Question: File Edit View History Bookmarks Profiles Tab Window Help Question 4 - Chapter 12 HW - X Search Results | Course Hero X C A

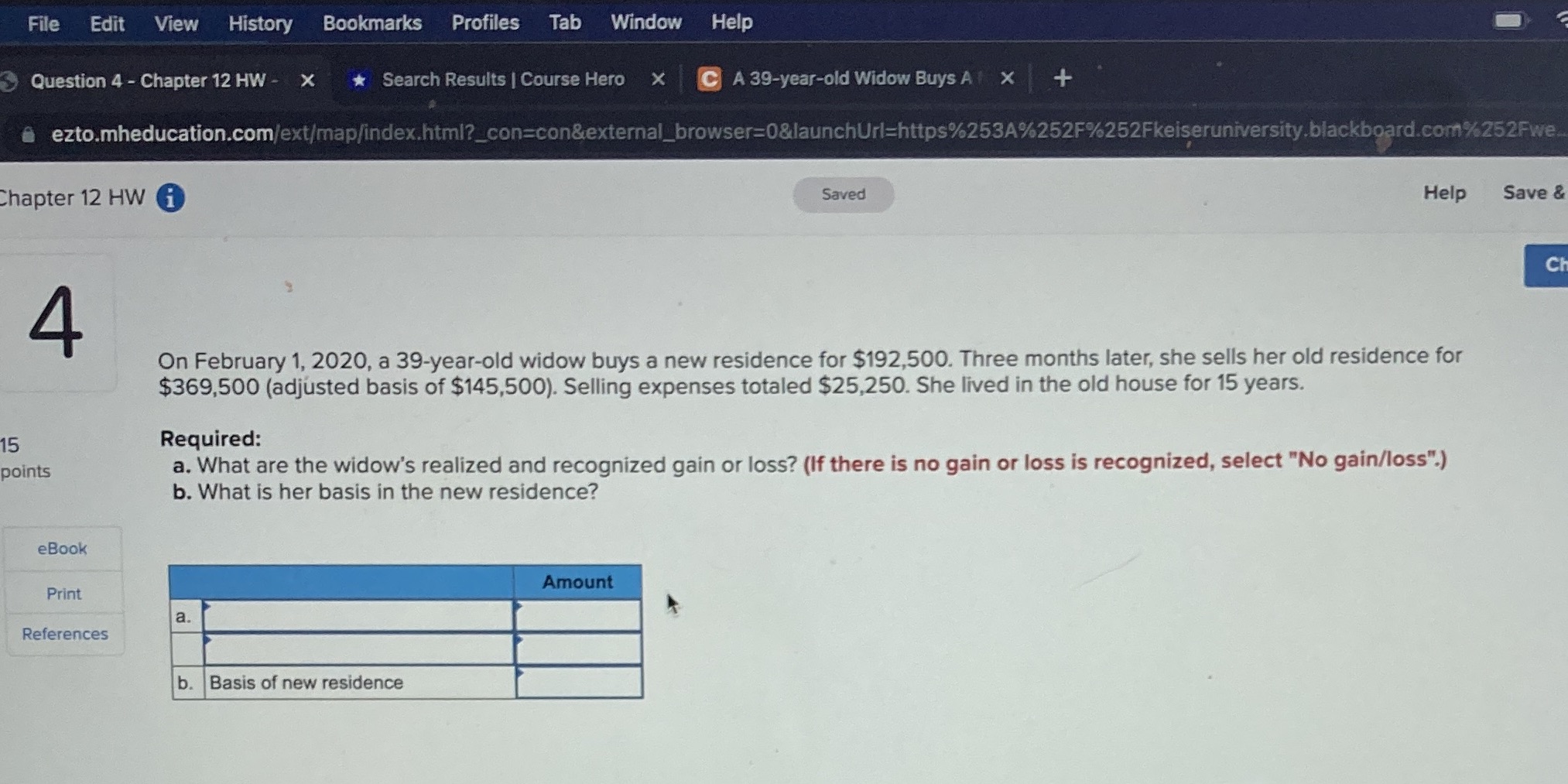

File Edit View History Bookmarks Profiles Tab Window Help Question 4 - Chapter 12 HW - X Search Results | Course Hero X C A 39-year-old Widow Buys A| X + ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fkeiseruniversity.blackboard.com%252Fwe. Chapter 12 HW i Saved Help Save & Ch 4 On February 1, 2020, a 39-year-old widow buys a new residence for $192,500. Three months later, she sells her old residence for $369,500 (adjusted basis of $145,500). Selling expenses totaled $25,250. She lived in the old house for 15 years. 15 Required: points a. What are the widow's realized and recognized gain or loss? (If there is no gain or loss is recognized, select "No gain/loss".) b. What is her basis in the new residence? eBook Print Amount a References b Basis of new residence

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts