Question: File Edit View History Bookmarks Tools Help X M Inbox - eta123958@gmail.com - x CengageNOWv2 Registration In X CengageNOWv2 | Online teachi X + O

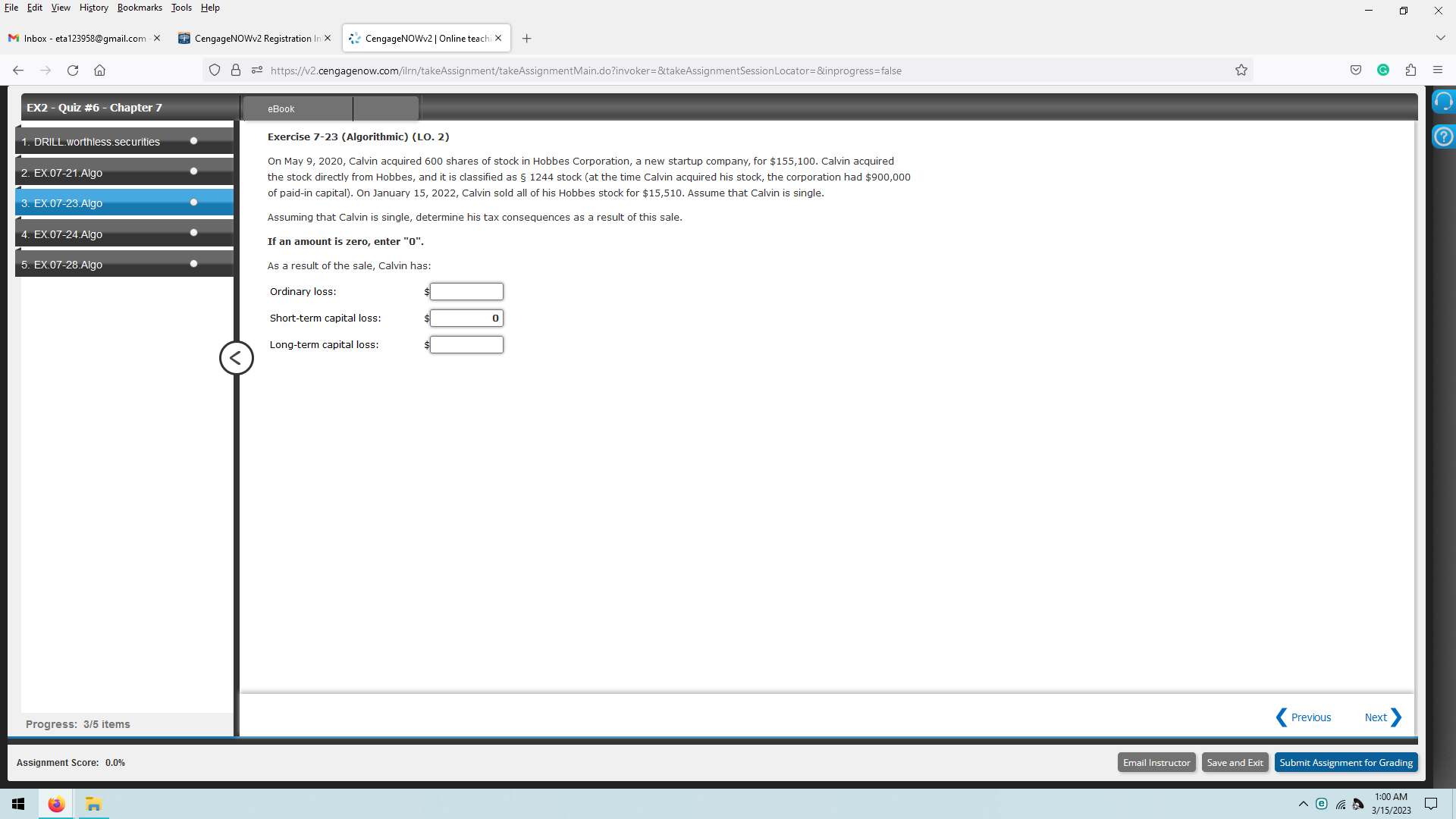

File Edit View History Bookmarks Tools Help X M Inbox - eta123958@gmail.com - x CengageNOWv2 Registration In X CengageNOWv2 | Online teachi X + O 8 0 https://v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false G S E EX2 - Quiz #6 - Chapter 7 eBook 1. DRILL.worthless.securities Exercise 7-23 (Algorithmic) (LO. 2) On May 9, 2020, Calvin acquired 600 shares of stock in Hobbes Corporation, a new startup company, for $155,100. Calvin acquired 2. EX.07-21.Algo the stock directly from Hobbes, and it is classified as $ 1244 stock (at the time Calvin acquired his stock, the corporation had $900,000 of paid-in capital). On January 15, 2022, Calvin sold all of his Hobbes stock for $15,510. Assume that Calvin is single. 3. EX.07-23.Algo Assuming that Calvin is single, determine his tax consequences as a result of this sale. 4. EX.07-24.Algo If an amount is zero, enter "0". 5. EX.07-28.Algo As a result of the sale, Calvin has: Ordinary loss: Short-term capital loss: Long-term capital loss: Progress: 3/5 items Previous Next Assignment Score: 0.0% Email Instructor Save and Exit Submit Assignment for Grading 1:00 AM 3/15/2023

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts