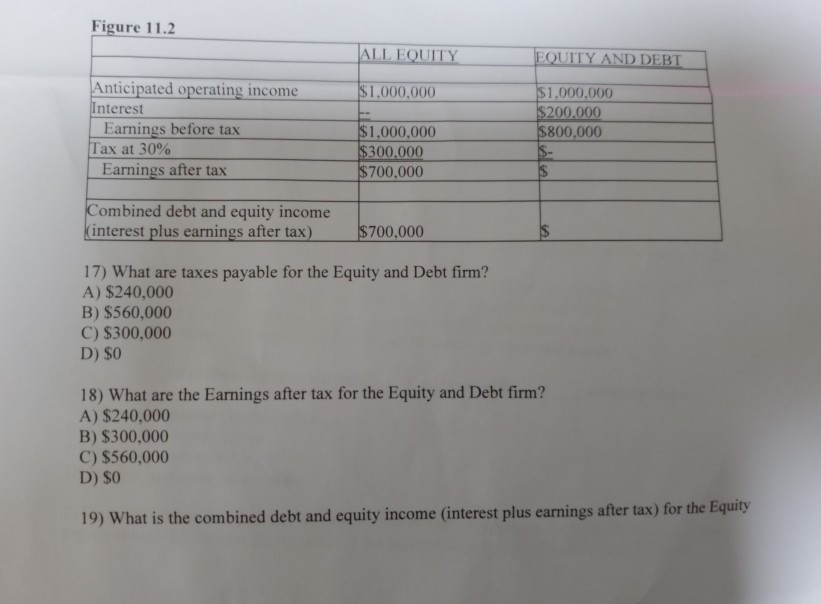

Question: Figure 11.2 ALL EQUITY EQUITY AND DEBT $1.000.000 Anticipated operating income Interest Earnings before tax Tax at 30% Earnings after tax $1,000,000 $200,000 $800,000 $1,000,000

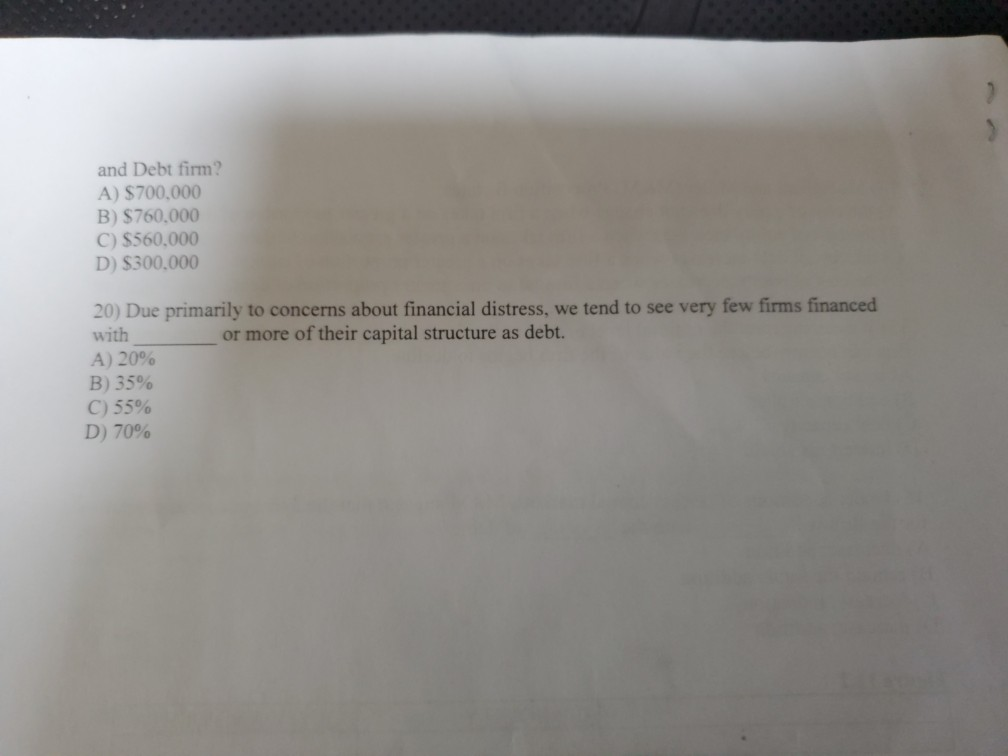

Figure 11.2 ALL EQUITY EQUITY AND DEBT $1.000.000 Anticipated operating income Interest Earnings before tax Tax at 30% Earnings after tax $1,000,000 $200,000 $800,000 $1,000,000 $300,000 $700,000 $ Combined debt and equity income Kinterest plus earnings after tax) $700.000 17) What are taxes payable for the Equity and Debt firm? A) $240,000 B) $560.000 C) $300,000 D) $0 18) What are the Earnings after tax for the Equity and Debt firm?! A) $240,000 B) $300,000 C) $560,000 D) $0 19) What is the combined debt and equity income interest plus earnings after tax) for the Equity, and Debt firm? A) $700.000 B) $760,000 C) $560.000 D) $300,000 20) Due primarily to concerns about financial distress, we tend to see very few firms financed with or more of their capital structure as debt. A) 20% B) 35% C) 55% D) 70%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts