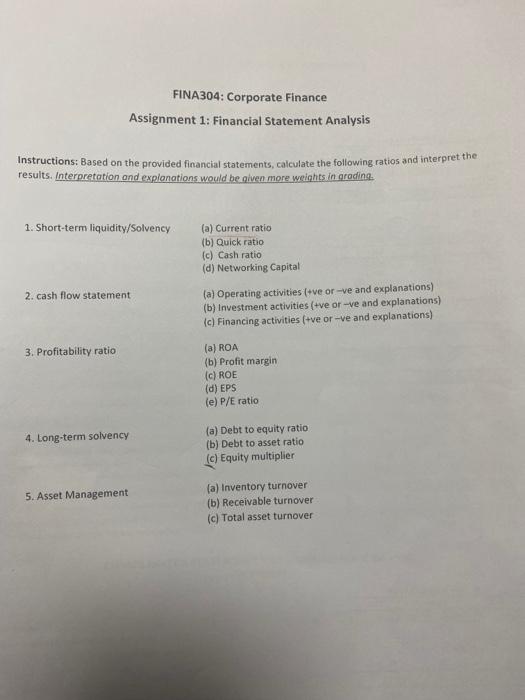

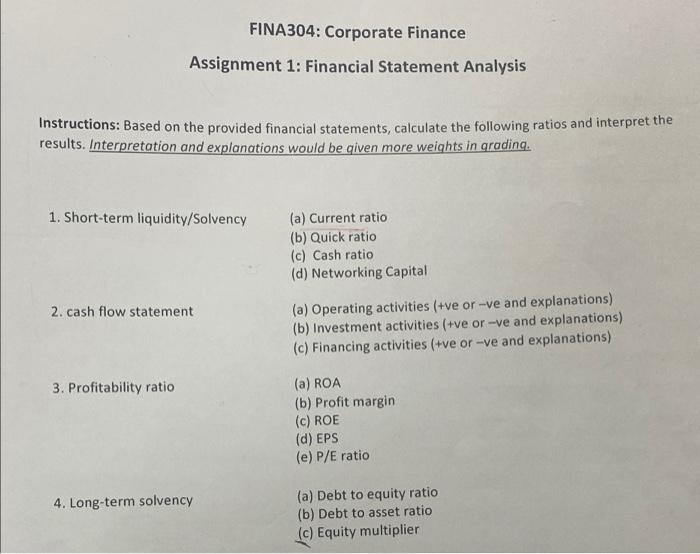

Question: FINA304: Corporate Finance Assignment 1: Financial Statement Analysis Instructions: Based on the provided financial statements, calculate the following ratios and interpret the results. Interpretation and

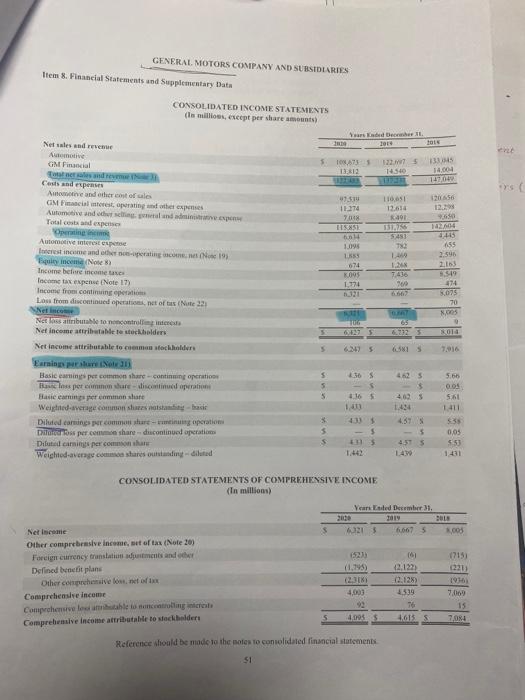

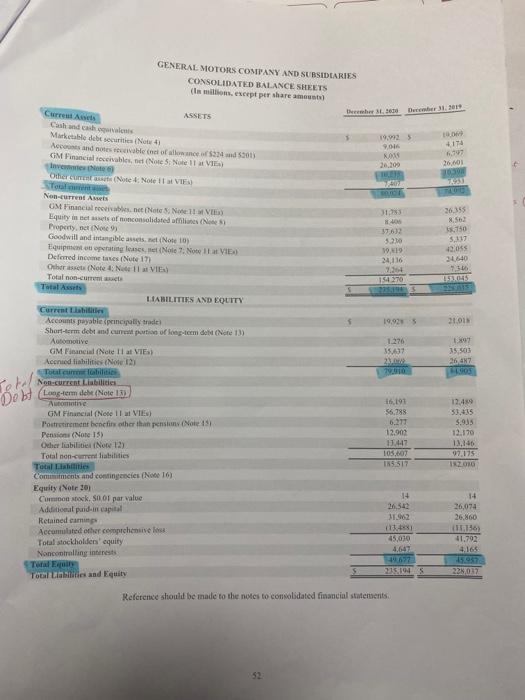

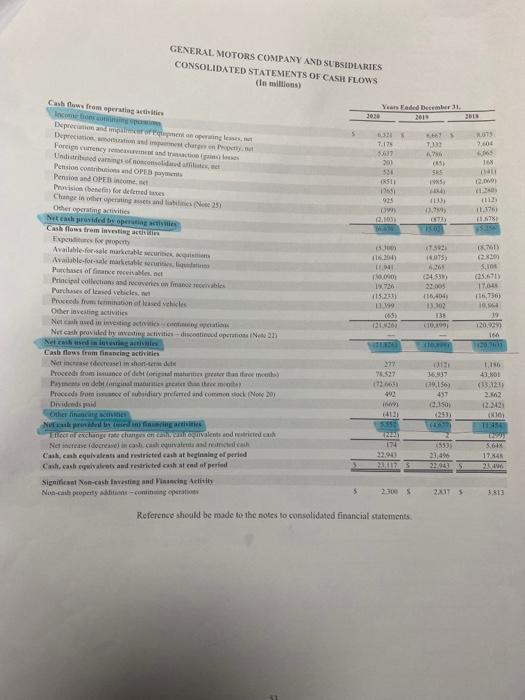

FINA304: Corporate Finance Assignment 1: Financial Statement Analysis Instructions: Based on the provided financial statements, calculate the following ratios and interpret the results. Interpretation and explanations would be given more weights in gradina 1. Short-term liquidity/Solvency (a) Current ratio (b) Quick ratio (c) Cash ratio (d) Networking Capital 2. cash flow statement (a) Operating activities (+ve or -ve and explanations) (b) Investment activities (+ve or -ve and explanations) (c) Financing activities (+ve or -ve and explanations) 3. Profitability ratio (a) ROA (b) Profit margin (c) ROE (d) EPS le) P/E ratio 4. Long-term solvency (a) Debt to equity ratio (b) Debt to asset ratio (c) Equity multiplier 5. Asset Management (a) Inventory turnover (b) Receivable turnover (c) Total asset turnover GENERAL MOTORS COMPANY AND SUBSIDIARIES Item 8. Financial Statements and Supplementary Data CONSOLIDATED INCOME STATEMENTS (le millions, except per share amounts) de tener 2011 to re 108.4735 13.12 132.75 14540 1004 112 12 43650 7.5.19 11274 7.048 HSS tin 1095 110051 12.614 R01 INS 57431 TO 455 2.595 2.13 674 KOS 1.774 1. 7436 90 Net sales and revenue Automotive GM Financial Tende Costs and express Antender of sale GM Finestres operating the pe Automotive and decide Toilet and expenses Operating Automotive interestep Interest income and the operating comic 19 Bly income one ) Income bence Tecome tax expense (Note 17) Income from continuing operation Lou from descontinued operation net oftas (Nute 121 Nel com Net loss buhle to no controller Net income attributable testockholders Net Income attributable to come stockholder Earning prote) Basic camins per common share continuing operation Reines per me shares operation Basic eating permanslate Weighted average common has not back Diluted carmines per common shart-rug operation Dicos por comme share-discontinued operation Diatell ci 8 fet CHI HAI Weighted average costures outstanding-diluted 14 5075 70 N. 65 64125 7.016 tos 5 5 3 165 4625 $ 4625 1434 437 - 5 4515 5.66 008 5.61 1.11 $35 0,05 5.53 1431 3 5 5 - 5 CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (in millions) Year Ested December 31 21 2019 23 6075 BOLS 2008 101 (715) Netice Other comprehensive income, set of tax (Note 20) Foreign currency translation ments and her Defined bencit plans Other comprehensive low, net fix Comprehensive income Comprehensive locales controlling interest Comprehensive Income attributable to stockholders 15233 (1.795) (2.3 4,003 12.122) 2.128) 4519 16 4,613 S 1916) 7009 15 4.003s 7,084 Reference should be made to the notes to consolidated financial statements 51 GENERAL MOTORS COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (la milions, exerpt per shares) thech Duwwer 31.90 ASSETS Cwrs Cand showrooms Martable de securities Note 4 Accounts and te weet of 453015 CIM Financial receivable seal 19.93 906 4174 6.797 26. 20.00 TOTO 3655 Other cum (Note: Note VIES Non-curred As GM Financial reset Notes No VE Equity is set of consolidated offline (3) Property, net (Nose Goodwill and intangible anses (Note 10) Equipping lesse, et Note 7 Not at VI Deferred income taxes (Nute 17) Other (Note 4 Nella VIE) Total non-current Total Assis LIABILITIES AND EQUITY Current Accounts payable principally trade Short-term debt and current portion of long-term det (Note 13) Automotive GM Financial (Note 11 al VIE:) Acented liabilities (Note 12) Total cualiti Non-current Liabilities 31.753 1.400 62 3.21 1919 34,116 7264 154.270 1.750 3.117 13.055 30540 TLUS 45 19.92 21.01 1.276 35.637 2W 35.503 2647 03 Tot Debt Long-term del Norte 15 1.191 56.788 6,277 12.907 1:47 105,00 IN 517 12.49 53.415 5,935 12.170 13,146 07.175 TRZORG Automotive GM Financial (Note 11 VIE) Potretirement benefits other than pension (Note 15 Pension (Note 13) Odher liabilities (Now 12) Total non-curren ibilities Total Landes Comments and contingencies (16) Equity (Noir 201 Common stock, SO of par value Additional puid-in capital Retained caming Accumulated other comprehensive Total stockholders' equity Noncontrolling interest Total To Lies and Equity 4 24,542 37.962 14 26,074 26,860 (1115) 41.792 4.165 45,030 4.647 77 225.10 22017 Reference should be made to the notes to consolidated financial statements 52 GENERAL MOTORS COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS la mos) Yoon Eeded December 31 20.30 2012 7.175 300 300 304 1511 1981 925 (8) SE 12.00 112 . 11,176 . 2103 7:52 10 0330 10 25.171) I. Cashows from operating the copo Deprecente page, Deprecat currently Foreign mindig hatsaptamil Pension Payments Pension OPB income Prots ben fordelenedes Change in other operating and Other parts activities Neka prasided by sperti Cestions from investing the Experties for property Available for sale marketable Available for mobile Purchases office cent Principal collections and recoveries fiches Purchases of lawed vehicles Proceeds frumentionated vehicles Other inviting activities Nechnining activitation Net cash provided by investivities - discotid operations in Neringar Cash flows from financing activities Netcase decrease in short-tedes Proceeds from ince of debtorial mutes previste mens et dobrog modem Preces from is of diery reformed and commock (Note 2017 Dividendspuld Other in NE The exchange the chment amurales and write and Nel coche in cash cases de Cukca equivalents and restricted cash at beginning of period Canh, cashewharety and restricted cash teacher Significant Non-calvesting and incing Activity Non-Cash property congration 4,61 04.533) 22.00 116.404) 13.03 136 10991 1726 115.25 19 (65) 303 7363 TO 1200) 104 277 77 12 492 36.937 (29.15 157 3150 2533 L.IS 13. NOL (131211 2.12 21 (10 TU 074 22.000 117 553 23,4 23.94 5,64% 17.4 25 5 230$ 2x17 5 3813 Reference should be made to the notes to consolidated financial statements FINA304: Corporate Finance Assignment 1: Financial Statement Analysis Instructions: Based on the provided financial statements, calculate the following ratios and interpret the results. Interpretation and explanations would be given more weights in grading. 1. Short-term liquidity/Solvency (a) Current ratio (b) Quick ratio (c) Cash ratio (d) Networking Capital 2. cash flow statement (a) Operating activities (+ve or -ve and explanations) (b) Investment activities (+ve or -ve and explanations) (c) Financing activities (+ve or -ve and explanations) 3. Profitability ratio (a) ROA (b) Profit margin (c) ROE (d) EPS (e) P/E ratio 4. Long-term solvency (a) Debt to equity ratio (b) Debt to asset ratio (c) Equity multiplier FINA304: Corporate Finance Assignment 1: Financial Statement Analysis Instructions: Based on the provided financial statements, calculate the following ratios and interpret the results. Interpretation and explanations would be given more weights in gradina 1. Short-term liquidity/Solvency (a) Current ratio (b) Quick ratio (c) Cash ratio (d) Networking Capital 2. cash flow statement (a) Operating activities (+ve or -ve and explanations) (b) Investment activities (+ve or -ve and explanations) (c) Financing activities (+ve or -ve and explanations) 3. Profitability ratio (a) ROA (b) Profit margin (c) ROE (d) EPS le) P/E ratio 4. Long-term solvency (a) Debt to equity ratio (b) Debt to asset ratio (c) Equity multiplier 5. Asset Management (a) Inventory turnover (b) Receivable turnover (c) Total asset turnover GENERAL MOTORS COMPANY AND SUBSIDIARIES Item 8. Financial Statements and Supplementary Data CONSOLIDATED INCOME STATEMENTS (le millions, except per share amounts) de tener 2011 to re 108.4735 13.12 132.75 14540 1004 112 12 43650 7.5.19 11274 7.048 HSS tin 1095 110051 12.614 R01 INS 57431 TO 455 2.595 2.13 674 KOS 1.774 1. 7436 90 Net sales and revenue Automotive GM Financial Tende Costs and express Antender of sale GM Finestres operating the pe Automotive and decide Toilet and expenses Operating Automotive interestep Interest income and the operating comic 19 Bly income one ) Income bence Tecome tax expense (Note 17) Income from continuing operation Lou from descontinued operation net oftas (Nute 121 Nel com Net loss buhle to no controller Net income attributable testockholders Net Income attributable to come stockholder Earning prote) Basic camins per common share continuing operation Reines per me shares operation Basic eating permanslate Weighted average common has not back Diluted carmines per common shart-rug operation Dicos por comme share-discontinued operation Diatell ci 8 fet CHI HAI Weighted average costures outstanding-diluted 14 5075 70 N. 65 64125 7.016 tos 5 5 3 165 4625 $ 4625 1434 437 - 5 4515 5.66 008 5.61 1.11 $35 0,05 5.53 1431 3 5 5 - 5 CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (in millions) Year Ested December 31 21 2019 23 6075 BOLS 2008 101 (715) Netice Other comprehensive income, set of tax (Note 20) Foreign currency translation ments and her Defined bencit plans Other comprehensive low, net fix Comprehensive income Comprehensive locales controlling interest Comprehensive Income attributable to stockholders 15233 (1.795) (2.3 4,003 12.122) 2.128) 4519 16 4,613 S 1916) 7009 15 4.003s 7,084 Reference should be made to the notes to consolidated financial statements 51 GENERAL MOTORS COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (la milions, exerpt per shares) thech Duwwer 31.90 ASSETS Cwrs Cand showrooms Martable de securities Note 4 Accounts and te weet of 453015 CIM Financial receivable seal 19.93 906 4174 6.797 26. 20.00 TOTO 3655 Other cum (Note: Note VIES Non-curred As GM Financial reset Notes No VE Equity is set of consolidated offline (3) Property, net (Nose Goodwill and intangible anses (Note 10) Equipping lesse, et Note 7 Not at VI Deferred income taxes (Nute 17) Other (Note 4 Nella VIE) Total non-current Total Assis LIABILITIES AND EQUITY Current Accounts payable principally trade Short-term debt and current portion of long-term det (Note 13) Automotive GM Financial (Note 11 al VIE:) Acented liabilities (Note 12) Total cualiti Non-current Liabilities 31.753 1.400 62 3.21 1919 34,116 7264 154.270 1.750 3.117 13.055 30540 TLUS 45 19.92 21.01 1.276 35.637 2W 35.503 2647 03 Tot Debt Long-term del Norte 15 1.191 56.788 6,277 12.907 1:47 105,00 IN 517 12.49 53.415 5,935 12.170 13,146 07.175 TRZORG Automotive GM Financial (Note 11 VIE) Potretirement benefits other than pension (Note 15 Pension (Note 13) Odher liabilities (Now 12) Total non-curren ibilities Total Landes Comments and contingencies (16) Equity (Noir 201 Common stock, SO of par value Additional puid-in capital Retained caming Accumulated other comprehensive Total stockholders' equity Noncontrolling interest Total To Lies and Equity 4 24,542 37.962 14 26,074 26,860 (1115) 41.792 4.165 45,030 4.647 77 225.10 22017 Reference should be made to the notes to consolidated financial statements 52 GENERAL MOTORS COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS la mos) Yoon Eeded December 31 20.30 2012 7.175 300 300 304 1511 1981 925 (8) SE 12.00 112 . 11,176 . 2103 7:52 10 0330 10 25.171) I. Cashows from operating the copo Deprecente page, Deprecat currently Foreign mindig hatsaptamil Pension Payments Pension OPB income Prots ben fordelenedes Change in other operating and Other parts activities Neka prasided by sperti Cestions from investing the Experties for property Available for sale marketable Available for mobile Purchases office cent Principal collections and recoveries fiches Purchases of lawed vehicles Proceeds frumentionated vehicles Other inviting activities Nechnining activitation Net cash provided by investivities - discotid operations in Neringar Cash flows from financing activities Netcase decrease in short-tedes Proceeds from ince of debtorial mutes previste mens et dobrog modem Preces from is of diery reformed and commock (Note 2017 Dividendspuld Other in NE The exchange the chment amurales and write and Nel coche in cash cases de Cukca equivalents and restricted cash at beginning of period Canh, cashewharety and restricted cash teacher Significant Non-calvesting and incing Activity Non-Cash property congration 4,61 04.533) 22.00 116.404) 13.03 136 10991 1726 115.25 19 (65) 303 7363 TO 1200) 104 277 77 12 492 36.937 (29.15 157 3150 2533 L.IS 13. NOL (131211 2.12 21 (10 TU 074 22.000 117 553 23,4 23.94 5,64% 17.4 25 5 230$ 2x17 5 3813 Reference should be made to the notes to consolidated financial statements FINA304: Corporate Finance Assignment 1: Financial Statement Analysis Instructions: Based on the provided financial statements, calculate the following ratios and interpret the results. Interpretation and explanations would be given more weights in grading. 1. Short-term liquidity/Solvency (a) Current ratio (b) Quick ratio (c) Cash ratio (d) Networking Capital 2. cash flow statement (a) Operating activities (+ve or -ve and explanations) (b) Investment activities (+ve or -ve and explanations) (c) Financing activities (+ve or -ve and explanations) 3. Profitability ratio (a) ROA (b) Profit margin (c) ROE (d) EPS (e) P/E ratio 4. Long-term solvency (a) Debt to equity ratio (b) Debt to asset ratio (c) Equity multiplier

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts