Question: FIN 3 5 6 / AC 3 5 6 Case Study 1 Notes: This is an individual case study. You are NOT allowed to share

FINAC Case Study

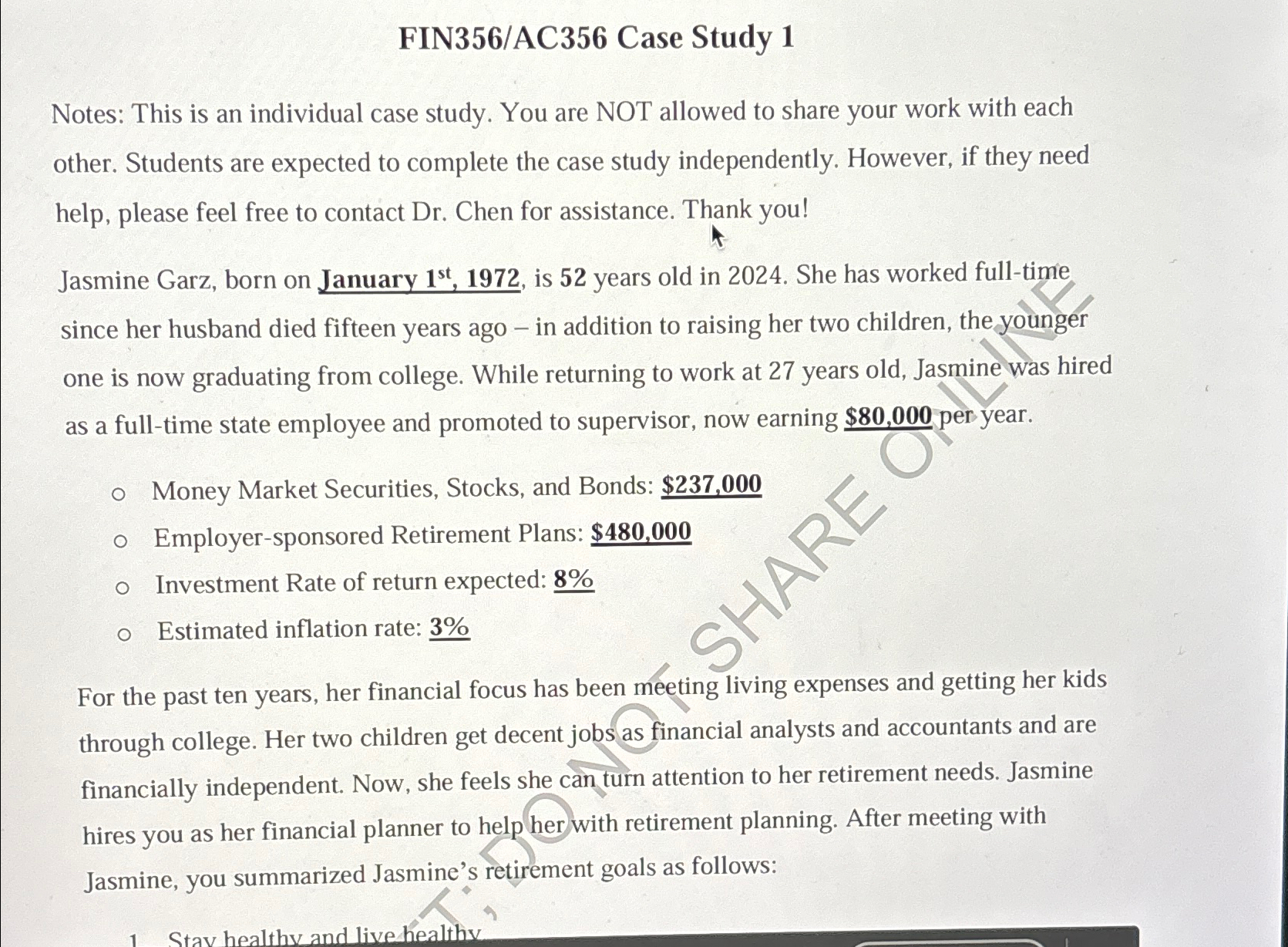

Notes: This is an individual case study. You are NOT allowed to share your work with each other. Students are expected to complete the case study independently. However, if they need help, please feel free to contact Dr Chen for assistance. Thank you!

Jasmine Garz, born on January is years old in She has worked fulltime since her husband died fifteen years ago in addition to raising her two children, the younger one is now graduating from college. While returning to work at years old, Jasmine was hired as a fulltime state employee and promoted to supervisor, now earning $ per year.

Money Market Securities, Stocks, and Bonds: $

Employersponsored Retirement Plans: $$

Investment Rate of return expected:

Estimated inflation rate:

For the past ten years, her financial focus has been meeting living expenses and getting her kids through college. Her two children get decent jobs as financial analysts and accountants and are financially independent. Now, she feels she can turn attention to her retirement needs. Jasmine hires you as her financial planner to help her with retirement planning. After meeting with Jasmine, you summarized Jasmine's retirement goals as follows:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock