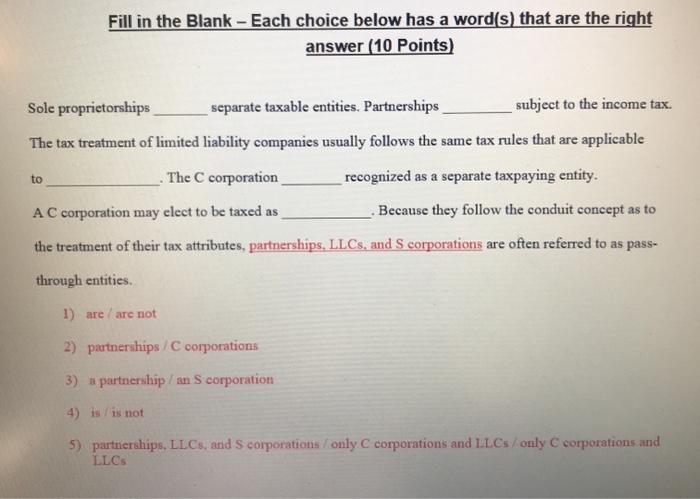

Question: Fill in the Blank - Each choice below has a word(s) that are the right answer (10 Points) Sole proprietorships separate taxable entities. Partnerships subject

Fill in the Blank - Each choice below has a word(s) that are the right answer (10 Points) Sole proprietorships separate taxable entities. Partnerships subject to the income tax The tax treatment of limited liability companies usually follows the same tax rules that are applicable The C corporation recognized as a separate taxpaying entity. AC corporation may elect to be taxed as Because they follow the conduit concept as to the treatment of their tax attributes, partnerships, LLCs, and S corporations are often referred to as pass- to through entities 1) are / are not 2) partnerships C corporations 3) a partnership /an S corporation 4) is is not 5) partnerships, LLCs, and corporations only C corporations and LLCs/only C corporations and LLCs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts