Question: Fill in the blanks using words that fit the context. The answers are NOT case sensitive: According to investopedia, an initial public offering (IPO) refers

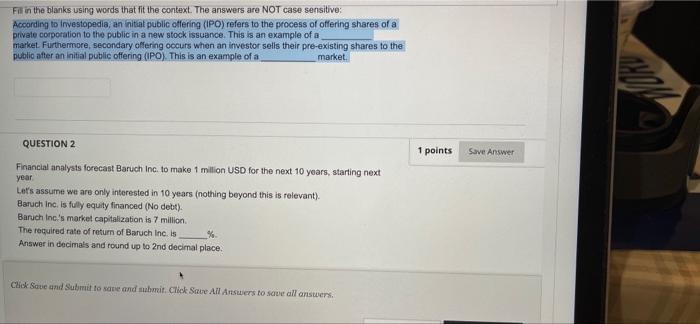

Fill in the blanks using words that fit the context. The answers are NOT case sensitive: According to investopedia, an initial public offering (IPO) refers to the process of offering shares of a private corporation to the public in a new stock issuance. This is an example of a market. Furthermore, secondary offering occurs when an investor sells their pre-existing shares to the public after an initial public offering (IPO). This is an example of a market. QUESTION 2 Financial analysts forecast Baruch Inc. to make 1 million USD for the next 10 years, starting next year Let's assume we are only interested in 10 years (nothing beyond this is relevant). Baruch Inc. is fully equity financed (No debt). Baruch Inc.'s market capitalization is 7 million. The required rate of return of Baruch Inc. is % Answer in decimals and round up to 2nd decimal place. Click Save and Submit to save and submit. Click Save All Answers to save all answers. 1 points Save

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts