Question: Figured out the first question...I am stuck on the second one! If possible to do it manually that would be great! 9) (10 pts) Tally

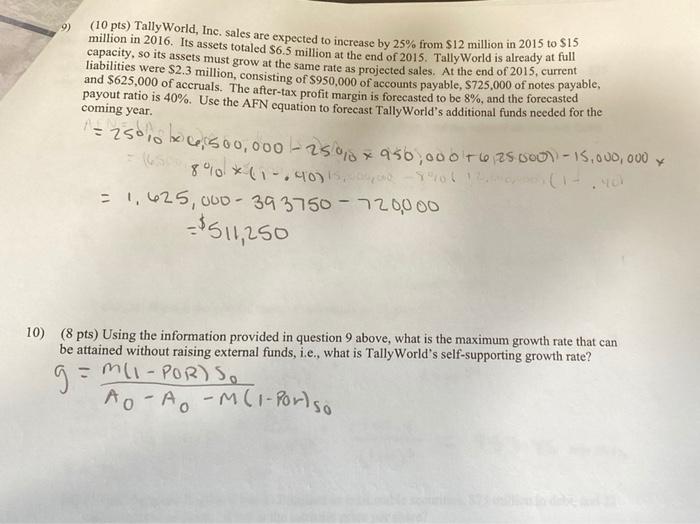

9) (10 pts) Tally World, Inc. sales are expected to increase by 25% from $12 million in 2015 to fall million in 2016. Its assets totaled 86.5 million at the end of 2015. Tally World is already at full capacity, so its assets must grow at the same rate as projected sales. At the end of 2015, current liabilities were $2.3 million, consisting of $950,000 of accounts payable, $725,000 of notes payable, payout ratio is 40%. Use the AFN equation to forecast Tally World's additional funds needed for the coming year. = 250 10 be,500,000 - 25010 x 950,000 TZS 100)- 15,000,000 x 810*(1-.40) (1-0 = 1,625,000 - 39 3750 - 720000 - $511,250 10) (8 pts) Using the information provided in question 9 above, what is the maximum growth rate that can be attained without raising external funds, i.e., what is Tally World's self-supporting growth rate? =mI-POR) SO g= AO-A -M (1-Portso

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts