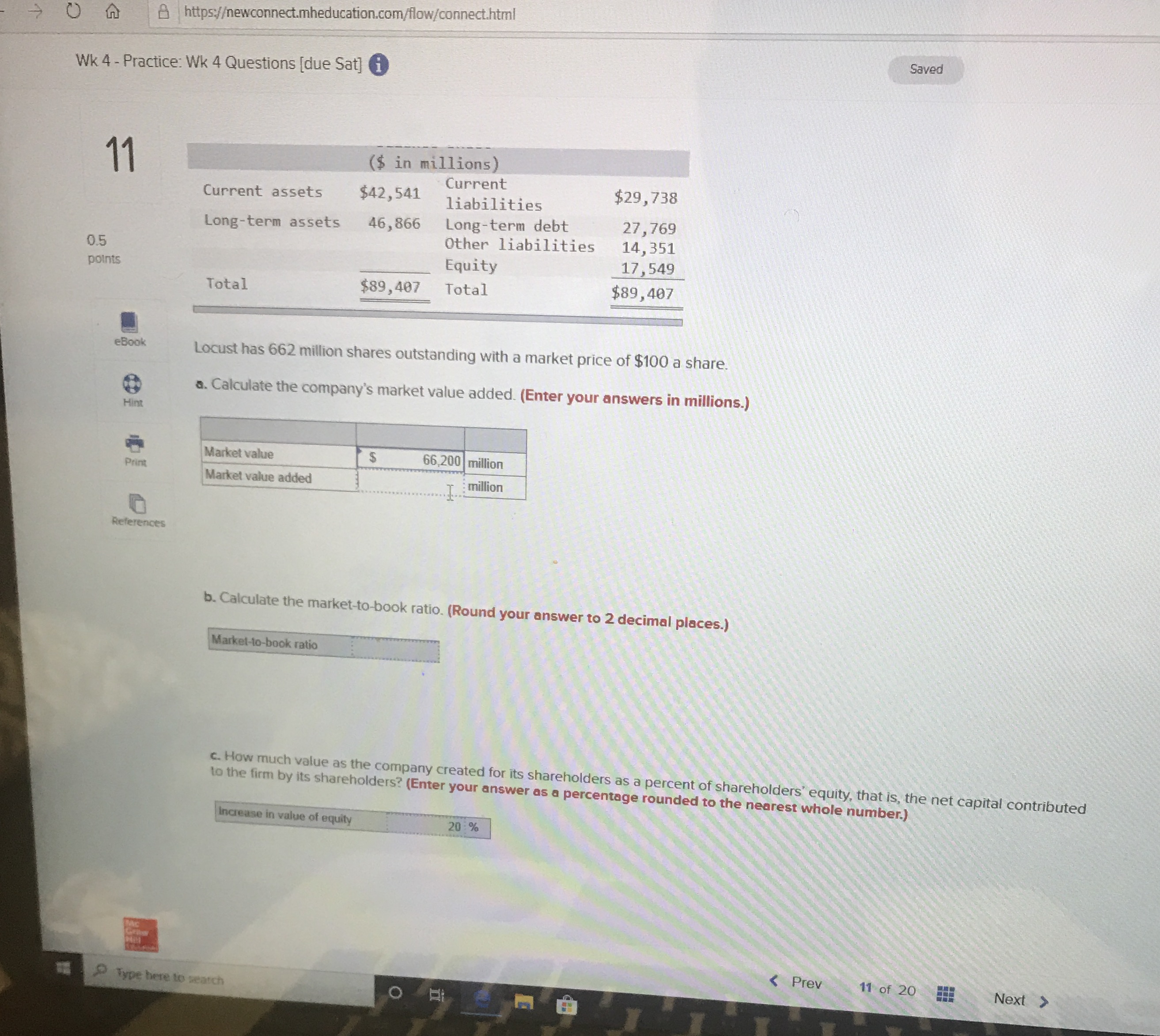

Question: FIN 571 Finance https:ewconnect.mheducation.com/flow/connect.html Wk 4 - Practice: Wk 4 Questions [due Sat] i Saved 11 ($ in millions) Current assets $42, 541 Current liabilities

FIN 571 Finance

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock