Question: On December 3 1 , 2 0 2 4 , Joe Smith sold unimproved real estate, located in Southern Shores, NC , for a total

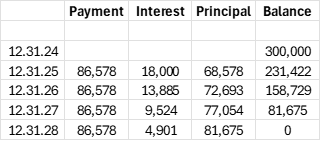

On December Joe Smith sold unimproved real estate, located in Southern Shores, NC for a total sales price of $ to an unrelated party. Joe had purchased the lot for $ years ago. The terms of the sale provide for the buyer to pay $ at closing and payments on December of and in an amount sufficient to amortize the remaining balance of $ with interest at An amortization schedule for the loan follows. Answer the Following Questions What amount of capital gain and interest will Joe recognize on his tax return for the calendar year What amount of capital gain and interest will Joe recognize on his tax return for the calendar year If Joe and the Buyer had agreed that the note for the remaining balance be interest free, would this be acceptable to the IRS? Remember, Joe and the buyer are unrelated. What total amount cash interest and principal did Joe receive over the entire transaction for the sale of the NC land? Based on the information presented, would there be any potential tax consequences if Joe needed to repossess based on the buyers default on the note the land on December when the fair market value of the land was $ Please answer YES or NO computations are not necessary.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock