Question: FIFO, LIFO, and WEIGHTED AVERAGE METHOD: Hurst Company's beginning inventory and purchases during the fiscal year ended December 31, 20X2 were as follows Date Event

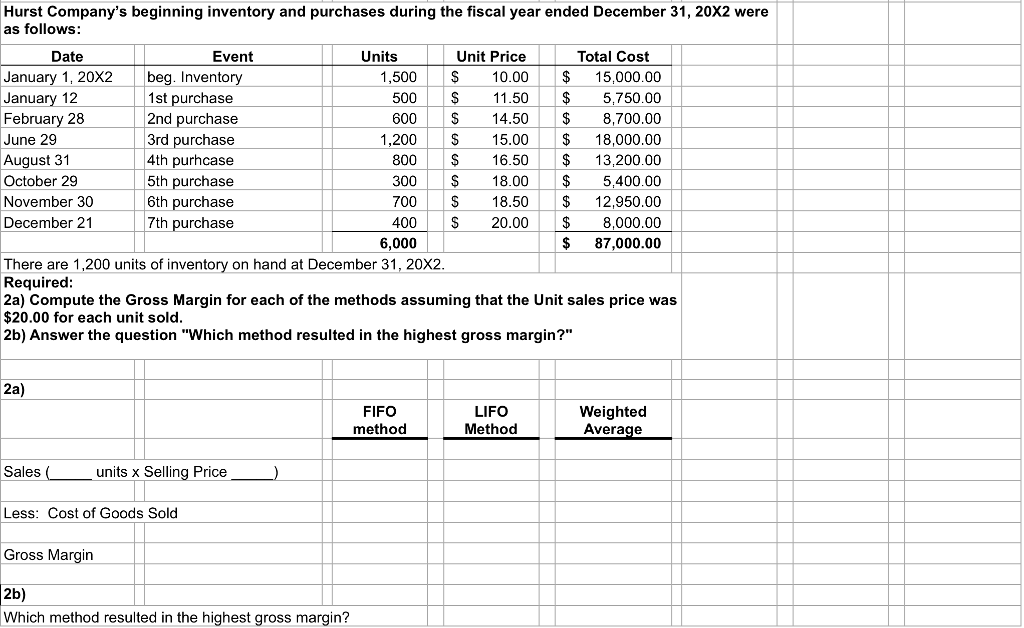

FIFO, LIFO, and WEIGHTED AVERAGE METHOD:

Hurst Company's beginning inventory and purchases during the fiscal year ended December 31, 20X2 were as follows Date Event Units Unit Price Total Cost January 1,20X2 January 12 February 28 June 29 August 31 October 29 November 30 December 21 g. Invento 1st purchase 2nd purchase 3rd purchase 4th purhcase 5th purchase 6th purchase 7th purchase 1,500 10.00$ 15,000.00 500 11.50$ 5,750.00 600 S14.50$ 8,700.00 1,200 15.00 18,000.00 800 $ 16.50$ 13,200.00 300 $ 18.00$ 5,400.00 700 S 18.50 12,950.00 400 S 20.00$ 8,000.00 $87,000.00 be 6,000 There are 1,200 units of inventory on hand at December 31,20X2 Required: 2a) Compute the Gross Margin for each of the methods assuming that the Unit sales price was $20.00 for each unit sold 2b) Answer the question "Which method resulted in the highest gross margin?" FIFO method LIFO Method Weighted Average Sales units x Selling Price Less: Cost of Goods Sold Gross Margin 2b) Which method resulted in the highest gross margin

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts