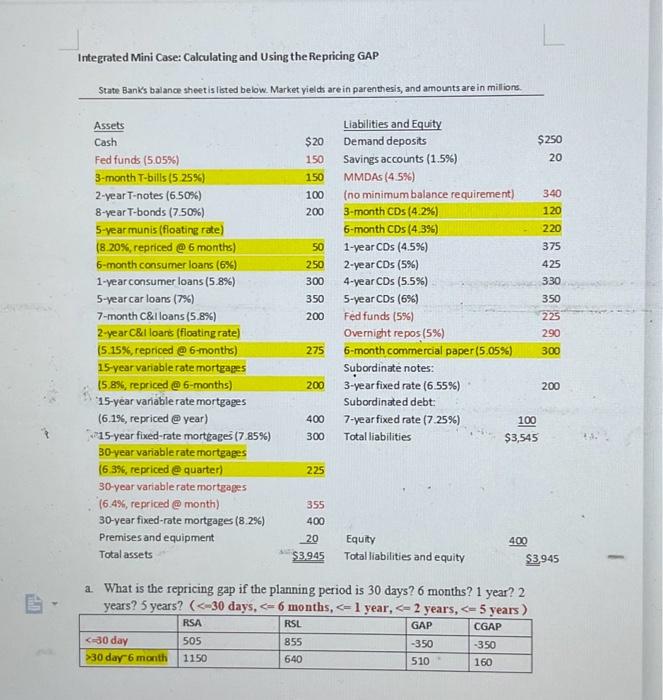

Question: fil Integrated Mini Case: Calculating and Using the Repricing GAP State Bank's balance sheet is listed below. Market yields are in parenthesis, and amounts are

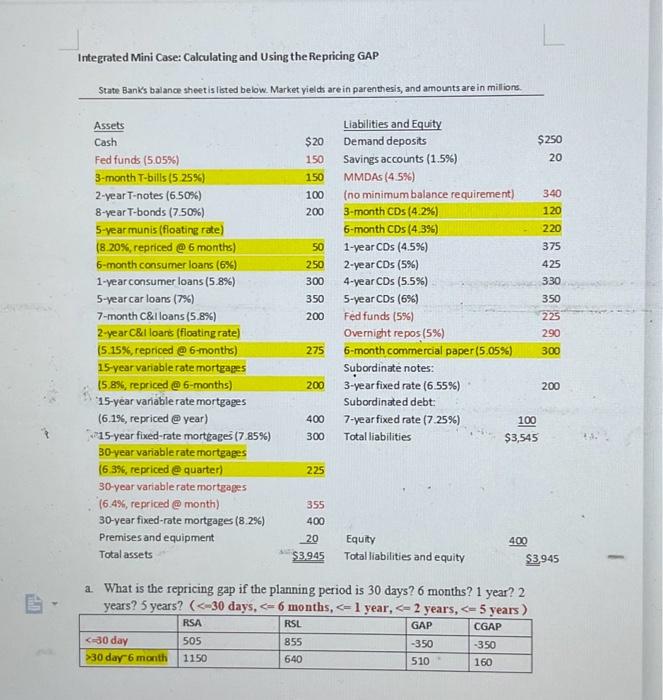

fil Integrated Mini Case: Calculating and Using the Repricing GAP State Bank's balance sheet is listed below. Market yields are in parenthesis, and amounts are in millions. Assets Cash Fed funds (5.05%) 3-month T-bills (5.25%) 2-year T-notes (6.50%) 8-year T-bonds (7.50%) 5-year munis (floating rate) (8.20%, repriced @ 6 months) 6-month consumer loans (6%) 1-year consumer loans (5.8%) 5-year car loans (7%) 7-month C&I loans (5.8%) 2-year C&I loans (floating rate) (5.15%, repriced @ 6-months) 15-year variable rate mortgages (5.8%, repriced @ 6-months) 15-year variable rate mortgages (6.1%, repriced @ year) 15-year fixed-rate mortgages (7.85%) 30-year variable rate mortgages (6.3%, repriced @quarter) 30-year variable rate mortgages (6.4%, repriced @ month) 30-year fixed-rate mortgages (8.2%) Premises and equipment Total assets 30 day 6 month $20 150 150 100 200 RSA 505 1150 50 250 300 350 200 275 200 400 300 225 355 400 20 $3,945 Liabilities and Equity Demand deposits Savings accounts (1.5%) MMDAs (4.5%) (no minimum balance requirement) 3-month CDs (4.2%) 6-month CDs (4.3%) 1-year CDs (4.5%) 2-year CDs (5%) 4-year CDs (5.5%) 5-year CDs (6%) Fed funds (5%) Overnight repos (5%) 6-month commercial paper (5.05%) Subordinate notes: 3-year fixed rate (6.55%) Subordinated debt: 7-year fixed rate (7.25%) Total liabilities Equity Total liabilities and equity 100 $3,545 400 a. What is the repricing gap if the planning period is 30 days? 6 months? 1 year? 2 years? 5 years? (

Integrated Mini Case: Calculating and Using the Repricing GAP

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock