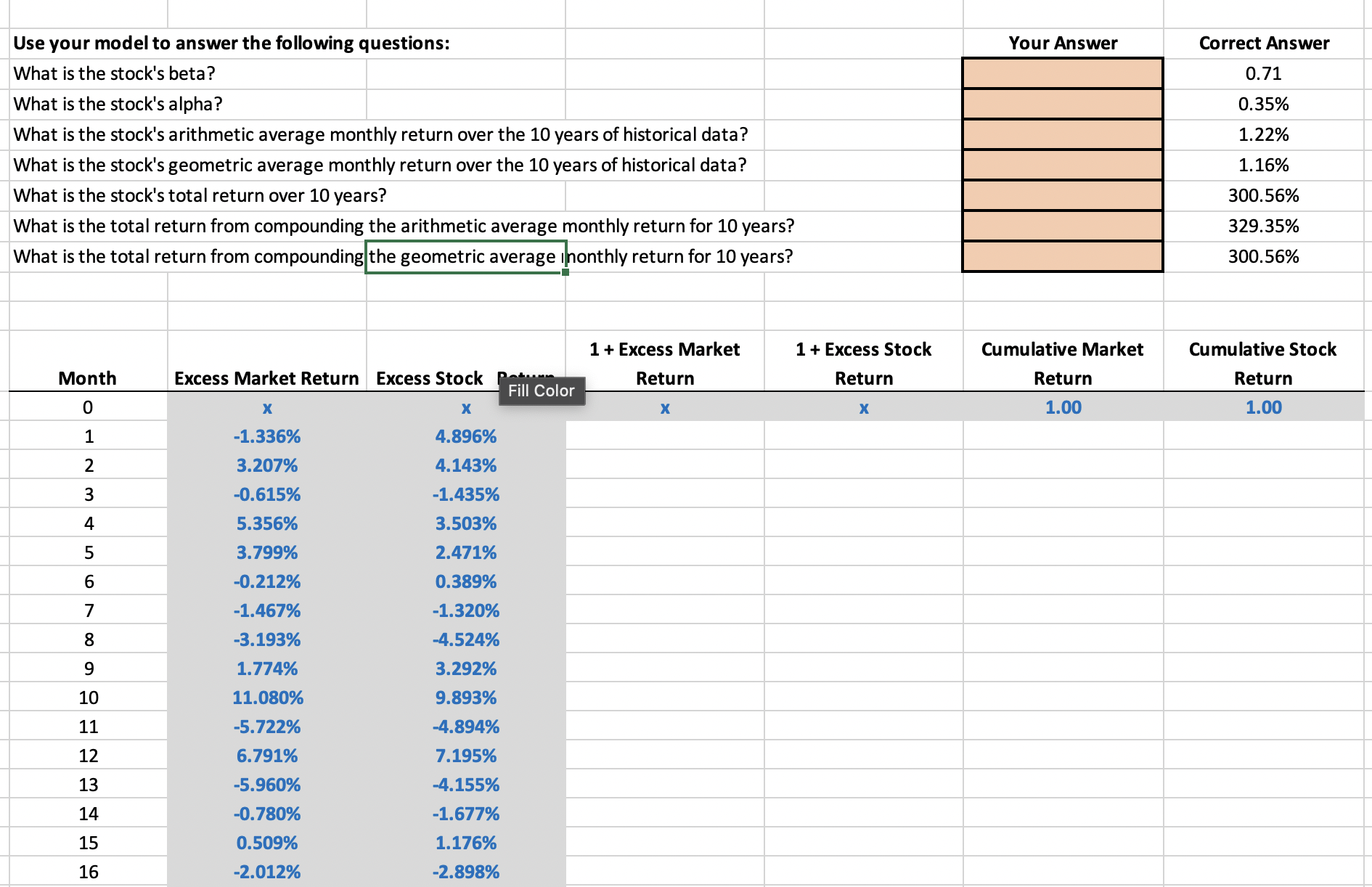

Question: ffffUse your model to answer the following questions: Your Answer Correct Answer What is the stock's beta? 0.71 What is the stock's alpha? 0.35% What

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts