Question: File Tools View Document1 - Word - 0 The payroll records of Fine Foods Company provide the fol- lowing data for the bi-weekly pay period

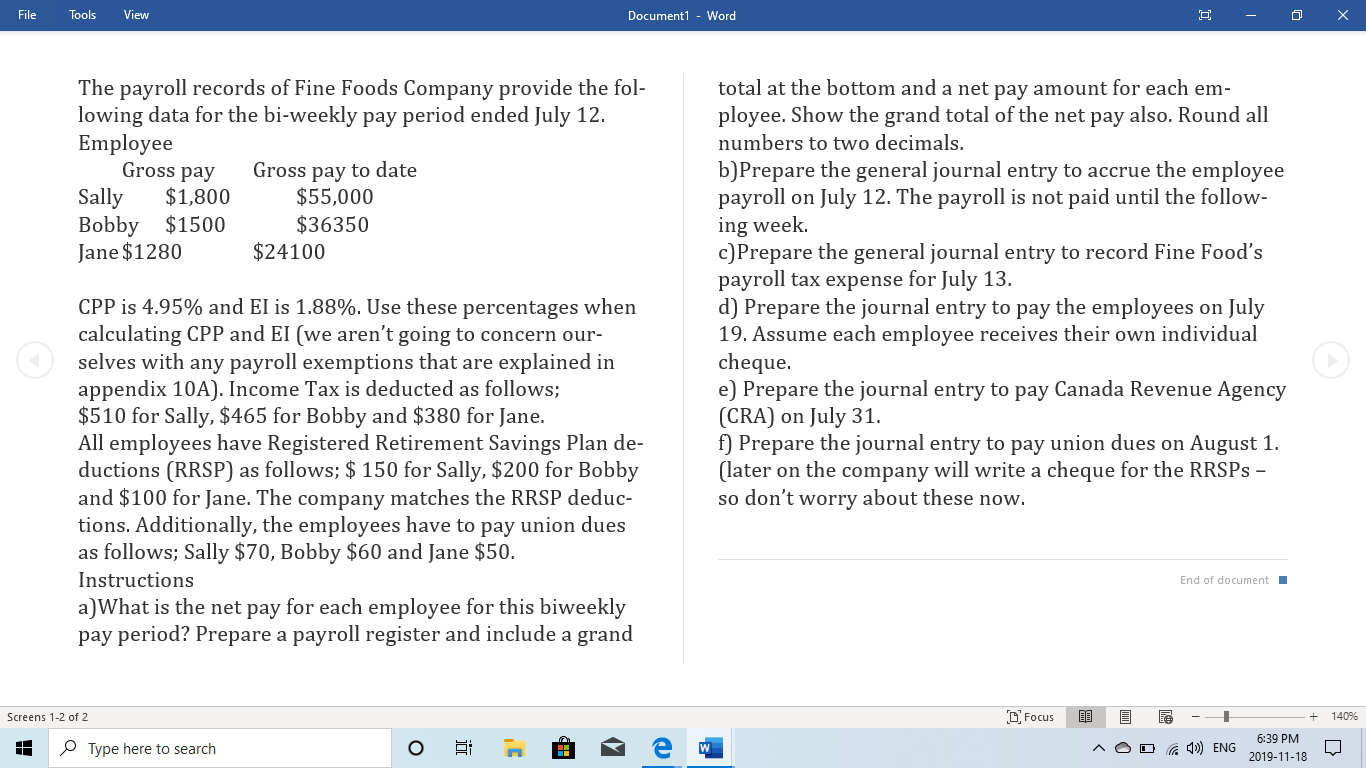

File Tools View Document1 - Word - 0 The payroll records of Fine Foods Company provide the fol- lowing data for the bi-weekly pay period ended July 12. Employee Gross pay Gross pay to date Sally $1,800 $55,000 Bobby $1500 $36350 Jane $1280 $24100 CPP is 4.95% and El is 1.88%. Use these percentages when calculating CPP and El (we aren't going to concern our- selves with any payroll exemptions that are explained in appendix 10A). Income Tax is deducted as follows; $510 for Sally, $465 for Bobby and $380 for Jane. All employees have Registered Retirement Savings Plan de- ductions (RRSP) as follows; $ 150 for Sally, $200 for Bobby and $100 for Jane. The company matches the RRSP deduc- tions. Additionally, the employees have to pay union dues as follows; Sally $70, Bobby $60 and Jane $50. Instructions a)What is the net pay for each employee for this biweekly pay period? Prepare a payroll register and include a grand total at the bottom and a net pay amount for each em- ployee. Show the grand total of the net pay also. Round all numbers to two decimals. b)Prepare the general journal entry to accrue the employee payroll on July 12. The payroll is not paid until the follow- ing week. c)Prepare the general journal entry to record Fine Food's payroll tax expense for July 13. d) Prepare the journal entry to pay the employees on July 19. Assume each employee receives their own individual cheque. e) Prepare the journal entry to pay Canada Revenue Agency (CRA) on July 31. f) Prepare the journal entry to pay union dues on August 1. (later on the company will write a cheque for the RRSPs - so don't worry about these now. End of document Screens 1-2 of 2 D Focus 140% - 1 AOOT 1) ENG Type here to search - + 6:39 PM 2019-11-18 File Tools View Document1 - Word - 0 The payroll records of Fine Foods Company provide the fol- lowing data for the bi-weekly pay period ended July 12. Employee Gross pay Gross pay to date Sally $1,800 $55,000 Bobby $1500 $36350 Jane $1280 $24100 CPP is 4.95% and El is 1.88%. Use these percentages when calculating CPP and El (we aren't going to concern our- selves with any payroll exemptions that are explained in appendix 10A). Income Tax is deducted as follows; $510 for Sally, $465 for Bobby and $380 for Jane. All employees have Registered Retirement Savings Plan de- ductions (RRSP) as follows; $ 150 for Sally, $200 for Bobby and $100 for Jane. The company matches the RRSP deduc- tions. Additionally, the employees have to pay union dues as follows; Sally $70, Bobby $60 and Jane $50. Instructions a)What is the net pay for each employee for this biweekly pay period? Prepare a payroll register and include a grand total at the bottom and a net pay amount for each em- ployee. Show the grand total of the net pay also. Round all numbers to two decimals. b)Prepare the general journal entry to accrue the employee payroll on July 12. The payroll is not paid until the follow- ing week. c)Prepare the general journal entry to record Fine Food's payroll tax expense for July 13. d) Prepare the journal entry to pay the employees on July 19. Assume each employee receives their own individual cheque. e) Prepare the journal entry to pay Canada Revenue Agency (CRA) on July 31. f) Prepare the journal entry to pay union dues on August 1. (later on the company will write a cheque for the RRSPs - so don't worry about these now. End of document Screens 1-2 of 2 D Focus 140% - 1 AOOT 1) ENG Type here to search - + 6:39 PM 2019-11-18

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts