Question: FIN 3023 Risk and Expected Returns Class Practice Expected return and standard deviation if probabilities are given You are considering two investment options, Oil Co.

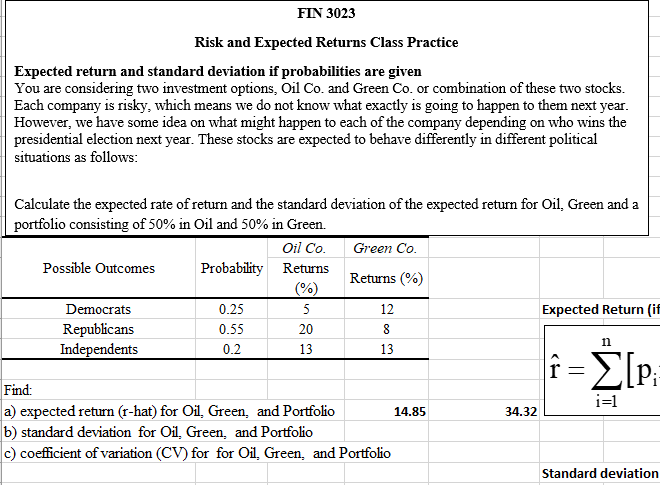

FIN 3023 Risk and Expected Returns Class Practice Expected return and standard deviation if probabilities are given You are considering two investment options, Oil Co. and Green Co. or combination of these two stocks. Each company is risky, which means we do not know what exactly is going to happen to them next year. However, we have some idea on what might happen to each of the company depending on who wins the presidential election next year. These stocks are expected to behave differently in different political situations as follows: Calculate the expected rate of return and the standard deviation of the expected return for Oil, Green and a portfolio consisting of 50% in Oil and 50% in Green. Oil Co. Green Co. Possible Outcomes Probability Returns Returns (%) (%) Democrats 0.25 5 12 Expected Return (if Republicans 0.55 20 8 Independents 0.2 13 n 13 r = Find i=1 a) expected return (r-hat) for Oil, Green, and Portfolio 14.85 b) standard deviation for Oil, Green, and Portfolio c) coefficient of variation (CV) for for Oil, Green, and Portfolio Standard deviation f = [P: [: 34.32

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts