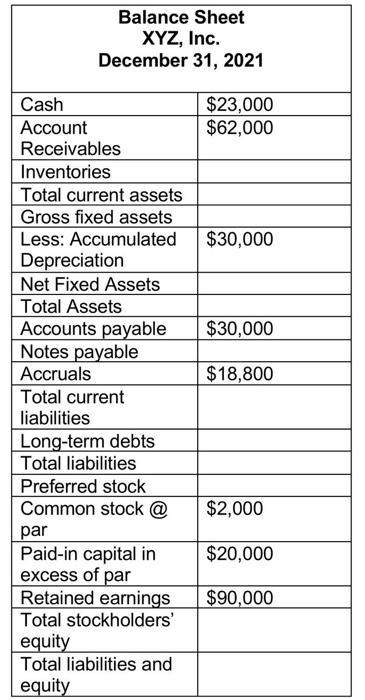

Question: fill the table using the keys please Balance Sheet XYZ, Inc. December 31, 2021 $23,000 $62,000 $30,000 $30,000 $18,800 Cash Account Receivables Inventories Total current

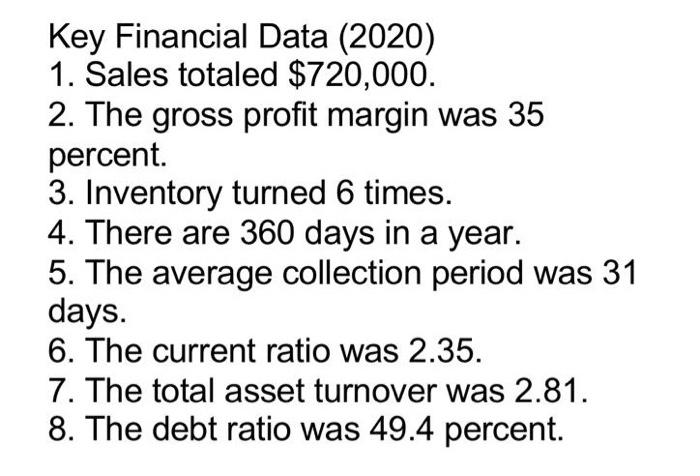

Balance Sheet XYZ, Inc. December 31, 2021 $23,000 $62,000 $30,000 $30,000 $18,800 Cash Account Receivables Inventories Total current assets Gross fixed assets Less: Accumulated Depreciation Net Fixed Assets Total Assets Accounts payable Notes payable Accruals Total current liabilities Long-term debts Total liabilities Preferred stock Common stock @ par Paid-in capital in excess of par Retained earnings Total stockholders' equity Total liabilities and equity $2,000 $20,000 $90,000 Key Financial Data (2020) 1. Sales totaled $720,000. 2. The gross profit margin was 35 percent. 3. Inventory turned 6 times. 4. There are 360 days in a year. 5. The average collection period was 31 days. 6. The current ratio was 2.35. 7. The total asset turnover was 2.81. 8. The debt ratio was 49.4 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts