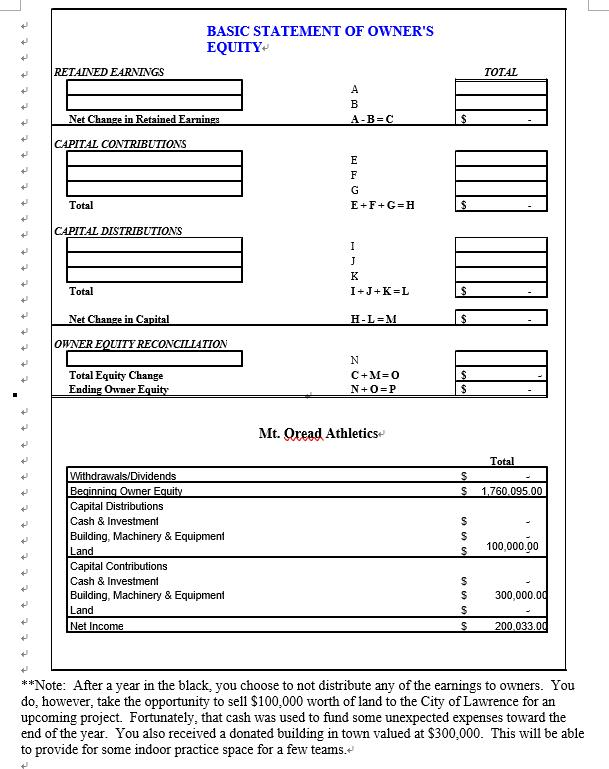

Question: Fill the blank BASIC STATEMENT OF OWNER'S EQUITY RETAINED EARNINGS TOTAL A Net Change in Retained Earnings A-B-C CAPITAL CONTRIBUTIONS E F G E F

Fill the blank

BASIC STATEMENT OF OWNER'S EQUITY RETAINED EARNINGS TOTAL A Net Change in Retained Earnings A-B-C CAPITAL CONTRIBUTIONS E F G E F G H Total CAPITAL DISTRIBUTIONS T T K Total I J+K L Net Change in Capital H-L M OWNER EQUITY RECONCILIATION N Total Equity Change Ending Owner Equity C+M-0 N 0 P Mt. Oread Athletics Total Withdrawals/Dividends Beqinning Owner Equity Capital Distributions Cash & Investment Building, Machinery & Equipment Land S S 1,760,095.00 S S 100,000.00 S Capital Contributions Cash & Investment Building, Machinery & Equipment Land 300,000,00 S S Net Income 200,033.00 S *Note: After a year in the black, you choose to not distribute any of the earnings to owners. You do, however, take the opportunity to sell $100,000 worth of land to the City of Lawrence for an upcoming project. Fortunately, that cash was used to fund some unexpected expenses toward the end of the year. You also received a donated building in town valued at $300,000. This will be able to provide for some indoor practice space for a few teams. BASIC STATEMENT OF OWNER'S EQUITY RETAINED EARNINGS TOTAL A Net Change in Retained Earnings A-B-C CAPITAL CONTRIBUTIONS E F G E F G H Total CAPITAL DISTRIBUTIONS T T K Total I J+K L Net Change in Capital H-L M OWNER EQUITY RECONCILIATION N Total Equity Change Ending Owner Equity C+M-0 N 0 P Mt. Oread Athletics Total Withdrawals/Dividends Beqinning Owner Equity Capital Distributions Cash & Investment Building, Machinery & Equipment Land S S 1,760,095.00 S S 100,000.00 S Capital Contributions Cash & Investment Building, Machinery & Equipment Land 300,000,00 S S Net Income 200,033.00 S *Note: After a year in the black, you choose to not distribute any of the earnings to owners. You do, however, take the opportunity to sell $100,000 worth of land to the City of Lawrence for an upcoming project. Fortunately, that cash was used to fund some unexpected expenses toward the end of the year. You also received a donated building in town valued at $300,000. This will be able to provide for some indoor practice space for a few teams

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts