Question: FIN3003 Home Assignment 1 (Due date: 9 Oct) The assignment can be handwritten or typed. Submission in pdf format via Moodle. You are required to

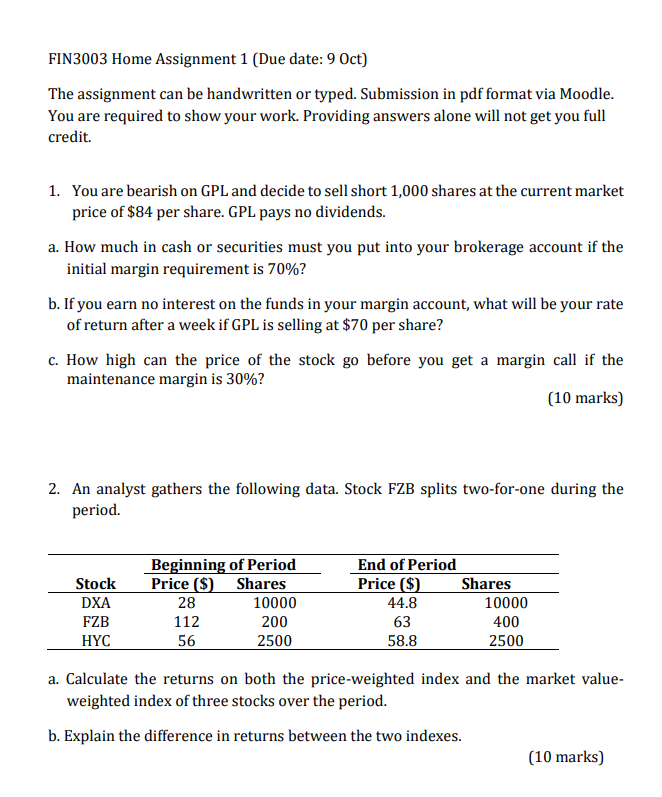

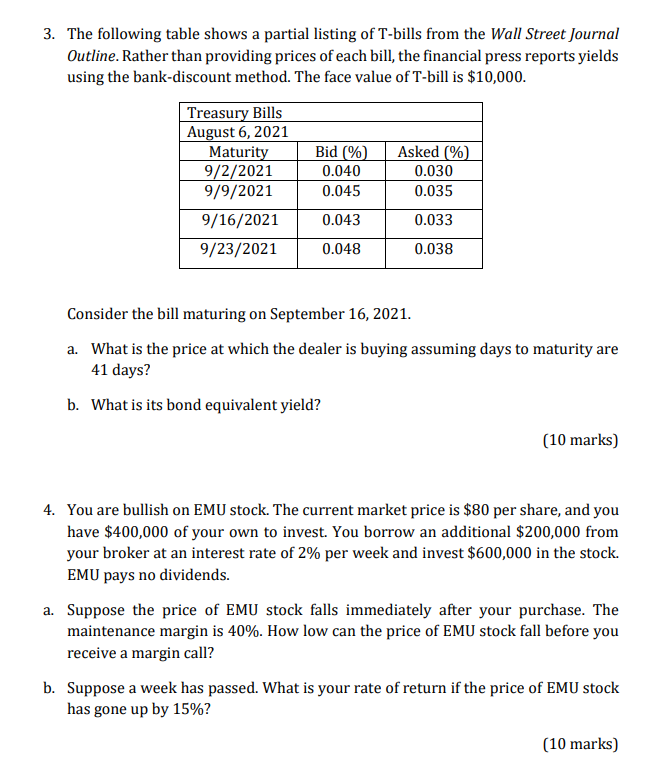

FIN3003 Home Assignment 1 (Due date: 9 Oct) The assignment can be handwritten or typed. Submission in pdf format via Moodle. You are required to show your work. Providing answers alone will not get you full credit 1. You are bearish on GPL and decide to sell short 1,000 shares at the current market price of $84 per share. GPL pays no dividends. a. How much in cash or securities must you put into your brokerage account if the initial margin requirement is 70%? b. If you earn no interest on the funds in your margin account, what will be your rate of return after a week if GPL is selling at $70 per share? c. How high can the price of the stock go before you get a margin call if the maintenance margin is 30%? (10 marks) 2. An analyst gathers the following data. Stock FZB splits two-for-one during the period. Stock DXA FZB HYC Beginning of Period Price ($) Shares 28 10000 112 200 56 2500 End of Period Price ($) Shares 44.8 10000 63 400 58.8 2500 a. Calculate the returns on both the price-weighted index and the market value- weighted index of three stocks over the period. b. Explain the difference in returns between the two indexes. (10 marks) 3. The following table shows a partial listing of T-bills from the Wall Street Journal Outline. Rather than providing prices of each bill, the financial press reports yields using the bank-discount method. The face value of T-bill is $10,000. Treasury Bills August 6, 2021 Maturity 9/2/2021 9/9/2021 9/16/2021 9/23/2021 Bid (%) 0.040 0.045 Asked (%) 0.030 0.035 0.043 0.033 0.048 0.038 Consider the bill maturing on September 16, 2021. a. What is the price at which the dealer is buying assuming days to maturity are 41 days? b. What is its bond equivalent yield? (10 marks) 4. You are bullish on EMU stock. The current market price is $80 per share, and you have $400,000 of your own to invest. You borrow an additional $200,000 from your broker at an interest rate of 2% per week and invest $600,000 in the stock. EMU pays no dividends. a. Suppose the price of EMU stock falls immediately after your purchase. The maintenance margin is 40%. How low can the price of EMU stock fall before you receive a margin call? b. Suppose a week has passed. What is your rate of return if the price of EMU stock has gone up by 15%? (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts