Question: File Home Insert Formulas Data Review View Help V Tell me what you want to do Open in Desktop App Editing ... Comments Conversation bv

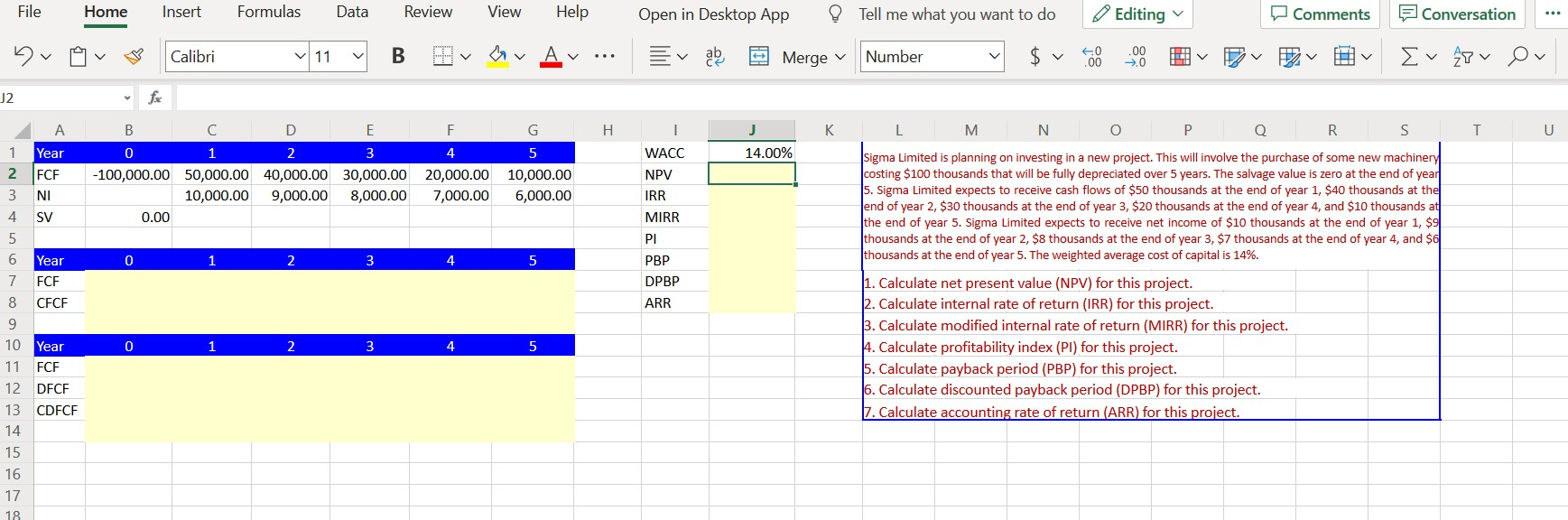

File Home Insert Formulas Data Review View Help V Tell me what you want to do Open in Desktop App Editing ... Comments Conversation bv Calibri v 11 B v v Av ab Merge Number $ V 60 .00 .00 >0 Ev 27 v Oy J2 F K L M N O Q R S T U 14.00% 2 Year FCF NI SV B D E G 0 1 2 3 4 5 -100,000.00 50,000.00 40,000.00 30,000.00 20,000.00 10,000.00 10,000.00 9,000.00 8,000.00 7,000.00 6,000.00 0.00 3 4 WACC NPV IRR MIRR PI PBP DPBP ARR 5 6 0 1 2 3 4 5 Year FCF CFCF Sigma Limited is planning on investing in a new project. This will involve the purchase of some new machinery costing $100 thousands that will be fully depreciated over 5 years. The salvage value is zero at the end of year 5. Sigma Limited expects to receive cash flows of $50 thousands at the end of year 1, $40 thousands at the end of year 2, $30 thousands at the end of year 3, $20 thousands at the end of year 4, and $10 thousands at the end of year 5. Sigma Limited expects to receive net income of $10 thousands at the end of year 1, $9 thousands at the end of year 2, $8 thousands at the end of year 3, $7 thousands at the end of year 4, and $6 thousands at the end of year 5. The weighted average cost of capital is 14%. 1. Calculate net present value (NPV) for this project. 2. Calculate internal rate of return (IRR) for this project. 3. Calculate modified internal rate of return (MIRR) for this project. 4. Calculate profitability index (Pl) for this project. 5. Calculate payback period (PBP) for this project. 6. Calculate discounted payback period (DPBP) for this project. 7. Calculate accounting rate of return (ARR) for this project. 8 9 0 1 2 3 4 5 10 Year 11 FCF 12 DFCF 13 CDFCF 14 15 16 17 18

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts