Question: File Home Insert Design Layout References Mailings Review View Help 4 5 1 6 7 10 How tax affects your income Jack has an income

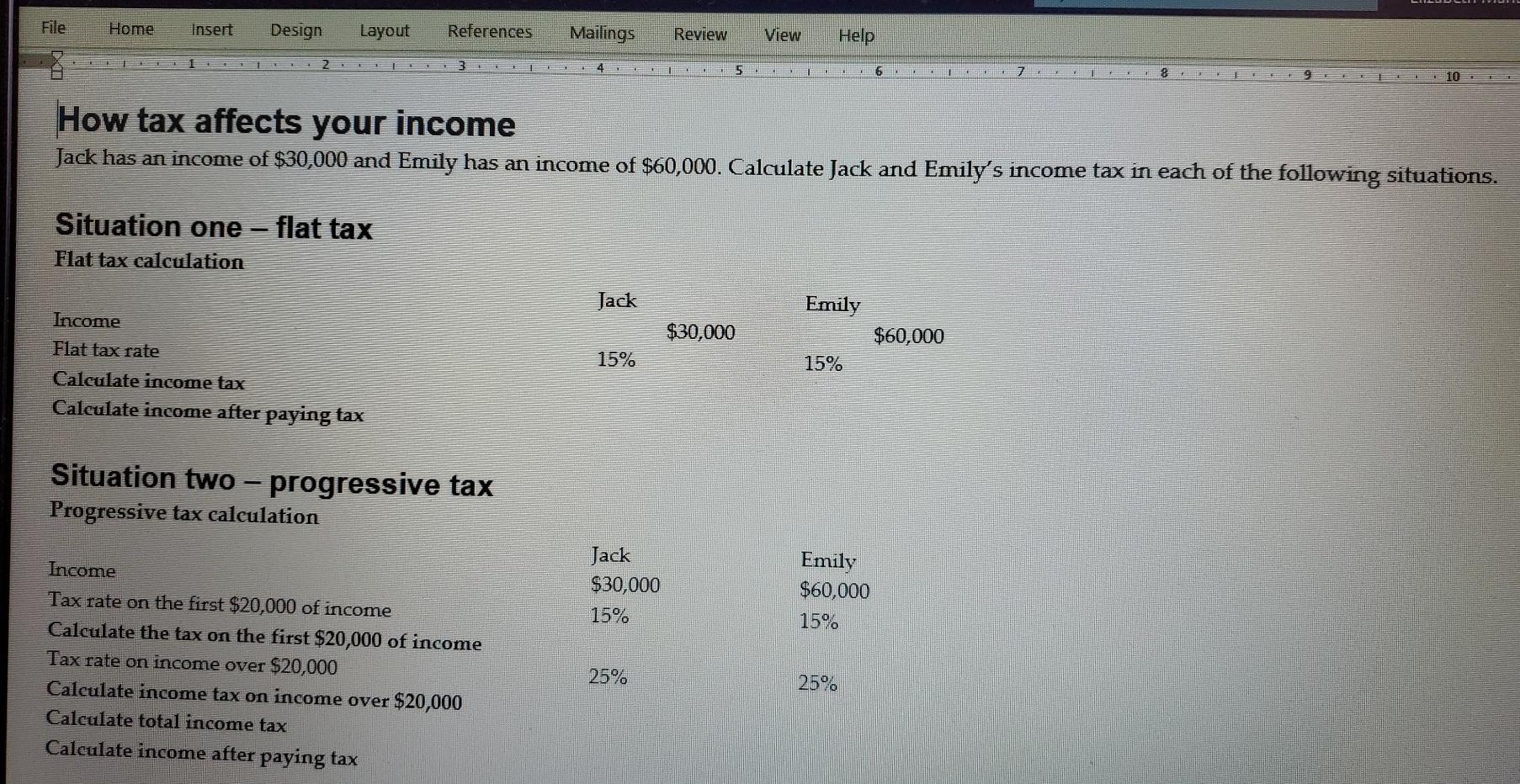

File Home Insert Design Layout References Mailings Review View Help 4 5 1 6 7 10 How tax affects your income Jack has an income of $30,000 and Emily has an income of $60,000. Calculate Jack and Emily's income tax in each of the following situations. Situation one - flat tax Flat tax calculation Jack Emily $30,000 $60,000 Income Flat tax rate Calculate income tax Calculate income after paying tax 15% 15% Situation two - progressive tax Progressive tax calculation Jack $30,000 15% Emily $60,000 15% Income Tax rate on the first $20,000 of income Calculate the tax on the first $20,000 of income Tax rate on income over $20,000 Caleulate income tax on income over $20,000 Calculate total income tax Calculate income after paying tax 25% 25%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts