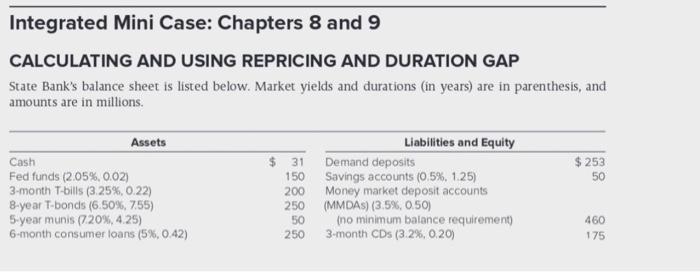

Question: Integrated Mini Case: Chapters 8 and 9 CALCULATING AND USING REPRICING AND DURATION GAP State Bank's balance sheet is listed below. Market yields and durations

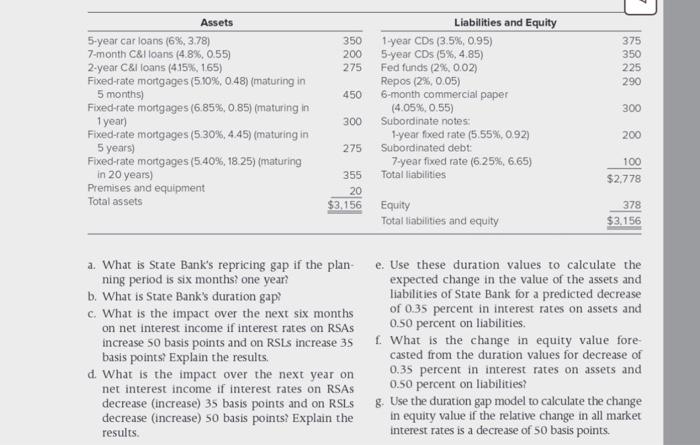

Integrated Mini Case: Chapters 8 and 9 CALCULATING AND USING REPRICING AND DURATION GAP State Bank's balance sheet is listed below. Market yields and durations (in years) are in parenthesis, and amounts are in millions. a. What is State Bank's repricing gap if the plan- e. Use these duration values to calculate the ning period is six months? one year? b.WhatisStateBanksdurationgapc.WhatistheimpactoverthenextsixmonthsliabilitiesofStateBankforapredicteddecreaseof0.35percentininterestratesonassetsand expected change in the value of the assets and on net interest income if interest rates on RSAs 0.50 percent on liabilities. increase 50 basis points and on RSLS increase 3s f. What is the change in equity value forebasis points? Explain the results. casted from the duration values for decrease of d.WhatistheimpactoverthenextyearonnetinterestincomeifinterestratesonRSAs0.35percentininterestratesonassetsand0.50percentonliabilities? net interest income if interest rates on RSAs g. Use the duration gap model to calculate the change decrease (increase) 35 basis points and on RSLS in equity value if the relative change in all market interest rates is a decrease of 50 basis points. results. Integrated Mini Case: Chapters 8 and 9 CALCULATING AND USING REPRICING AND DURATION GAP State Bank's balance sheet is listed below. Market yields and durations (in years) are in parenthesis, and amounts are in millions. a. What is State Bank's repricing gap if the plan- e. Use these duration values to calculate the ning period is six months? one year? b.WhatisStateBanksdurationgapc.WhatistheimpactoverthenextsixmonthsliabilitiesofStateBankforapredicteddecreaseof0.35percentininterestratesonassetsand expected change in the value of the assets and on net interest income if interest rates on RSAs 0.50 percent on liabilities. increase 50 basis points and on RSLS increase 3s f. What is the change in equity value forebasis points? Explain the results. casted from the duration values for decrease of d.WhatistheimpactoverthenextyearonnetinterestincomeifinterestratesonRSAs0.35percentininterestratesonassetsand0.50percentonliabilities? net interest income if interest rates on RSAs g. Use the duration gap model to calculate the change decrease (increase) 35 basis points and on RSLS in equity value if the relative change in all market interest rates is a decrease of 50 basis points. results

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts