Question: FIN3IPM Portfolio Management ASSIGNMENT PART 1 - PORTFOLIO PROPOSAL CASE STUDY You currently work for an individual client adviser for Bell Potter Securities, a leading

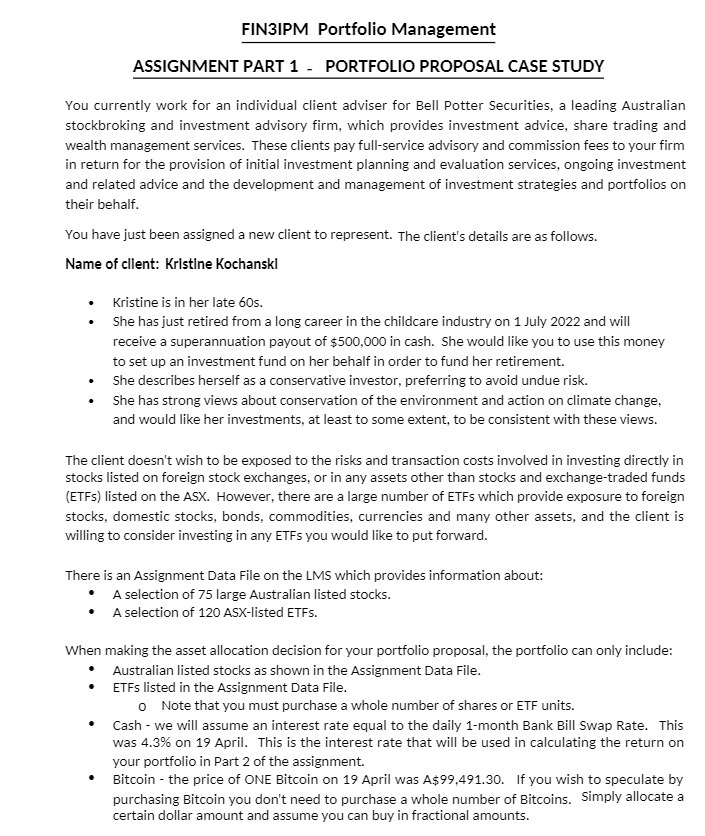

FIN3IPM Portfolio Management ASSIGNMENT PART 1 - PORTFOLIO PROPOSAL CASE STUDY You currently work for an individual client adviser for Bell Potter Securities, a leading Australian stockbroking and investment advisory firm, which provides investment advice, share trading and wealth management services. These clients pay full-service advisory and commission fees to your firm in return for the provision of initial investment planning and evaluation services, ongoing investment and related advice and the development and management of investment strategies and portfolios on their behalf. You have just been assigned a new client to represent. The client's details are as follows. Name of cllent: Kristine Kochanskl = Hristine is in her late 60s. = She has just retired from a long career in the childcare industry on 1 July 2022 and will receive a superannuation payout of $500,000 in cash. She would like you to use this money to set up an investment fund on her behalf in order to fund her retirement. She describes herself as a conservative investor, preferring to avoid undue risk. She has strong views about conservation of the environment and action on climate change, and would like her investments, at least to some extent, to be consistent with these views. The client doesn't wish to be exposed to the risks and transaction costs involved in investing directly in stocks listed on foreign stock exchanges, or in any assets other than stocks and exchange-traded funds (ETFs) listed on the ASY. However, there are a large number of ETFs which provide exposure to foreign stocks, domestic stocks, bonds, commeodities, currencies and many other assets, and the client is willing to consider investing in any ETFs you would like to put forward. There is an Assignment Data File on the LMS which provides information about: * A selection of 75 large Australian listed stocks. s A selection of 120 ASK-listed ETFs. When making the asset allocation decision for your portfolio proposal, the portfolio can only include: * pAustralian listed stocks as shown in the Assignment Data File. * ETFs listed in the Assignment Ciata File. 0 Mote that you must purchase a whole number of shares or ETF units. * Cash - we will assume an interest rate equal to the daily 1-month Bank Bill Swap Rate. This was 4.3% on 19 April. This is the interest rate that will be used in calculating the return on your portfolio in Part 2 of the assignment. * Bitcoin - the price of ONE Bitcoin on 19 April was A$99,491.20. If you wish to speculate by purchasing Bitcoin you don't need to purchase a whole number of Bitcoins. Simply allocate a certain dollar amount and assume you can buy in fractional amounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts