Question: File Home Insert Draw Page Layout Formulas Data Review View Help X Calibri 11 ~ Ai ab Wrap Text General LO Paste U A =

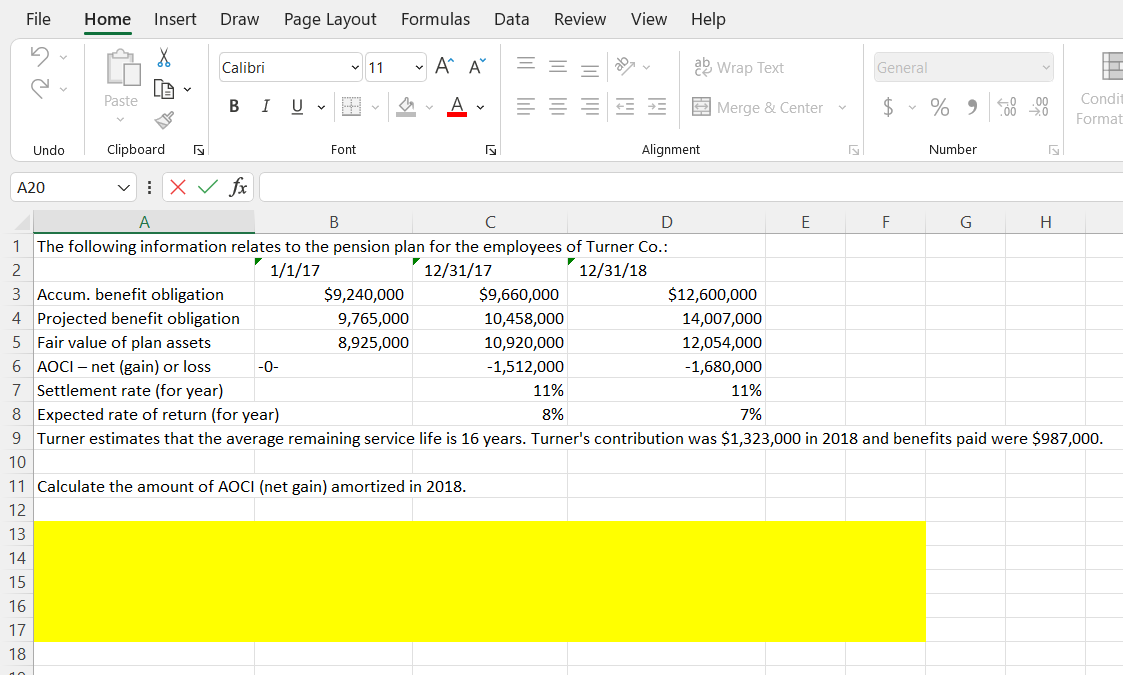

File Home Insert Draw Page Layout Formulas Data Review View Help X Calibri 11 ~ Ai ab Wrap Text General LO Paste U A = = Condit + + Merge & Center $ % 0 - 0 Format Undo Clipboard Font Alignment Number A20 1 X v fx B D E F G H 1 The following information relates to the pension plan for the employees of Turner Co.: 2 1/1/17 12/31/17 12/31/18 3 Accum. benefit obligation $9,240,000 $9,660,000 $12,600,000 4 Projected benefit obligation 9,765,000 10,458,000 14,007,000 5 Fair value of plan assets 8,925,000 10,920,000 12,054,000 6 AOCI - net (gain) or loss -0 -1,512,000 -1,680,000 7 Settlement rate (for year) 11% 11% 8 Expected rate of return (for year) 8% 7% 9 Turner estimates that the average remaining service life is 16 years. Turner's contribution was $1,323,000 in 2018 and benefits paid were $987,000. 10 11 Calculate the amount of AOCI (net gain) amortized in 2018. 12 13 14 15 16 17 18

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts