Question: Fill out the excel below: Taxable deductions can differ in timing from book expenses. In this example, amounts are deducted for taxes before they are

Fill out the excel below:

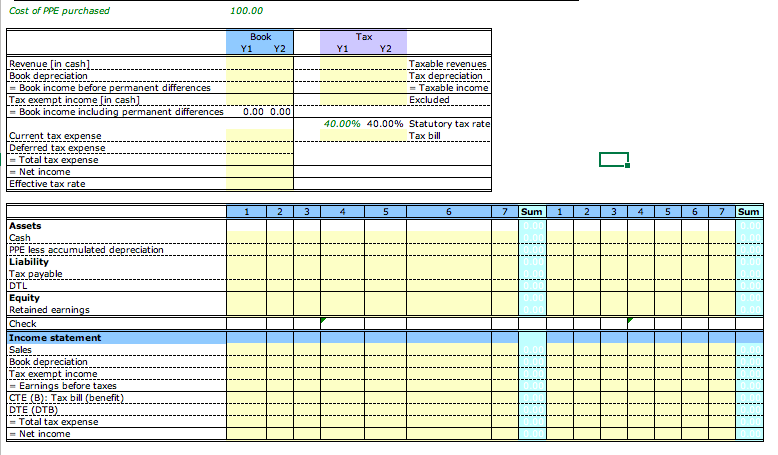

Taxable deductions can differ in timing from book expenses. In this example, amounts are deducted for taxes before they are booked as expenses. This situation arises here because the company depreciates its assets faster for taxes than for books. As a result, the book basis of the PP&E exceeds its tax basis. Year 1: 1. ACo books sales revenue of $125 for cash. This is immediately taxable. 2. ACo buys PPE for $100 in cash. The PPE has a useful life of two years with no salvage value. Its depreciation is described below. 3. ACo books depreciation of $55 for financial reporting. The tax depreciation is $75. 4. ACo books tax-exempt income of $30. The income is received in cash. 5. ACo books a current tax expense for the tax bill. The tax rate is 40%. 6. ACo pays $18 in cash taxes with the remaining to be paid in the following year. 7. ACo books a deferred tax liability. Year 2: 1. ACo books sales revenue of $125 in cash. This is immediately taxable. 2. ACo does not buy in new PP&E is Year 2. No entry is needed here. 3. ACo books the remaining depreciation for PPE. 4. ACo books tax-exempt income of $48. The income is received in cash. 5. ACo books a current tax expense for the tax bill. The tax rate is 40%. 6. ACo pays taxes due from prior year plus the entire tax bill for year 2. 7. ACo reverses the deferred tax liability.

Cost of PPE purchased 100.00 Book Y1 Y2 Tax Y2 Y1 Revenue [in cash) Book depreciation Book income before permanent differences Tax exempt income [in cash Book income including permanent differences Taxable revenues Tax depreciation = Taxable income Excluded ---- 0.00 0.00 40.00% 40.00% Statutory tax rate Tax bill Current tax expense Deferred tax expense = Total tax expense Net income Effective tax rate 1 2 3 5 6 7 Sum 1 2 3 5 6 7 Sum Assets Cash PPE less accumulated depreciation Liability Tax payable DTL Equity Retained earnings Check Income statement Sales Book depreciation Tax exempt income Earnings before taxes CTE (B): Tax bill benefit DTE (DTB). = Total tax expense Net income Cost of PPE purchased 100.00 Book Y1 Y2 Tax Y2 Y1 Revenue [in cash) Book depreciation Book income before permanent differences Tax exempt income [in cash Book income including permanent differences Taxable revenues Tax depreciation = Taxable income Excluded ---- 0.00 0.00 40.00% 40.00% Statutory tax rate Tax bill Current tax expense Deferred tax expense = Total tax expense Net income Effective tax rate 1 2 3 5 6 7 Sum 1 2 3 5 6 7 Sum Assets Cash PPE less accumulated depreciation Liability Tax payable DTL Equity Retained earnings Check Income statement Sales Book depreciation Tax exempt income Earnings before taxes CTE (B): Tax bill benefit DTE (DTB). = Total tax expense Net income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts