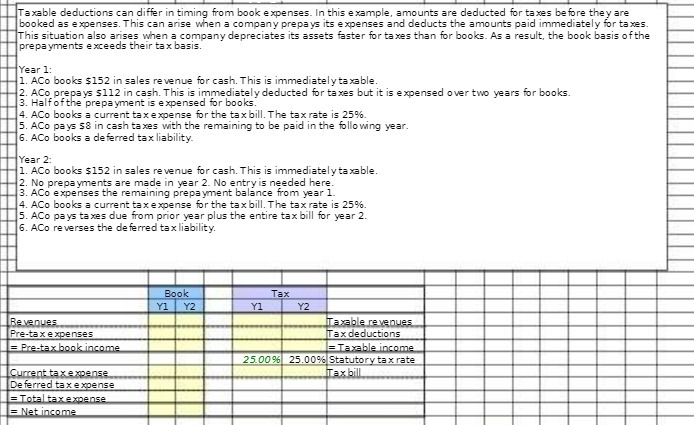

Question: Taxable deductions can differ in timing from book expenses. In this example, amounts are deducted for taxes before they are booked as expenses. This can

Taxable deductions can differ in timing from book expenses. In this example, amounts are deducted for taxes before they are booked as expenses. This can arse when a company prepays its expenses and deducts the amounts paid immediately for taxes. This situation also arises when a company depreciates its assets faster for taxes than for books. As a result, the book basis of the prepayments exceeds their tax basis. Year 1: 1. ACo books $152 in sales revenue for cash. This is immediately taxable. 2. ACo prepays $112 in cash. This is immediately deducted for taxes but it is expensed over two years for books. 3. Half of the prepayment is expensed for books. 4. ACo books a current tax expense for the tax bill. The tax rate is 25%. 5. ACo pays $8 in cash taxes with the remaining to be paid in the following year. 6. ACo books a deferred tax liability. Year 2: 1. ACo books $152 in sales revenue for cash. This is immediately taxable. 2. No prepayments are made in year 2. No entry is needed here. 3. ACo expenses the remaining prepayment balance from year 1. 4. ACo books a current tax expense for the tax bill. The tax rate is 25%. 5. ACo pays taxes due from prior year plus the entire tax bill for year 2. 6. ACo reverses the deferred tax liability. Book Tax Yl Y2 Yl Y2 Revenues Taxable revenues Pre-tax expenses Tax deductions = Pre-tax book income = Taxable income 25.006 25.00% Statutory tax rate Current tax expense Tax bill Deferred tax expense = Tota tax expense = Net income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts