Question: FIN2303 Financial Case # 2 Submit ONE Microsoft Word file using Bright Space, do not email to professor. Part A: Take a look at the

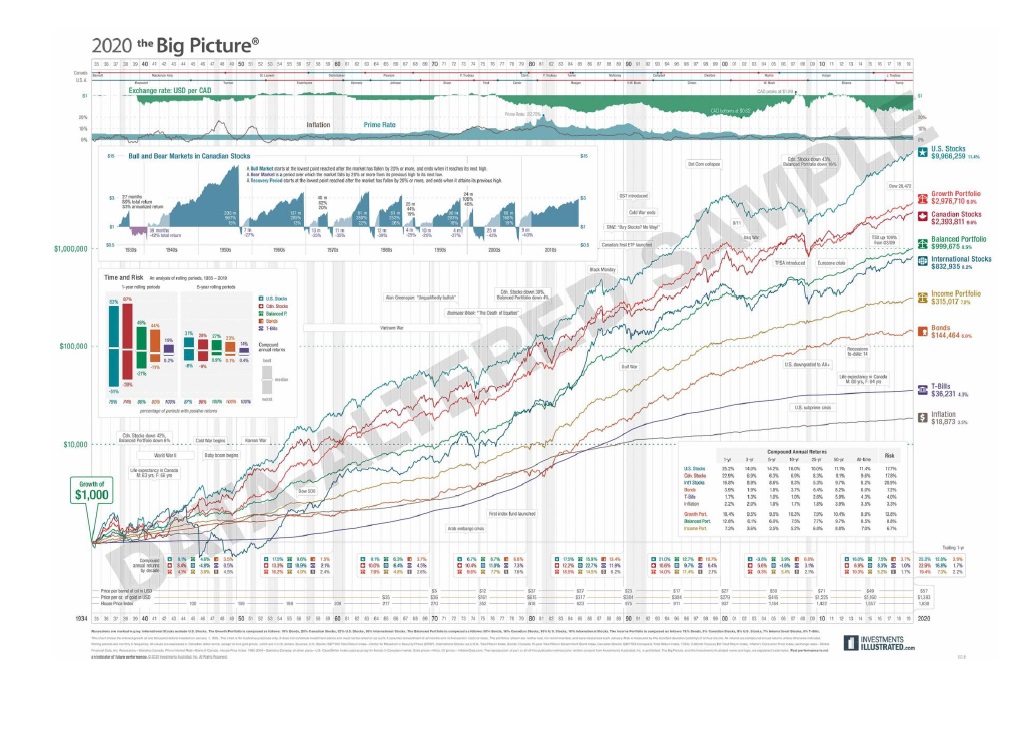

FIN2303 Financial Case # 2 Submit ONE Microsoft Word file using Bright Space, do not email to professor. Part A: Take a look at the Canadian Andex chart (Attached PDF File) 1. List 10 elements of the Andex chart. All combined Indices performance count as 1 element. 2. Why do you thing the Andex chart can be a great tool for financial planning? 3. After analyzing the chart, name 2 lessons/stories/relationships in the data that stand out personally as important, interesting or surprising Part B: List the risk-return trade off in ascending order of the following securities: Corporate bonds . Small capitalization stocks . Government bonds . GIC's Precious metals Large capitalization stocks . Cash T-bills Assign the appropriate securities (from the list above) to the following goals: Saving for a down payment on a house in the next 5 years Saving for your retirement 30 years into the future Saving for your child's education 15 years into the future Saving for a new car next summer Earning a higher return in your long-term savings Part C: Three friends, Jenna, Michael & Alice are debating whether an RRSP or a TFSA would be a better choice for them. Each of them is the same age (e.g. 40 years old) and is saving for a goal that is 15 years into the future (retirement). Jenna has an income of $100,000, Michael has an income of $70,000 and Alice's income is $40,000. After the target date, Jenna expects to have an income of $70,000, Michael expects to be earning about the same and Alice expects to be earning $70,000. Assume they planning to contribute $5,000, and they face different income tax brackets based on their income levels. For example, the Federal Tax Rates for 2020 are as follows: Federal tax rates for 2020 15% on the first $48,535 of taxable income, plus 20.5% on the next $48,534 of taxable income (on the portion of taxable income over 48,535 up to $97,069), plus 26% on the next $53.404 of taxable income (on the portion of taxable income over $97,069 up to $150,473), plus 29% on the next $63,895 of taxable income (on the portion of taxable income over 150,473 up to $214,368), plus 33% of taxable income over $214,3681 Provincially, the Ontario tax rates are as follows: . 5.05% on the first $44,740 of taxable income, + 9.15% on the next $44,742, . . . 11.16% on the next $60,518, + 12.16% on the next $70,000, + 13.16% on the amount over $220,0002 Assuming they use the tax refund generated from RRSP contributions to re-invest into their RRSP, which vehicle would be the best choice for each of Jenna, Michael and Alice? Assume they live in Ontario and will earn the same return (e.g. 5 percent) in both vehicles. Identify any assumptions made. Your conclusions should focus on the reason(s) for selecting a RRSP or TFSA, including tax implications of a changing income level, and not just focused on calculations. NOTE: All of the analysis provided by you must be your own work and reflect your own original thought. Do not provide any copy/paste material, do not reference or provide citations for other material. I want to receive your opinion, the results of your research and your own thoughts.2020 the Big Picture Exchange rate: USD per CAD Inflation Prime Rabe 56 - Bull and Bear Markets in Canadian Stocks U.S. Stocks $9,968,259 may Growth Partfolio $2,976,710 sas anadian Stocks $2.393 811 er $1 000,000 Balanced Portfolio ige International Stocks $832 935 LMS Time and Risk & mip Insome Portfolio $315.017 215 $144 ,464 LOS $100.000 T-Bills 536 731 AM 2$18,873 14% -.. .. ..... Gorath of $1,000 955 Price panos d gold in ED INVESTMENTS ILLUSTRATED.com