Question: FINA6301 HWK Problems 12th Edition Chapter 2 - Session 2 20. Calculating Cash Flows Consider the following abbreviated financial statements for Weston Enterprises: WESTON ENTERPRISES

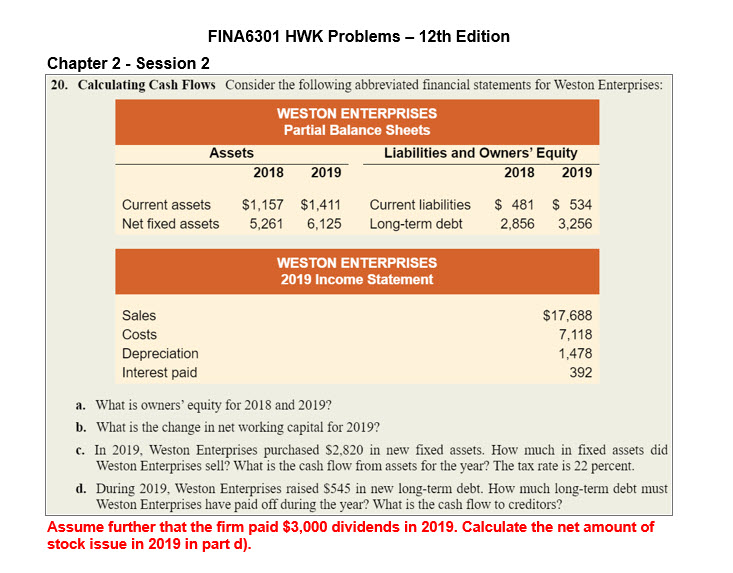

FINA6301 HWK Problems 12th Edition Chapter 2 - Session 2 20. Calculating Cash Flows Consider the following abbreviated financial statements for Weston Enterprises: WESTON ENTERPRISES Partial Balance Sheets Assets Liabilities and Owners' Equity 2018 2019 2018 2019 Current assets $1,157 $1,411 Current liabilities $ 481 $ 534 Net fixed assets 5,261 6,125 Long-term debt 2,856 3,256 WESTON ENTERPRISES 2019 Income Statement Sales Costs Depreciation Interest paid $17.688 7,118 1,478 392 a. What is owners' equity for 2018 and 2019? b. What is the change in net working capital for 2019? c. In 2019, Weston Enterprises purchased $2,820 in new fixed assets. How much in fixed assets did Weston Enterprises sell? What is the cash flow from assets for the year? The tax rate is 22 percent. d. During 2019, Weston Enterprises raised $545 in new long-term debt. How much long-term debt must Weston Enterprises have paid off during the year? What is the cash flow to creditors? Assume further that the firm paid $3,000 dividends in 2019. Calculate the net amount of stock issue in 2019 in part d)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts