Question: FIN 3200-Chapter 6 Assignment-I (6 points) A buy-side equity analysts from Oppenheimer & Co. is using abnormal earnings growth model to analyze the value of

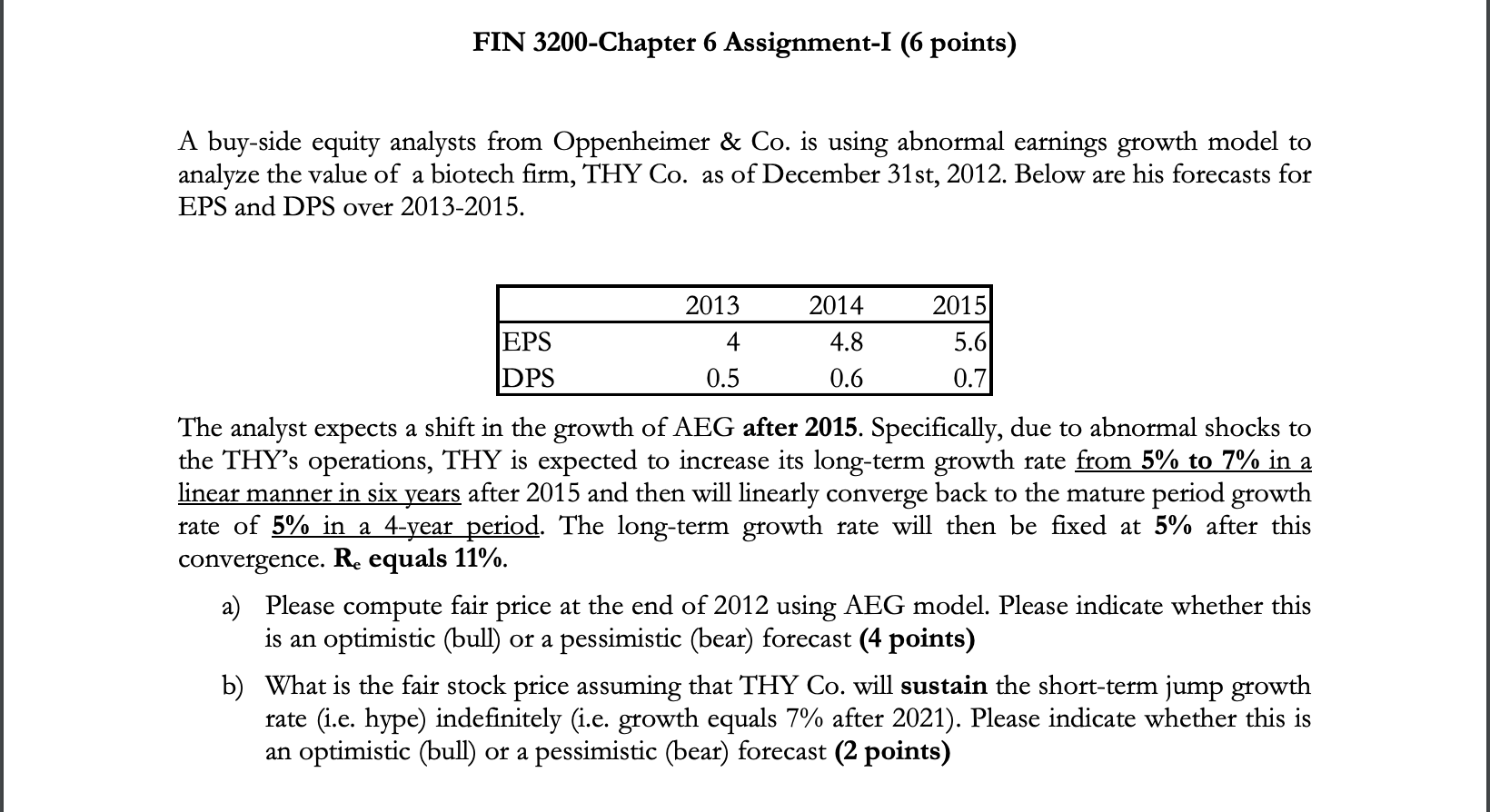

FIN 3200-Chapter 6 Assignment-I (6 points) A buy-side equity analysts from Oppenheimer & Co. is using abnormal earnings growth model to analyze the value of a biotech firm, THY Co. as of December 31st, 2012. Below are his forecasts for EPS and DPS over 2013-2015. 2013 2014 2015 EPS 4 4.8 5.6 DPS 0.5 0.6 0.7 The analyst expects a shift in the growth of AEG after 2015. Specifically, due to abnormal shocks to the THY's operations, THY is expected to increase its long-term growth rate from 5% to 7% in a linear manner in six years after 2015 and then will linearly converge back to the mature period growth rate of 5% in a 4-year period. The long-term growth rate will then be fixed at 5% after this convergence. Re equals 11%. a) Please compute fair price at the end of 2012 using AEG model. Please indicate whether this is an optimistic (bull) or a pessimistic (bear) forecast (4 points) b) What is the fair stock price assuming that THY Co. will sustain the short-term jump growth rate (i.e. hype) indefinitely (i.e. growth equals 7% after 2021). Please indicate whether this is an optimistic (bull) or a pessimistic (bear) forecast (2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts