Question: File Home Insert Draw Page Layout Formulas Data Review View Automate Help Comments Share Insert v Calibri 11 A ab General Conditional Formatting AY O

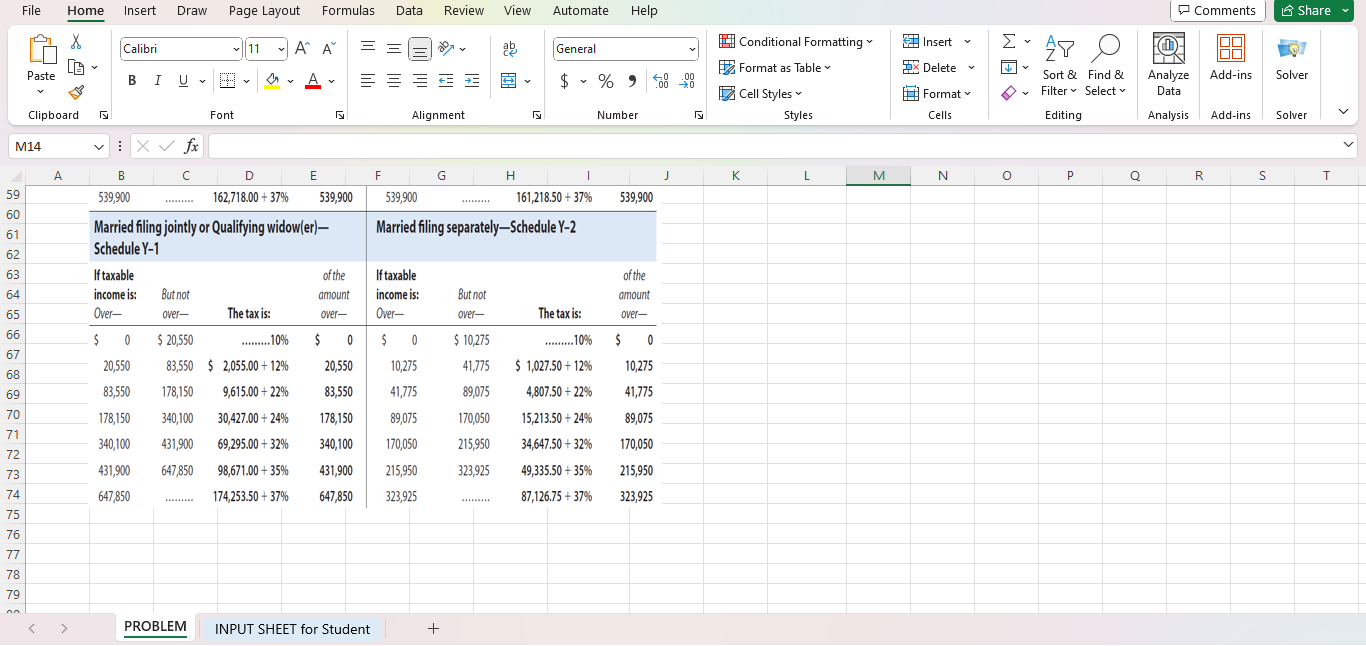

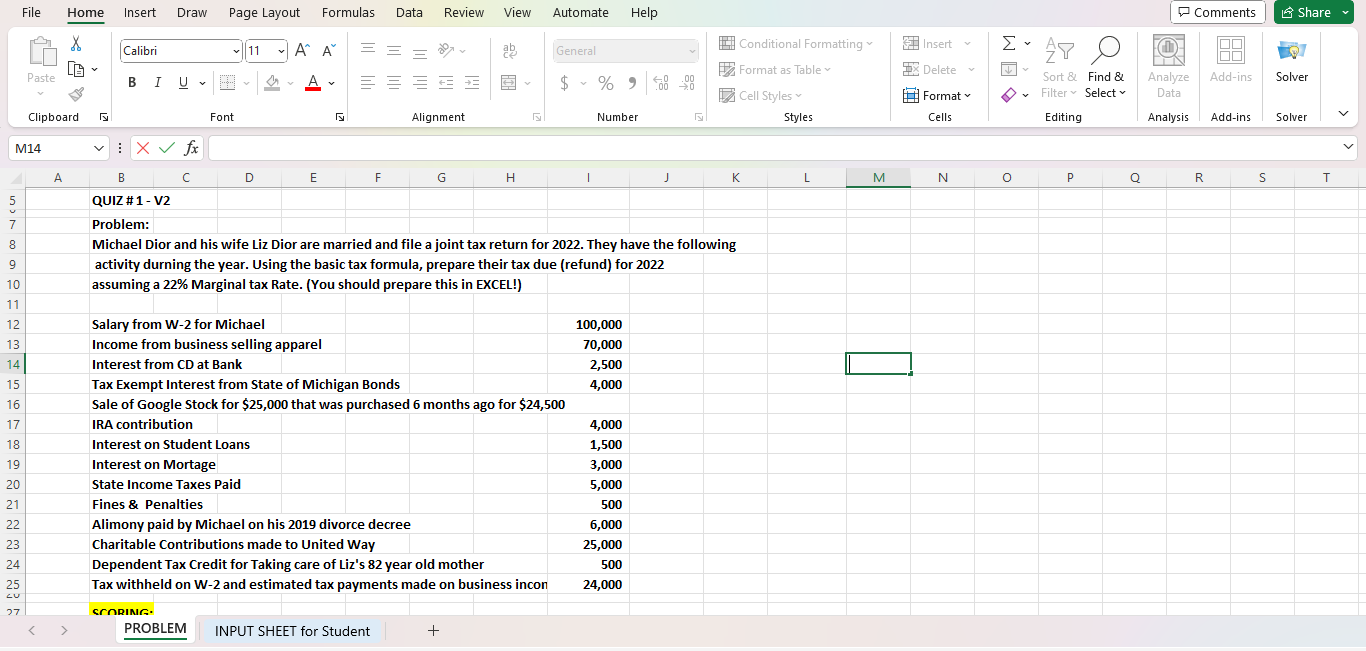

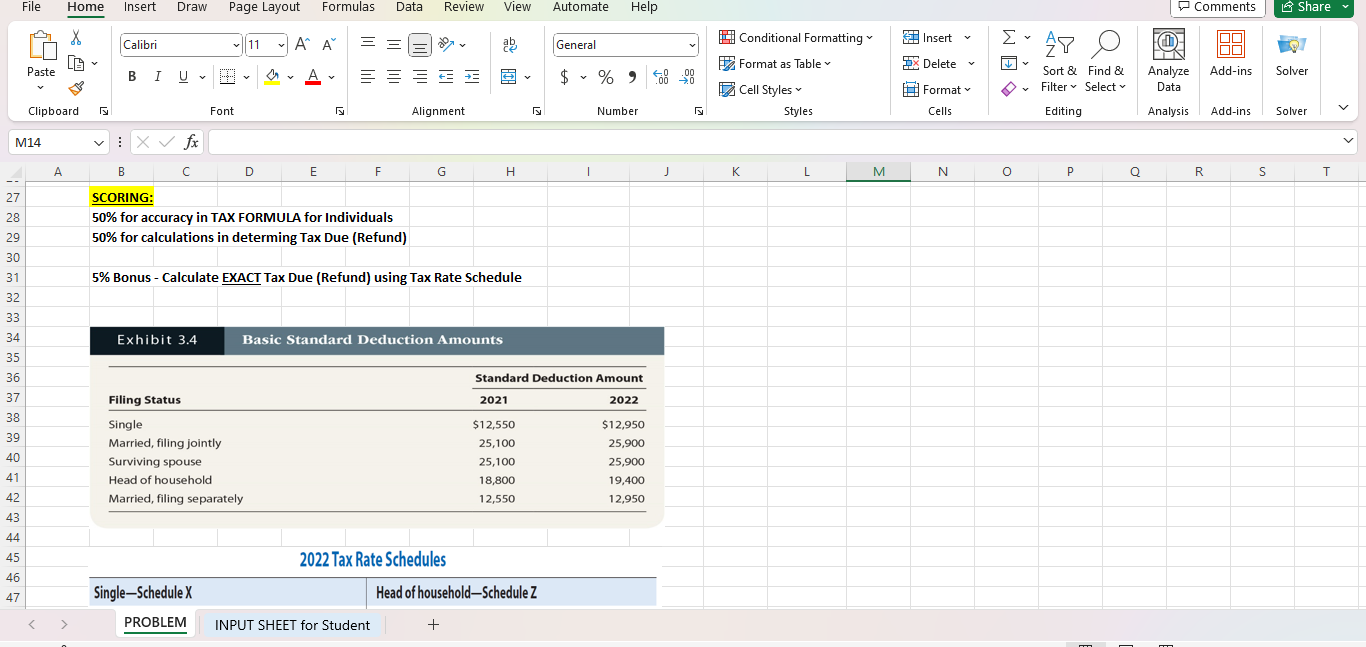

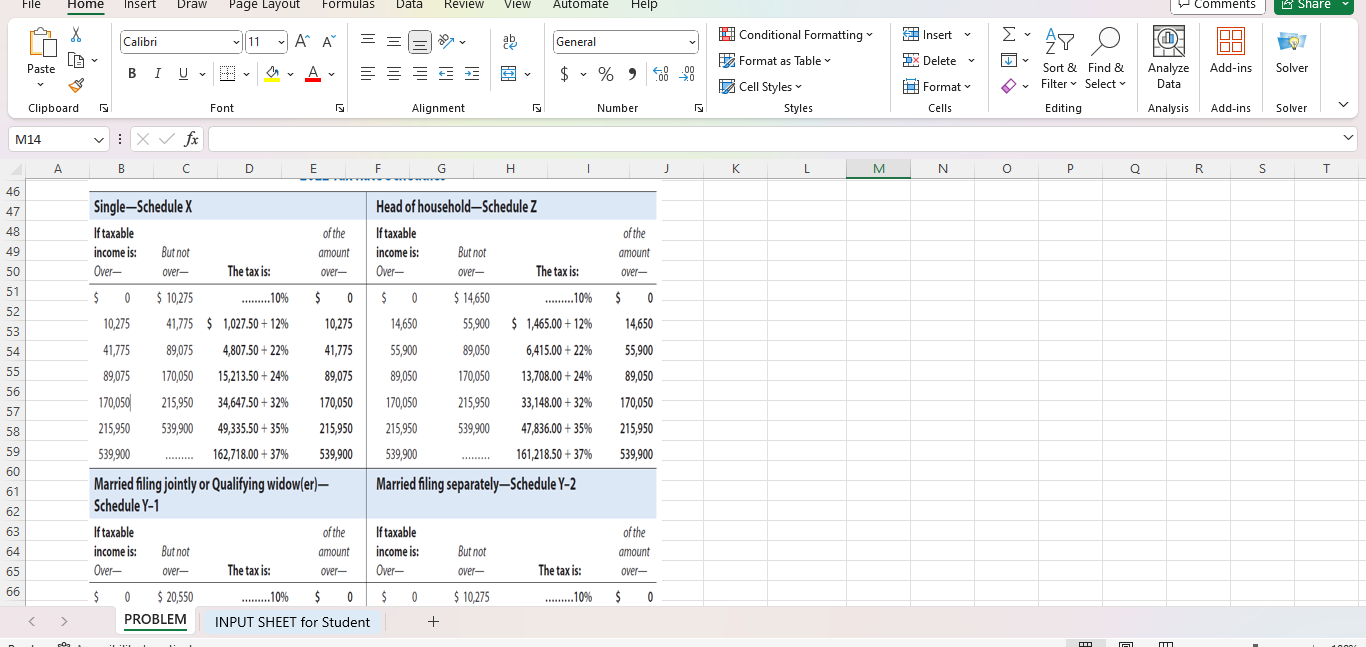

File Home Insert Draw Page Layout Formulas Data Review View Automate Help Comments Share Insert v Calibri 11 A ab General Conditional Formatting AY O Format as Table Delete Paste Solver BIU~ A E I V $ ~ % " Sort & Find & Analyze Add-ins Cell Styles ~ Format Filter * Select Data Clipboard Font Alignment Number Styles Cells Editing Analysis Add-ins Solver M14 VIX f A B C D E F G H K L M N O P Q R S T 59 539,900 162,718.00 + 37% 539,900 539,900 161,218.50 + 37% 539,900 60 61 Married filing jointly or Qualifying widow(er)- Married filing separately-Schedule Y-2 62 Schedule Y-1 63 If taxable of the If taxable of the 64 income is: But not amount income is: But not amount 65 Over- over- The tax is: over- Over- over- The tax is: over- 66 $ 0 $ 20,550 ........10% 0 0 $ 10,275 .........10% 67 20,550 83,550 $ 2,055.00 + 12% 20,550 10,275 41,775 $ 1,027.50 + 12% 10,275 68 69 83,550 178,150 9,615.00 + 22% 83,550 41,775 89,075 4,807.50 + 22% 41,775 70 178,150 340,100 30,427.00 + 24% 178,150 89,075 170.050 15,213.50 + 24% 89,075 71 340,100 431,900 69,295.00 + 32% 340,100 170,050 215,950 34,647.50 + 32% 170,050 72 73 431,900 647,850 98,671.00 + 35% 431,900 215,950 323,925 49,335.50 + 35% 215,950 74 647 850 174,253.50 + 37% 647,850 323,925 87,126.75 + 37% 323,925 75 76 77 78 79 > PROBLEM INPUT SHEET for Student +File Home Insert Draw Page Layout Formulas Data Review View Automate Help Comments Share Calibri 11 A A ab General Conditional Formatting Insert Ex AY O Format as Table ~ Delete Paste BIU~ = $ ~ % " Sort & Find & Analyze Add-ins Solver Cell Styles ~ Format Filter ~ Select v Data Clipboard Font Alignment Number Styles Cells Editing Analysis Add-ins Solver M14 A B C D E F G H J K L M N O P Q R S T QUIZ # 1 - V2 CUI Problem: Michael Dior and his wife Liz Dior are married and file a joint tax return for 2022. They have the following activity during the year. Using the basic tax formula, prepare their tax due (refund) for 2022 10 assuming a 22% Marginal tax Rate. (You should prepare this in EXCEL!) 11 12 Salary from W-2 for Michael 100,000 13 Income from business selling apparel 70,000 14 Interest from CD at Bank 2,500 15 Tax Exempt Interest from State of Michigan Bonds 4,000 16 Sale of Google Stock for $25,000 that was purchased 6 months ago for $24,500 17 IRA contribution 4,000 18 Interest on Student Loans 1,500 19 Interest on Mortage 3,000 20 State Income Taxes Paid 5,000 21 Fines & Penalties 500 22 Alimony paid by Michael on his 2019 divorce decree 6,000 23 Charitable Contributions made to United Way 25,000 24 Dependent Tax Credit for Taking care of Liz's 82 year old mother 500 25 Tax withheld on W-2 and estimated tax payments made on business incon 24,000 37 SCORING. PROBLEM INPUT SHEET for Student +File Home Insert Draw Page Layout Formulas Data Review View Automate Help Comments Share Calibri 11 A General Conditional Formatting Insert v Ex AY O Paste Format as Table Delete B I U - v 00 Sort & Find & Analyze Add-ins Solver Cell Styles Format Filter * Select v Data Clipboard Font Alignment Number Styles Cells Editing Analysis Add-ins Solver M14 vi X fx A B C D E F G H K L M N O P Q R S T 27 SCORING: 28 50% for accuracy in TAX FORMULA for Individuals 29 50% for calculations in determing Tax Due (Refund) 30 31 5% Bonus - Calculate EXACT Tax Due (Refund) using Tax Rate Schedule 32 33 34 Exhibit 3.4 Basic Standard Deduction Amounts 35 36 Standard Deduction Amount 37 Filing Status 2021 2022 38 Single $12,550 $12,950 39 Married, filing jointly 25,100 25,900 40 Surviving spouse 25,100 25,900 41 Head of household 18,800 19,400 42 Married, filing separately 12,550 12,950 43 44 45 2022 Tax Rate Schedules 46 47 Single-Schedule X Head of household-Schedule Z

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts