Three-Month Project NOTE! Templates needed Ampersand, Inc., is a small business that operates in Somerset, VT...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

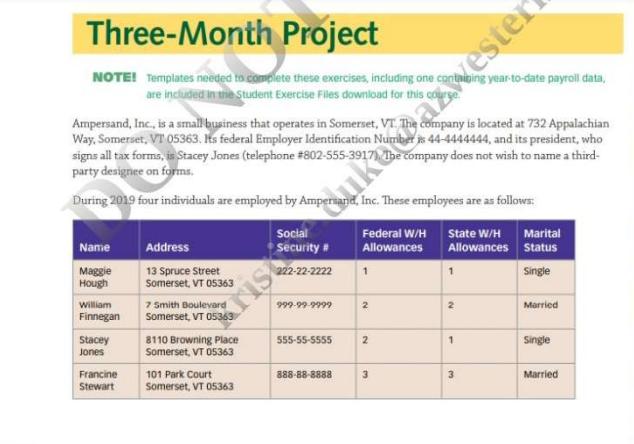

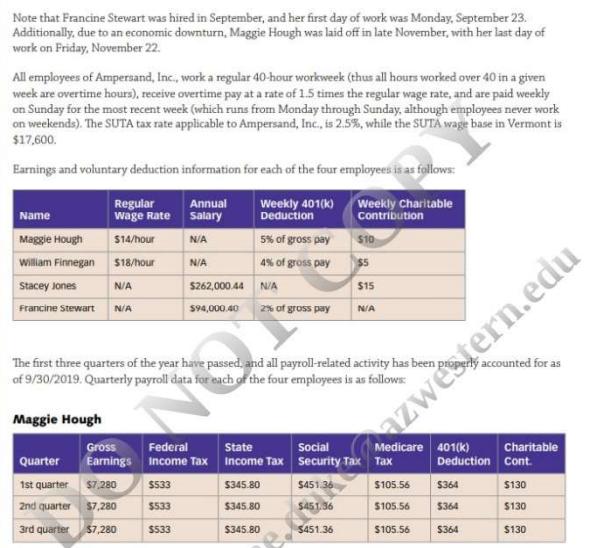

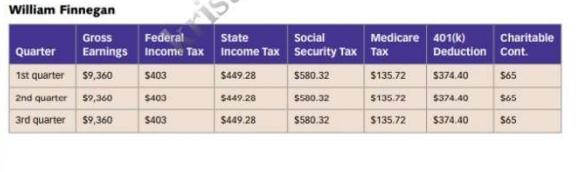

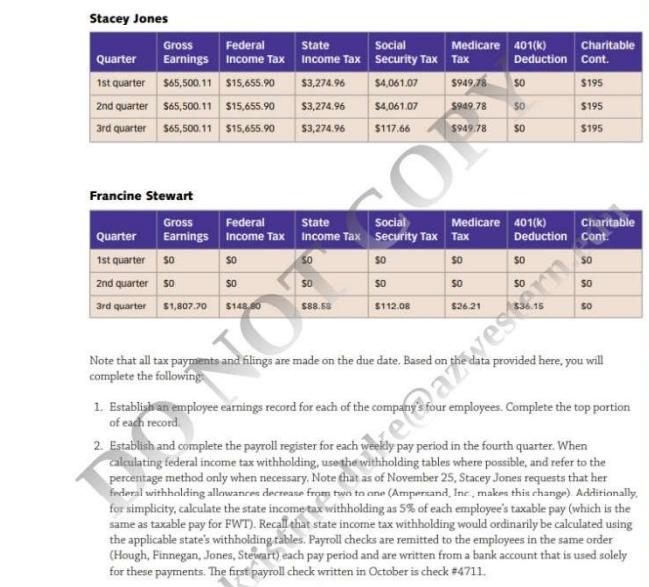

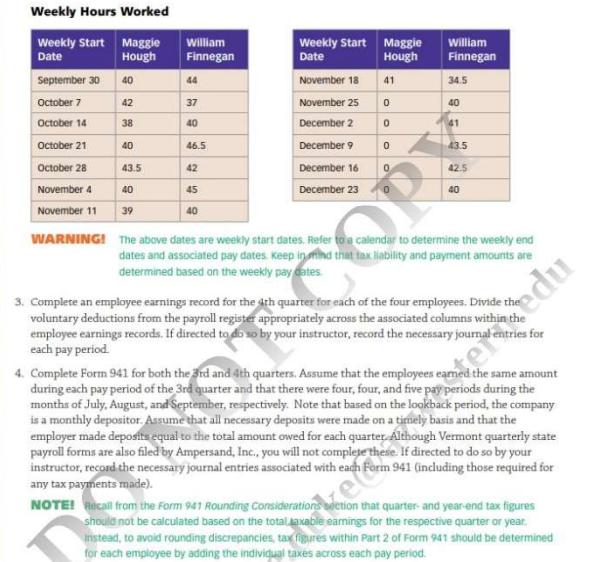

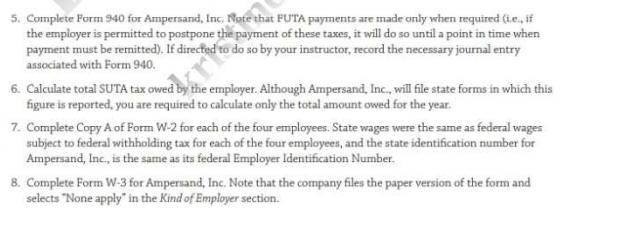

Three-Month Project NOTE! Templates needed Ampersand, Inc., is a small business that operates in Somerset, VT The company is located at 732 Appalachian Way, Somerset, VT 05363. Its federal Employer Identification Number is 44-4444444, and its president, who signs all tax forms, is Stacey Jones (telephone #802-555-3917) party designee on forms. e company does not wish to name a third- During 2019 four individuals are employed by Ampersand, Inc. These employees are as follows: Name Maggie Hough William Finnegan to complete these exercises, including one containing year-to-date payroll data, are included in the Student Exercise Files download for this cours Onth Stacey Jones Francine Stewart Address 13 Spruce Street Somerset, VT 05363 7 Smith Boulevard Somerset, VT 05363 8110 Browning Place Somerset, VT 05363 KNIS 101 Park Court Somerset, VT 05363 duke wazwester 222-22-2222 999-99-9999 555-55-5555 888-88-8888 Federal W/H State W/H Marital Allowances Allowances Status Single 1 2 W N 3 1 2 1 3 Married Single Married Note that Francine Stewart was hired in September, and her first day of work was Monday, September 23. Additionally, due to an economic downturn, Maggie Hough was laid off in late November, with her last day of work on Friday, November 22. All employees of Ampersand, Inc., work a regular 40-hour workweek (thus all hours worked over 40 in a given week are overtime hours), receive overtime pay at a rate of 1.5 times the regular wage rate, and are paid weekly on Sunday for the most recent week (which runs from Monday through Sunday, although employees never work on weekends). The SUTA tax rate applicable to Ampersand, Inc., is 2.5%, while the SUTA wage base in Vermont is $17,600. Earnings and voluntary deduction information for each of the four employees is as follows: Regular Annual Wage Rate Salary $14/hour $18/hour Name Maggie Hough William Finnegan Stacey Jones N/A Francine Stewart N/A Maggie Hough N/A Gross Quarter Earnings 1st quarter $7,280 2nd quarter $7,280 3rd quarter $7,280 N/A $262,000.44 $94,000.40 Weekly 401(k) Deduction Federal Income Tax $533 $533 $533 5% of gross pay 4% of gross pay N/A 2% of gross pay Weekly Charitable Contribution The first three quarters of the year have passed, and all payroll-related activity has been p of 9/30/2019. Quarterly payroll data for each of the four employees is as follows: $10 $5 $451.36 $15 N/A State Social Income Tax Security Tax Tax $345.80 $345.80 $345.80 azwestern.edu Medicare 401(k) accounted for as Deduction $105.56 $364 $105.56 $364 $105.56 $364 Charitable Cont. $130 $130 $130 William Finnegan Gross Federal Earnings Income Tax $9,360 $403 $403 $403 Quarter 1st quarter 2nd quarter $9,360 3rd quarter $9,360 Medicare 401(k) Charitable Deduction Cont. $374.40 $65 $374.40 $65 $65 State Social Income Tax Security Tax Tax $449.28 $580.32 $449.28 $580.32 $449.28 $580.32 $135.72 $135.72 $135.72 $374.40 Stacey Jones Gross Quarter Federal Earnings Income Tax 1st quarter $65,500.11 $15,655.90 2nd quarter $65,500.11 $15,655.90 3rd quarter $65,500.11 $15,655.90 Francine Stewart Gross Federal Earnings Income Tax Quarter 1st quarter So 2nd quarter so 3rd quarter $1,807.70 8 8 $0 $148.80 State Income Tax $3,274.96 $3,274.96 $4,061.07 $3,274.96 $117.66 Social Security Tax $4,061.07 $88.58 Medicare Tax $949,78 State Social Income Tax Security Tax Tax 50 so so SO SO so $26.21 $112.08 401(k) Deduction Cont. $195 $195 $195 so $949.78 so $949.78 so Medicare 401(k) Charitable so Charitable Deduction Cont $0 $0 50 Note that all tax payments and filings are made on the due date. Based on the data provided here, you will complete the following 1. Establish an employee earnings record for each of the company's four employees. Complete the top portion of each record. 2. Establish and complete the payroll register for each weekly pay period in the fourth quarter. When calculating federal income tax withholding, use the withholding tables where possible, and refer to the percentage method only when necessary. Note that as of November 25, Stacey Jones requests that her federal withholding allowances decrease from two to one (Ampersand, Inc, makes this change). Additionally, for simplicity, calculate the state income tax withholding as 5% of each employee's taxable pay (which is the same as taxable pay for FWT). Recall that state income tax withholding would ordinarily be calculated using the applicable state's withholding tables. Payroll checks are remitted to the employees in the same order (Hough, Finnegan, Jones, Stewart) each pay period and are written from a bank account that is used solely for these payments. The first payroll check written in October is check #4711. ketat vestir Note that all charitable contributions are deemed to be made on the final day of each pay period. The following information will be required for the completion of these records for the two employees who are compensated via an hourly wage: Weekly Hours Worked Weekly Start Maggie Date Hough 40 September 30 October 7 October 14 October 21 October 28 November 4 November 11 WARNING! 42 38 40 43.5 40 39 William Finnegan 44 37 40 46.5 42 45 40 Weekly Start Maggie William Date Hough Finnegan November 18 November 25 December 2 December 9 December 16 December 23 41 0 0 0 0 OP 34.5 40 41 43.5 NOTE! Recall from the Form 941 Rounding considerations should not be calculated based on the total axable Instead, to avoid rounding discrepancies, tax for each employee by adding the individual taxes across each pay period. 42.5 40 The above dates are weekly start dates. Refer to a calendar to determine the weekly end dates and associated pay dates keep in mind that tax liability and payment amounts are determined based on the weekly pay dates. 3. Complete an employee earnings record for the 4th quarter for each of the four employees. Divide the voluntary deductions from the payroll register appropriately across the associated columns within t employee earnings records. If directed to do so by your instructor, record the necessary journal each pay period. ries for the same amount 4. Complete Form 941 for both the 3rd and 4th quarters. Assume that the employees earned during each pay period of the 3rd quarter and that there were four, four, and five pay periods during the months of July, August, and September, respectively. Note that based on the lookback period, the company is a monthly depositor. Assume that all necessary deposits were made on a timely basis and that the employer made deposits equal to the total amount owed for each quarter. Although Vermont quarterly state payroll forms are also filed by Ampersand, Inc., you will not complete these. If directed to do so by your instructor, record the necessary journal entries associated with each Form 941 (including those required for any tax payments made). section that quarter- and year-end tax figures earnings for the respective quarter or year. mpak or UYAR figures within Part 2 of Form 941 should be determined 5. Complete Form 940 for Ampersand, Inc. Note that FUTA payments are made only when required (i.e., if the employer is permitted to postpone the payment of these taxes, it will do so until a point in time when payment must be remitted). If directed to do so by your instructor, record the necessary journal entry associated with Form 940. 6. Calculate total SUTA tax owed by the employer. Although Ampersand, Inc., will file state forms in which this figure is reported, you are required to calculate only the total amount owed for the year. 7. Complete Copy A of Form W-2 for each of the four employees. State wages were the same as federal wages subject to federal withholding tax for each of the four employees, and the state identification number for Ampersand, Inc., is the same as its federal Employer Identification Number. 8. Complete Form W-3 for Ampersand, Inc. Note that the company files the paper version of the form and selects "None apply" in the Kind of Employer section. Three-Month Project NOTE! Templates needed Ampersand, Inc., is a small business that operates in Somerset, VT The company is located at 732 Appalachian Way, Somerset, VT 05363. Its federal Employer Identification Number is 44-4444444, and its president, who signs all tax forms, is Stacey Jones (telephone #802-555-3917) party designee on forms. e company does not wish to name a third- During 2019 four individuals are employed by Ampersand, Inc. These employees are as follows: Name Maggie Hough William Finnegan to complete these exercises, including one containing year-to-date payroll data, are included in the Student Exercise Files download for this cours Onth Stacey Jones Francine Stewart Address 13 Spruce Street Somerset, VT 05363 7 Smith Boulevard Somerset, VT 05363 8110 Browning Place Somerset, VT 05363 KNIS 101 Park Court Somerset, VT 05363 duke wazwester 222-22-2222 999-99-9999 555-55-5555 888-88-8888 Federal W/H State W/H Marital Allowances Allowances Status Single 1 2 W N 3 1 2 1 3 Married Single Married Note that Francine Stewart was hired in September, and her first day of work was Monday, September 23. Additionally, due to an economic downturn, Maggie Hough was laid off in late November, with her last day of work on Friday, November 22. All employees of Ampersand, Inc., work a regular 40-hour workweek (thus all hours worked over 40 in a given week are overtime hours), receive overtime pay at a rate of 1.5 times the regular wage rate, and are paid weekly on Sunday for the most recent week (which runs from Monday through Sunday, although employees never work on weekends). The SUTA tax rate applicable to Ampersand, Inc., is 2.5%, while the SUTA wage base in Vermont is $17,600. Earnings and voluntary deduction information for each of the four employees is as follows: Regular Annual Wage Rate Salary $14/hour $18/hour Name Maggie Hough William Finnegan Stacey Jones N/A Francine Stewart N/A Maggie Hough N/A Gross Quarter Earnings 1st quarter $7,280 2nd quarter $7,280 3rd quarter $7,280 N/A $262,000.44 $94,000.40 Weekly 401(k) Deduction Federal Income Tax $533 $533 $533 5% of gross pay 4% of gross pay N/A 2% of gross pay Weekly Charitable Contribution The first three quarters of the year have passed, and all payroll-related activity has been p of 9/30/2019. Quarterly payroll data for each of the four employees is as follows: $10 $5 $451.36 $15 N/A State Social Income Tax Security Tax Tax $345.80 $345.80 $345.80 azwestern.edu Medicare 401(k) accounted for as Deduction $105.56 $364 $105.56 $364 $105.56 $364 Charitable Cont. $130 $130 $130 William Finnegan Gross Federal Earnings Income Tax $9,360 $403 $403 $403 Quarter 1st quarter 2nd quarter $9,360 3rd quarter $9,360 Medicare 401(k) Charitable Deduction Cont. $374.40 $65 $374.40 $65 $65 State Social Income Tax Security Tax Tax $449.28 $580.32 $449.28 $580.32 $449.28 $580.32 $135.72 $135.72 $135.72 $374.40 Stacey Jones Gross Quarter Federal Earnings Income Tax 1st quarter $65,500.11 $15,655.90 2nd quarter $65,500.11 $15,655.90 3rd quarter $65,500.11 $15,655.90 Francine Stewart Gross Federal Earnings Income Tax Quarter 1st quarter So 2nd quarter so 3rd quarter $1,807.70 8 8 $0 $148.80 State Income Tax $3,274.96 $3,274.96 $4,061.07 $3,274.96 $117.66 Social Security Tax $4,061.07 $88.58 Medicare Tax $949,78 State Social Income Tax Security Tax Tax 50 so so SO SO so $26.21 $112.08 401(k) Deduction Cont. $195 $195 $195 so $949.78 so $949.78 so Medicare 401(k) Charitable so Charitable Deduction Cont $0 $0 50 Note that all tax payments and filings are made on the due date. Based on the data provided here, you will complete the following 1. Establish an employee earnings record for each of the company's four employees. Complete the top portion of each record. 2. Establish and complete the payroll register for each weekly pay period in the fourth quarter. When calculating federal income tax withholding, use the withholding tables where possible, and refer to the percentage method only when necessary. Note that as of November 25, Stacey Jones requests that her federal withholding allowances decrease from two to one (Ampersand, Inc, makes this change). Additionally, for simplicity, calculate the state income tax withholding as 5% of each employee's taxable pay (which is the same as taxable pay for FWT). Recall that state income tax withholding would ordinarily be calculated using the applicable state's withholding tables. Payroll checks are remitted to the employees in the same order (Hough, Finnegan, Jones, Stewart) each pay period and are written from a bank account that is used solely for these payments. The first payroll check written in October is check #4711. ketat vestir Note that all charitable contributions are deemed to be made on the final day of each pay period. The following information will be required for the completion of these records for the two employees who are compensated via an hourly wage: Weekly Hours Worked Weekly Start Maggie Date Hough 40 September 30 October 7 October 14 October 21 October 28 November 4 November 11 WARNING! 42 38 40 43.5 40 39 William Finnegan 44 37 40 46.5 42 45 40 Weekly Start Maggie William Date Hough Finnegan November 18 November 25 December 2 December 9 December 16 December 23 41 0 0 0 0 OP 34.5 40 41 43.5 NOTE! Recall from the Form 941 Rounding considerations should not be calculated based on the total axable Instead, to avoid rounding discrepancies, tax for each employee by adding the individual taxes across each pay period. 42.5 40 The above dates are weekly start dates. Refer to a calendar to determine the weekly end dates and associated pay dates keep in mind that tax liability and payment amounts are determined based on the weekly pay dates. 3. Complete an employee earnings record for the 4th quarter for each of the four employees. Divide the voluntary deductions from the payroll register appropriately across the associated columns within t employee earnings records. If directed to do so by your instructor, record the necessary journal each pay period. ries for the same amount 4. Complete Form 941 for both the 3rd and 4th quarters. Assume that the employees earned during each pay period of the 3rd quarter and that there were four, four, and five pay periods during the months of July, August, and September, respectively. Note that based on the lookback period, the company is a monthly depositor. Assume that all necessary deposits were made on a timely basis and that the employer made deposits equal to the total amount owed for each quarter. Although Vermont quarterly state payroll forms are also filed by Ampersand, Inc., you will not complete these. If directed to do so by your instructor, record the necessary journal entries associated with each Form 941 (including those required for any tax payments made). section that quarter- and year-end tax figures earnings for the respective quarter or year. mpak or UYAR figures within Part 2 of Form 941 should be determined 5. Complete Form 940 for Ampersand, Inc. Note that FUTA payments are made only when required (i.e., if the employer is permitted to postpone the payment of these taxes, it will do so until a point in time when payment must be remitted). If directed to do so by your instructor, record the necessary journal entry associated with Form 940. 6. Calculate total SUTA tax owed by the employer. Although Ampersand, Inc., will file state forms in which this figure is reported, you are required to calculate only the total amount owed for the year. 7. Complete Copy A of Form W-2 for each of the four employees. State wages were the same as federal wages subject to federal withholding tax for each of the four employees, and the state identification number for Ampersand, Inc., is the same as its federal Employer Identification Number. 8. Complete Form W-3 for Ampersand, Inc. Note that the company files the paper version of the form and selects "None apply" in the Kind of Employer section. Three-Month Project NOTE! Templates needed Ampersand, Inc., is a small business that operates in Somerset, VT The company is located at 732 Appalachian Way, Somerset, VT 05363. Its federal Employer Identification Number is 44-4444444, and its president, who signs all tax forms, is Stacey Jones (telephone #802-555-3917) party designee on forms. e company does not wish to name a third- During 2019 four individuals are employed by Ampersand, Inc. These employees are as follows: Name Maggie Hough William Finnegan to complete these exercises, including one containing year-to-date payroll data, are included in the Student Exercise Files download for this cours Onth Stacey Jones Francine Stewart Address 13 Spruce Street Somerset, VT 05363 7 Smith Boulevard Somerset, VT 05363 8110 Browning Place Somerset, VT 05363 KNIS 101 Park Court Somerset, VT 05363 duke wazwester 222-22-2222 999-99-9999 555-55-5555 888-88-8888 Federal W/H State W/H Marital Allowances Allowances Status Single 1 2 W N 3 1 2 1 3 Married Single Married Note that Francine Stewart was hired in September, and her first day of work was Monday, September 23. Additionally, due to an economic downturn, Maggie Hough was laid off in late November, with her last day of work on Friday, November 22. All employees of Ampersand, Inc., work a regular 40-hour workweek (thus all hours worked over 40 in a given week are overtime hours), receive overtime pay at a rate of 1.5 times the regular wage rate, and are paid weekly on Sunday for the most recent week (which runs from Monday through Sunday, although employees never work on weekends). The SUTA tax rate applicable to Ampersand, Inc., is 2.5%, while the SUTA wage base in Vermont is $17,600. Earnings and voluntary deduction information for each of the four employees is as follows: Regular Annual Wage Rate Salary $14/hour $18/hour Name Maggie Hough William Finnegan Stacey Jones N/A Francine Stewart N/A Maggie Hough N/A Gross Quarter Earnings 1st quarter $7,280 2nd quarter $7,280 3rd quarter $7,280 N/A $262,000.44 $94,000.40 Weekly 401(k) Deduction Federal Income Tax $533 $533 $533 5% of gross pay 4% of gross pay N/A 2% of gross pay Weekly Charitable Contribution The first three quarters of the year have passed, and all payroll-related activity has been p of 9/30/2019. Quarterly payroll data for each of the four employees is as follows: $10 $5 $451.36 $15 N/A State Social Income Tax Security Tax Tax $345.80 $345.80 $345.80 azwestern.edu Medicare 401(k) accounted for as Deduction $105.56 $364 $105.56 $364 $105.56 $364 Charitable Cont. $130 $130 $130 William Finnegan Gross Federal Earnings Income Tax $9,360 $403 $403 $403 Quarter 1st quarter 2nd quarter $9,360 3rd quarter $9,360 Medicare 401(k) Charitable Deduction Cont. $374.40 $65 $374.40 $65 $65 State Social Income Tax Security Tax Tax $449.28 $580.32 $449.28 $580.32 $449.28 $580.32 $135.72 $135.72 $135.72 $374.40 Stacey Jones Gross Quarter Federal Earnings Income Tax 1st quarter $65,500.11 $15,655.90 2nd quarter $65,500.11 $15,655.90 3rd quarter $65,500.11 $15,655.90 Francine Stewart Gross Federal Earnings Income Tax Quarter 1st quarter So 2nd quarter so 3rd quarter $1,807.70 8 8 $0 $148.80 State Income Tax $3,274.96 $3,274.96 $4,061.07 $3,274.96 $117.66 Social Security Tax $4,061.07 $88.58 Medicare Tax $949,78 State Social Income Tax Security Tax Tax 50 so so SO SO so $26.21 $112.08 401(k) Deduction Cont. $195 $195 $195 so $949.78 so $949.78 so Medicare 401(k) Charitable so Charitable Deduction Cont $0 $0 50 Note that all tax payments and filings are made on the due date. Based on the data provided here, you will complete the following 1. Establish an employee earnings record for each of the company's four employees. Complete the top portion of each record. 2. Establish and complete the payroll register for each weekly pay period in the fourth quarter. When calculating federal income tax withholding, use the withholding tables where possible, and refer to the percentage method only when necessary. Note that as of November 25, Stacey Jones requests that her federal withholding allowances decrease from two to one (Ampersand, Inc, makes this change). Additionally, for simplicity, calculate the state income tax withholding as 5% of each employee's taxable pay (which is the same as taxable pay for FWT). Recall that state income tax withholding would ordinarily be calculated using the applicable state's withholding tables. Payroll checks are remitted to the employees in the same order (Hough, Finnegan, Jones, Stewart) each pay period and are written from a bank account that is used solely for these payments. The first payroll check written in October is check #4711. ketat vestir Note that all charitable contributions are deemed to be made on the final day of each pay period. The following information will be required for the completion of these records for the two employees who are compensated via an hourly wage: Weekly Hours Worked Weekly Start Maggie Date Hough 40 September 30 October 7 October 14 October 21 October 28 November 4 November 11 WARNING! 42 38 40 43.5 40 39 William Finnegan 44 37 40 46.5 42 45 40 Weekly Start Maggie William Date Hough Finnegan November 18 November 25 December 2 December 9 December 16 December 23 41 0 0 0 0 OP 34.5 40 41 43.5 NOTE! Recall from the Form 941 Rounding considerations should not be calculated based on the total axable Instead, to avoid rounding discrepancies, tax for each employee by adding the individual taxes across each pay period. 42.5 40 The above dates are weekly start dates. Refer to a calendar to determine the weekly end dates and associated pay dates keep in mind that tax liability and payment amounts are determined based on the weekly pay dates. 3. Complete an employee earnings record for the 4th quarter for each of the four employees. Divide the voluntary deductions from the payroll register appropriately across the associated columns within t employee earnings records. If directed to do so by your instructor, record the necessary journal each pay period. ries for the same amount 4. Complete Form 941 for both the 3rd and 4th quarters. Assume that the employees earned during each pay period of the 3rd quarter and that there were four, four, and five pay periods during the months of July, August, and September, respectively. Note that based on the lookback period, the company is a monthly depositor. Assume that all necessary deposits were made on a timely basis and that the employer made deposits equal to the total amount owed for each quarter. Although Vermont quarterly state payroll forms are also filed by Ampersand, Inc., you will not complete these. If directed to do so by your instructor, record the necessary journal entries associated with each Form 941 (including those required for any tax payments made). section that quarter- and year-end tax figures earnings for the respective quarter or year. mpak or UYAR figures within Part 2 of Form 941 should be determined 5. Complete Form 940 for Ampersand, Inc. Note that FUTA payments are made only when required (i.e., if the employer is permitted to postpone the payment of these taxes, it will do so until a point in time when payment must be remitted). If directed to do so by your instructor, record the necessary journal entry associated with Form 940. 6. Calculate total SUTA tax owed by the employer. Although Ampersand, Inc., will file state forms in which this figure is reported, you are required to calculate only the total amount owed for the year. 7. Complete Copy A of Form W-2 for each of the four employees. State wages were the same as federal wages subject to federal withholding tax for each of the four employees, and the state identification number for Ampersand, Inc., is the same as its federal Employer Identification Number. 8. Complete Form W-3 for Ampersand, Inc. Note that the company files the paper version of the form and selects "None apply" in the Kind of Employer section. Three-Month Project NOTE! Templates needed Ampersand, Inc., is a small business that operates in Somerset, VT The company is located at 732 Appalachian Way, Somerset, VT 05363. Its federal Employer Identification Number is 44-4444444, and its president, who signs all tax forms, is Stacey Jones (telephone #802-555-3917) party designee on forms. e company does not wish to name a third- During 2019 four individuals are employed by Ampersand, Inc. These employees are as follows: Name Maggie Hough William Finnegan to complete these exercises, including one containing year-to-date payroll data, are included in the Student Exercise Files download for this cours Onth Stacey Jones Francine Stewart Address 13 Spruce Street Somerset, VT 05363 7 Smith Boulevard Somerset, VT 05363 8110 Browning Place Somerset, VT 05363 KNIS 101 Park Court Somerset, VT 05363 duke wazwester 222-22-2222 999-99-9999 555-55-5555 888-88-8888 Federal W/H State W/H Marital Allowances Allowances Status Single 1 2 W N 3 1 2 1 3 Married Single Married Note that Francine Stewart was hired in September, and her first day of work was Monday, September 23. Additionally, due to an economic downturn, Maggie Hough was laid off in late November, with her last day of work on Friday, November 22. All employees of Ampersand, Inc., work a regular 40-hour workweek (thus all hours worked over 40 in a given week are overtime hours), receive overtime pay at a rate of 1.5 times the regular wage rate, and are paid weekly on Sunday for the most recent week (which runs from Monday through Sunday, although employees never work on weekends). The SUTA tax rate applicable to Ampersand, Inc., is 2.5%, while the SUTA wage base in Vermont is $17,600. Earnings and voluntary deduction information for each of the four employees is as follows: Regular Annual Wage Rate Salary $14/hour $18/hour Name Maggie Hough William Finnegan Stacey Jones N/A Francine Stewart N/A Maggie Hough N/A Gross Quarter Earnings 1st quarter $7,280 2nd quarter $7,280 3rd quarter $7,280 N/A $262,000.44 $94,000.40 Weekly 401(k) Deduction Federal Income Tax $533 $533 $533 5% of gross pay 4% of gross pay N/A 2% of gross pay Weekly Charitable Contribution The first three quarters of the year have passed, and all payroll-related activity has been p of 9/30/2019. Quarterly payroll data for each of the four employees is as follows: $10 $5 $451.36 $15 N/A State Social Income Tax Security Tax Tax $345.80 $345.80 $345.80 azwestern.edu Medicare 401(k) accounted for as Deduction $105.56 $364 $105.56 $364 $105.56 $364 Charitable Cont. $130 $130 $130 William Finnegan Gross Federal Earnings Income Tax $9,360 $403 $403 $403 Quarter 1st quarter 2nd quarter $9,360 3rd quarter $9,360 Medicare 401(k) Charitable Deduction Cont. $374.40 $65 $374.40 $65 $65 State Social Income Tax Security Tax Tax $449.28 $580.32 $449.28 $580.32 $449.28 $580.32 $135.72 $135.72 $135.72 $374.40 Stacey Jones Gross Quarter Federal Earnings Income Tax 1st quarter $65,500.11 $15,655.90 2nd quarter $65,500.11 $15,655.90 3rd quarter $65,500.11 $15,655.90 Francine Stewart Gross Federal Earnings Income Tax Quarter 1st quarter So 2nd quarter so 3rd quarter $1,807.70 8 8 $0 $148.80 State Income Tax $3,274.96 $3,274.96 $4,061.07 $3,274.96 $117.66 Social Security Tax $4,061.07 $88.58 Medicare Tax $949,78 State Social Income Tax Security Tax Tax 50 so so SO SO so $26.21 $112.08 401(k) Deduction Cont. $195 $195 $195 so $949.78 so $949.78 so Medicare 401(k) Charitable so Charitable Deduction Cont $0 $0 50 Note that all tax payments and filings are made on the due date. Based on the data provided here, you will complete the following 1. Establish an employee earnings record for each of the company's four employees. Complete the top portion of each record. 2. Establish and complete the payroll register for each weekly pay period in the fourth quarter. When calculating federal income tax withholding, use the withholding tables where possible, and refer to the percentage method only when necessary. Note that as of November 25, Stacey Jones requests that her federal withholding allowances decrease from two to one (Ampersand, Inc, makes this change). Additionally, for simplicity, calculate the state income tax withholding as 5% of each employee's taxable pay (which is the same as taxable pay for FWT). Recall that state income tax withholding would ordinarily be calculated using the applicable state's withholding tables. Payroll checks are remitted to the employees in the same order (Hough, Finnegan, Jones, Stewart) each pay period and are written from a bank account that is used solely for these payments. The first payroll check written in October is check #4711. ketat vestir Note that all charitable contributions are deemed to be made on the final day of each pay period. The following information will be required for the completion of these records for the two employees who are compensated via an hourly wage: Weekly Hours Worked Weekly Start Maggie Date Hough 40 September 30 October 7 October 14 October 21 October 28 November 4 November 11 WARNING! 42 38 40 43.5 40 39 William Finnegan 44 37 40 46.5 42 45 40 Weekly Start Maggie William Date Hough Finnegan November 18 November 25 December 2 December 9 December 16 December 23 41 0 0 0 0 OP 34.5 40 41 43.5 NOTE! Recall from the Form 941 Rounding considerations should not be calculated based on the total axable Instead, to avoid rounding discrepancies, tax for each employee by adding the individual taxes across each pay period. 42.5 40 The above dates are weekly start dates. Refer to a calendar to determine the weekly end dates and associated pay dates keep in mind that tax liability and payment amounts are determined based on the weekly pay dates. 3. Complete an employee earnings record for the 4th quarter for each of the four employees. Divide the voluntary deductions from the payroll register appropriately across the associated columns within t employee earnings records. If directed to do so by your instructor, record the necessary journal each pay period. ries for the same amount 4. Complete Form 941 for both the 3rd and 4th quarters. Assume that the employees earned during each pay period of the 3rd quarter and that there were four, four, and five pay periods during the months of July, August, and September, respectively. Note that based on the lookback period, the company is a monthly depositor. Assume that all necessary deposits were made on a timely basis and that the employer made deposits equal to the total amount owed for each quarter. Although Vermont quarterly state payroll forms are also filed by Ampersand, Inc., you will not complete these. If directed to do so by your instructor, record the necessary journal entries associated with each Form 941 (including those required for any tax payments made). section that quarter- and year-end tax figures earnings for the respective quarter or year. mpak or UYAR figures within Part 2 of Form 941 should be determined 5. Complete Form 940 for Ampersand, Inc. Note that FUTA payments are made only when required (i.e., if the employer is permitted to postpone the payment of these taxes, it will do so until a point in time when payment must be remitted). If directed to do so by your instructor, record the necessary journal entry associated with Form 940. 6. Calculate total SUTA tax owed by the employer. Although Ampersand, Inc., will file state forms in which this figure is reported, you are required to calculate only the total amount owed for the year. 7. Complete Copy A of Form W-2 for each of the four employees. State wages were the same as federal wages subject to federal withholding tax for each of the four employees, and the state identification number for Ampersand, Inc., is the same as its federal Employer Identification Number. 8. Complete Form W-3 for Ampersand, Inc. Note that the company files the paper version of the form and selects "None apply" in the Kind of Employer section. Three-Month Project NOTE! Templates needed Ampersand, Inc., is a small business that operates in Somerset, VT The company is located at 732 Appalachian Way, Somerset, VT 05363. Its federal Employer Identification Number is 44-4444444, and its president, who signs all tax forms, is Stacey Jones (telephone #802-555-3917) party designee on forms. e company does not wish to name a third- During 2019 four individuals are employed by Ampersand, Inc. These employees are as follows: Name Maggie Hough William Finnegan to complete these exercises, including one containing year-to-date payroll data, are included in the Student Exercise Files download for this cours Onth Stacey Jones Francine Stewart Address 13 Spruce Street Somerset, VT 05363 7 Smith Boulevard Somerset, VT 05363 8110 Browning Place Somerset, VT 05363 KNIS 101 Park Court Somerset, VT 05363 duke wazwester 222-22-2222 999-99-9999 555-55-5555 888-88-8888 Federal W/H State W/H Marital Allowances Allowances Status Single 1 2 W N 3 1 2 1 3 Married Single Married Note that Francine Stewart was hired in September, and her first day of work was Monday, September 23. Additionally, due to an economic downturn, Maggie Hough was laid off in late November, with her last day of work on Friday, November 22. All employees of Ampersand, Inc., work a regular 40-hour workweek (thus all hours worked over 40 in a given week are overtime hours), receive overtime pay at a rate of 1.5 times the regular wage rate, and are paid weekly on Sunday for the most recent week (which runs from Monday through Sunday, although employees never work on weekends). The SUTA tax rate applicable to Ampersand, Inc., is 2.5%, while the SUTA wage base in Vermont is $17,600. Earnings and voluntary deduction information for each of the four employees is as follows: Regular Annual Wage Rate Salary $14/hour $18/hour Name Maggie Hough William Finnegan Stacey Jones N/A Francine Stewart N/A Maggie Hough N/A Gross Quarter Earnings 1st quarter $7,280 2nd quarter $7,280 3rd quarter $7,280 N/A $262,000.44 $94,000.40 Weekly 401(k) Deduction Federal Income Tax $533 $533 $533 5% of gross pay 4% of gross pay N/A 2% of gross pay Weekly Charitable Contribution The first three quarters of the year have passed, and all payroll-related activity has been p of 9/30/2019. Quarterly payroll data for each of the four employees is as follows: $10 $5 $451.36 $15 N/A State Social Income Tax Security Tax Tax $345.80 $345.80 $345.80 azwestern.edu Medicare 401(k) accounted for as Deduction $105.56 $364 $105.56 $364 $105.56 $364 Charitable Cont. $130 $130 $130 William Finnegan Gross Federal Earnings Income Tax $9,360 $403 $403 $403 Quarter 1st quarter 2nd quarter $9,360 3rd quarter $9,360 Medicare 401(k) Charitable Deduction Cont. $374.40 $65 $374.40 $65 $65 State Social Income Tax Security Tax Tax $449.28 $580.32 $449.28 $580.32 $449.28 $580.32 $135.72 $135.72 $135.72 $374.40 Stacey Jones Gross Quarter Federal Earnings Income Tax 1st quarter $65,500.11 $15,655.90 2nd quarter $65,500.11 $15,655.90 3rd quarter $65,500.11 $15,655.90 Francine Stewart Gross Federal Earnings Income Tax Quarter 1st quarter So 2nd quarter so 3rd quarter $1,807.70 8 8 $0 $148.80 State Income Tax $3,274.96 $3,274.96 $4,061.07 $3,274.96 $117.66 Social Security Tax $4,061.07 $88.58 Medicare Tax $949,78 State Social Income Tax Security Tax Tax 50 so so SO SO so $26.21 $112.08 401(k) Deduction Cont. $195 $195 $195 so $949.78 so $949.78 so Medicare 401(k) Charitable so Charitable Deduction Cont $0 $0 50 Note that all tax payments and filings are made on the due date. Based on the data provided here, you will complete the following 1. Establish an employee earnings record for each of the company's four employees. Complete the top portion of each record. 2. Establish and complete the payroll register for each weekly pay period in the fourth quarter. When calculating federal income tax withholding, use the withholding tables where possible, and refer to the percentage method only when necessary. Note that as of November 25, Stacey Jones requests that her federal withholding allowances decrease from two to one (Ampersand, Inc, makes this change). Additionally, for simplicity, calculate the state income tax withholding as 5% of each employee's taxable pay (which is the same as taxable pay for FWT). Recall that state income tax withholding would ordinarily be calculated using the applicable state's withholding tables. Payroll checks are remitted to the employees in the same order (Hough, Finnegan, Jones, Stewart) each pay period and are written from a bank account that is used solely for these payments. The first payroll check written in October is check #4711. ketat vestir Note that all charitable contributions are deemed to be made on the final day of each pay period. The following information will be required for the completion of these records for the two employees who are compensated via an hourly wage: Weekly Hours Worked Weekly Start Maggie Date Hough 40 September 30 October 7 October 14 October 21 October 28 November 4 November 11 WARNING! 42 38 40 43.5 40 39 William Finnegan 44 37 40 46.5 42 45 40 Weekly Start Maggie William Date Hough Finnegan November 18 November 25 December 2 December 9 December 16 December 23 41 0 0 0 0 OP 34.5 40 41 43.5 NOTE! Recall from the Form 941 Rounding considerations should not be calculated based on the total axable Instead, to avoid rounding discrepancies, tax for each employee by adding the individual taxes across each pay period. 42.5 40 The above dates are weekly start dates. Refer to a calendar to determine the weekly end dates and associated pay dates keep in mind that tax liability and payment amounts are determined based on the weekly pay dates. 3. Complete an employee earnings record for the 4th quarter for each of the four employees. Divide the voluntary deductions from the payroll register appropriately across the associated columns within t employee earnings records. If directed to do so by your instructor, record the necessary journal each pay period. ries for the same amount 4. Complete Form 941 for both the 3rd and 4th quarters. Assume that the employees earned during each pay period of the 3rd quarter and that there were four, four, and five pay periods during the months of July, August, and September, respectively. Note that based on the lookback period, the company is a monthly depositor. Assume that all necessary deposits were made on a timely basis and that the employer made deposits equal to the total amount owed for each quarter. Although Vermont quarterly state payroll forms are also filed by Ampersand, Inc., you will not complete these. If directed to do so by your instructor, record the necessary journal entries associated with each Form 941 (including those required for any tax payments made). section that quarter- and year-end tax figures earnings for the respective quarter or year. mpak or UYAR figures within Part 2 of Form 941 should be determined 5. Complete Form 940 for Ampersand, Inc. Note that FUTA payments are made only when required (i.e., if the employer is permitted to postpone the payment of these taxes, it will do so until a point in time when payment must be remitted). If directed to do so by your instructor, record the necessary journal entry associated with Form 940. 6. Calculate total SUTA tax owed by the employer. Although Ampersand, Inc., will file state forms in which this figure is reported, you are required to calculate only the total amount owed for the year. 7. Complete Copy A of Form W-2 for each of the four employees. State wages were the same as federal wages subject to federal withholding tax for each of the four employees, and the state identification number for Ampersand, Inc., is the same as its federal Employer Identification Number. 8. Complete Form W-3 for Ampersand, Inc. Note that the company files the paper version of the form and selects "None apply" in the Kind of Employer section. Three-Month Project NOTE! Templates needed Ampersand, Inc., is a small business that operates in Somerset, VT The company is located at 732 Appalachian Way, Somerset, VT 05363. Its federal Employer Identification Number is 44-4444444, and its president, who signs all tax forms, is Stacey Jones (telephone #802-555-3917) party designee on forms. e company does not wish to name a third- During 2019 four individuals are employed by Ampersand, Inc. These employees are as follows: Name Maggie Hough William Finnegan to complete these exercises, including one containing year-to-date payroll data, are included in the Student Exercise Files download for this cours Onth Stacey Jones Francine Stewart Address 13 Spruce Street Somerset, VT 05363 7 Smith Boulevard Somerset, VT 05363 8110 Browning Place Somerset, VT 05363 KNIS 101 Park Court Somerset, VT 05363 duke wazwester 222-22-2222 999-99-9999 555-55-5555 888-88-8888 Federal W/H State W/H Marital Allowances Allowances Status Single 1 2 W N 3 1 2 1 3 Married Single Married Note that Francine Stewart was hired in September, and her first day of work was Monday, September 23. Additionally, due to an economic downturn, Maggie Hough was laid off in late November, with her last day of work on Friday, November 22. All employees of Ampersand, Inc., work a regular 40-hour workweek (thus all hours worked over 40 in a given week are overtime hours), receive overtime pay at a rate of 1.5 times the regular wage rate, and are paid weekly on Sunday for the most recent week (which runs from Monday through Sunday, although employees never work on weekends). The SUTA tax rate applicable to Ampersand, Inc., is 2.5%, while the SUTA wage base in Vermont is $17,600. Earnings and voluntary deduction information for each of the four employees is as follows: Regular Annual Wage Rate Salary $14/hour $18/hour Name Maggie Hough William Finnegan Stacey Jones N/A Francine Stewart N/A Maggie Hough N/A Gross Quarter Earnings 1st quarter $7,280 2nd quarter $7,280 3rd quarter $7,280 N/A $262,000.44 $94,000.40 Weekly 401(k) Deduction Federal Income Tax $533 $533 $533 5% of gross pay 4% of gross pay N/A 2% of gross pay Weekly Charitable Contribution The first three quarters of the year have passed, and all payroll-related activity has been p of 9/30/2019. Quarterly payroll data for each of the four employees is as follows: $10 $5 $451.36 $15 N/A State Social Income Tax Security Tax Tax $345.80 $345.80 $345.80 azwestern.edu Medicare 401(k) accounted for as Deduction $105.56 $364 $105.56 $364 $105.56 $364 Charitable Cont. $130 $130 $130 William Finnegan Gross Federal Earnings Income Tax $9,360 $403 $403 $403 Quarter 1st quarter 2nd quarter $9,360 3rd quarter $9,360 Medicare 401(k) Charitable Deduction Cont. $374.40 $65 $374.40 $65 $65 State Social Income Tax Security Tax Tax $449.28 $580.32 $449.28 $580.32 $449.28 $580.32 $135.72 $135.72 $135.72 $374.40 Stacey Jones Gross Quarter Federal Earnings Income Tax 1st quarter $65,500.11 $15,655.90 2nd quarter $65,500.11 $15,655.90 3rd quarter $65,500.11 $15,655.90 Francine Stewart Gross Federal Earnings Income Tax Quarter 1st quarter So 2nd quarter so 3rd quarter $1,807.70 8 8 $0 $148.80 State Income Tax $3,274.96 $3,274.96 $4,061.07 $3,274.96 $117.66 Social Security Tax $4,061.07 $88.58 Medicare Tax $949,78 State Social Income Tax Security Tax Tax 50 so so SO SO so $26.21 $112.08 401(k) Deduction Cont. $195 $195 $195 so $949.78 so $949.78 so Medicare 401(k) Charitable so Charitable Deduction Cont $0 $0 50 Note that all tax payments and filings are made on the due date. Based on the data provided here, you will complete the following 1. Establish an employee earnings record for each of the company's four employees. Complete the top portion of each record. 2. Establish and complete the payroll register for each weekly pay period in the fourth quarter. When calculating federal income tax withholding, use the withholding tables where possible, and refer to the percentage method only when necessary. Note that as of November 25, Stacey Jones requests that her federal withholding allowances decrease from two to one (Ampersand, Inc, makes this change). Additionally, for simplicity, calculate the state income tax withholding as 5% of each employee's taxable pay (which is the same as taxable pay for FWT). Recall that state income tax withholding would ordinarily be calculated using the applicable state's withholding tables. Payroll checks are remitted to the employees in the same order (Hough, Finnegan, Jones, Stewart) each pay period and are written from a bank account that is used solely for these payments. The first payroll check written in October is check #4711. ketat vestir Note that all charitable contributions are deemed to be made on the final day of each pay period. The following information will be required for the completion of these records for the two employees who are compensated via an hourly wage: Weekly Hours Worked Weekly Start Maggie Date Hough 40 September 30 October 7 October 14 October 21 October 28 November 4 November 11 WARNING! 42 38 40 43.5 40 39 William Finnegan 44 37 40 46.5 42 45 40 Weekly Start Maggie William Date Hough Finnegan November 18 November 25 December 2 December 9 December 16 December 23 41 0 0 0 0 OP 34.5 40 41 43.5 NOTE! Recall from the Form 941 Rounding considerations should not be calculated based on the total axable Instead, to avoid rounding discrepancies, tax for each employee by adding the individual taxes across each pay period. 42.5 40 The above dates are weekly start dates. Refer to a calendar to determine the weekly end dates and associated pay dates keep in mind that tax liability and payment amounts are determined based on the weekly pay dates. 3. Complete an employee earnings record for the 4th quarter for each of the four employees. Divide the voluntary deductions from the payroll register appropriately across the associated columns within t employee earnings records. If directed to do so by your instructor, record the necessary journal each pay period. ries for the same amount 4. Complete Form 941 for both the 3rd and 4th quarters. Assume that the employees earned during each pay period of the 3rd quarter and that there were four, four, and five pay periods during the months of July, August, and September, respectively. Note that based on the lookback period, the company is a monthly depositor. Assume that all necessary deposits were made on a timely basis and that the employer made deposits equal to the total amount owed for each quarter. Although Vermont quarterly state payroll forms are also filed by Ampersand, Inc., you will not complete these. If directed to do so by your instructor, record the necessary journal entries associated with each Form 941 (including those required for any tax payments made). section that quarter- and year-end tax figures earnings for the respective quarter or year. mpak or UYAR figures within Part 2 of Form 941 should be determined 5. Complete Form 940 for Ampersand, Inc. Note that FUTA payments are made only when required (i.e., if the employer is permitted to postpone the payment of these taxes, it will do so until a point in time when payment must be remitted). If directed to do so by your instructor, record the necessary journal entry associated with Form 940. 6. Calculate total SUTA tax owed by the employer. Although Ampersand, Inc., will file state forms in which this figure is reported, you are required to calculate only the total amount owed for the year. 7. Complete Copy A of Form W-2 for each of the four employees. State wages were the same as federal wages subject to federal withholding tax for each of the four employees, and the state identification number for Ampersand, Inc., is the same as its federal Employer Identification Number. 8. Complete Form W-3 for Ampersand, Inc. Note that the company files the paper version of the form and selects "None apply" in the Kind of Employer section. Three-Month Project NOTE! Templates needed Ampersand, Inc., is a small business that operates in Somerset, VT The company is located at 732 Appalachian Way, Somerset, VT 05363. Its federal Employer Identification Number is 44-4444444, and its president, who signs all tax forms, is Stacey Jones (telephone #802-555-3917) party designee on forms. e company does not wish to name a third- During 2019 four individuals are employed by Ampersand, Inc. These employees are as follows: Name Maggie Hough William Finnegan to complete these exercises, including one containing year-to-date payroll data, are included in the Student Exercise Files download for this cours Onth Stacey Jones Francine Stewart Address 13 Spruce Street Somerset, VT 05363 7 Smith Boulevard Somerset, VT 05363 8110 Browning Place Somerset, VT 05363 KNIS 101 Park Court Somerset, VT 05363 duke wazwester 222-22-2222 999-99-9999 555-55-5555 888-88-8888 Federal W/H State W/H Marital Allowances Allowances Status Single 1 2 W N 3 1 2 1 3 Married Single Married Note that Francine Stewart was hired in September, and her first day of work was Monday, September 23. Additionally, due to an economic downturn, Maggie Hough was laid off in late November, with her last day of work on Friday, November 22. All employees of Ampersand, Inc., work a regular 40-hour workweek (thus all hours worked over 40 in a given week are overtime hours), receive overtime pay at a rate of 1.5 times the regular wage rate, and are paid weekly on Sunday for the most recent week (which runs from Monday through Sunday, although employees never work on weekends). The SUTA tax rate applicable to Ampersand, Inc., is 2.5%, while the SUTA wage base in Vermont is $17,600. Earnings and voluntary deduction information for each of the four employees is as follows: Regular Annual Wage Rate Salary $14/hour $18/hour Name Maggie Hough William Finnegan Stacey Jones N/A Francine Stewart N/A Maggie Hough N/A Gross Quarter Earnings 1st quarter $7,280 2nd quarter $7,280 3rd quarter $7,280 N/A $262,000.44 $94,000.40 Weekly 401(k) Deduction Federal Income Tax $533 $533 $533 5% of gross pay 4% of gross pay N/A 2% of gross pay Weekly Charitable Contribution The first three quarters of the year have passed, and all payroll-related activity has been p of 9/30/2019. Quarterly payroll data for each of the four employees is as follows: $10 $5 $451.36 $15 N/A State Social Income Tax Security Tax Tax $345.80 $345.80 $345.80 azwestern.edu Medicare 401(k) accounted for as Deduction $105.56 $364 $105.56 $364 $105.56 $364 Charitable Cont. $130 $130 $130 William Finnegan Gross Federal Earnings Income Tax $9,360 $403 $403 $403 Quarter 1st quarter 2nd quarter $9,360 3rd quarter $9,360 Medicare 401(k) Charitable Deduction Cont. $374.40 $65 $374.40 $65 $65 State Social Income Tax Security Tax Tax $449.28 $580.32 $449.28 $580.32 $449.28 $580.32 $135.72 $135.72 $135.72 $374.40 Stacey Jones Gross Quarter Federal Earnings Income Tax 1st quarter $65,500.11 $15,655.90 2nd quarter $65,500.11 $15,655.90 3rd quarter $65,500.11 $15,655.90 Francine Stewart Gross Federal Earnings Income Tax Quarter 1st quarter So 2nd quarter so 3rd quarter $1,807.70 8 8 $0 $148.80 State Income Tax $3,274.96 $3,274.96 $4,061.07 $3,274.96 $117.66 Social Security Tax $4,061.07 $88.58 Medicare Tax $949,78 State Social Income Tax Security Tax Tax 50 so so SO SO so $26.21 $112.08 401(k) Deduction Cont. $195 $195 $195 so $949.78 so $949.78 so Medicare 401(k) Charitable so Charitable Deduction Cont $0 $0 50 Note that all tax payments and filings are made on the due date. Based on the data provided here, you will complete the following 1. Establish an employee earnings record for each of the company's four employees. Complete the top portion of each record. 2. Establish and complete the payroll register for each weekly pay period in the fourth quarter. When calculating federal income tax withholding, use the withholding tables where possible, and refer to the percentage method only when necessary. Note that as of November 25, Stacey Jones requests that her federal withholding allowances decrease from two to one (Ampersand, Inc, makes this change). Additionally, for simplicity, calculate the state income tax withholding as 5% of each employee's taxable pay (which is the same as taxable pay for FWT). Recall that state income tax withholding would ordinarily be calculated using the applicable state's withholding tables. Payroll checks are remitted to the employees in the same order (Hough, Finnegan, Jones, Stewart) each pay period and are written from a bank account that is used solely for these payments. The first payroll check written in October is check #4711. ketat vestir Note that all charitable contributions are deemed to be made on the final day of each pay period. The following information will be required for the completion of these records for the two employees who are compensated via an hourly wage: Weekly Hours Worked Weekly Start Maggie Date Hough 40 September 30 October 7 October 14 October 21 October 28 November 4 November 11 WARNING! 42 38 40 43.5 40 39 William Finnegan 44 37 40 46.5 42 45 40 Weekly Start Maggie William Date Hough Finnegan November 18 November 25 December 2 December 9 December 16 December 23 41 0 0 0 0 OP 34.5 40 41 43.5 NOTE! Recall from the Form 941 Rounding considerations should not be calculated based on the total axable Instead, to avoid rounding discrepancies, tax for each employee by adding the individual taxes across each pay period. 42.5 40 The above dates are weekly start dates. Refer to a calendar to determine the weekly end dates and associated pay dates keep in mind that tax liability and payment amounts are determined based on the weekly pay dates. 3. Complete an employee earnings record for the 4th quarter for each of the four employees. Divide the voluntary deductions from the payroll register appropriately across the associated columns within t employee earnings records. If directed to do so by your instructor, record the necessary journal each pay period. ries for the same amount 4. Complete Form 941 for both the 3rd and 4th quarters. Assume that the employees earned during each pay period of the 3rd quarter and that there were four, four, and five pay periods during the months of July, August, and September, respectively. Note that based on the lookback period, the company is a monthly depositor. Assume that all necessary deposits were made on a timely basis and that the employer made deposits equal to the total amount owed for each quarter. Although Vermont quarterly state payroll forms are also filed by Ampersand, Inc., you will not complete these. If directed to do so by your instructor, record the necessary journal entries associated with each Form 941 (including those required for any tax payments made). section that quarter- and year-end tax figures earnings for the respective quarter or year. mpak or UYAR figures within Part 2 of Form 941 should be determined 5. Complete Form 940 for Ampersand, Inc. Note that FUTA payments are made only when required (i.e., if the employer is permitted to postpone the payment of these taxes, it will do so until a point in time when payment must be remitted). If directed to do so by your instructor, record the necessary journal entry associated with Form 940. 6. Calculate total SUTA tax owed by the employer. Although Ampersand, Inc., will file state forms in which this figure is reported, you are required to calculate only the total amount owed for the year. 7. Complete Copy A of Form W-2 for each of the four employees. State wages were the same as federal wages subject to federal withholding tax for each of the four employees, and the state identification number for Ampersand, Inc., is the same as its federal Employer Identification Number. 8. Complete Form W-3 for Ampersand, Inc. Note that the company files the paper version of the form and selects "None apply" in the Kind of Employer section. Three-Month Project NOTE! Templates needed Ampersand, Inc., is a small business that operates in Somerset, VT The company is located at 732 Appalachian Way, Somerset, VT 05363. Its federal Employer Identification Number is 44-4444444, and its president, who signs all tax forms, is Stacey Jones (telephone #802-555-3917) party designee on forms. e company does not wish to name a third- During 2019 four individuals are employed by Ampersand, Inc. These employees are as follows: Name Maggie Hough William Finnegan to complete these exercises, including one containing year-to-date payroll data, are included in the Student Exercise Files download for this cours Onth Stacey Jones Francine Stewart Address 13 Spruce Street Somerset, VT 05363 7 Smith Boulevard Somerset, VT 05363 8110 Browning Place Somerset, VT 05363 KNIS 101 Park Court Somerset, VT 05363 duke wazwester 222-22-2222 999-99-9999 555-55-5555 888-88-8888 Federal W/H State W/H Marital Allowances Allowances Status Single 1 2 W N 3 1 2 1 3 Married Single Married Note that Francine Stewart was hired in September, and her first day of work was Monday, September 23. Additionally, due to an economic downturn, Maggie Hough was laid off in late November, with her last day of work on Friday, November 22. All employees of Ampersand, Inc., work a regular 40-hour workweek (thus all hours worked over 40 in a given week are overtime hours), receive overtime pay at a rate of 1.5 times the regular wage rate, and are paid weekly on Sunday for the most recent week (which runs from Monday through Sunday, although employees never work on weekends). The SUTA tax rate applicable to Ampersand, Inc., is 2.5%, while the SUTA wage base in Vermont is $17,600. Earnings and voluntary deduction information for each of the four employees is as follows: Regular Annual Wage Rate Salary $14/hour $18/hour Name Maggie Hough William Finnegan Stacey Jones N/A Francine Stewart N/A Maggie Hough N/A Gross Quarter Earnings 1st quarter $7,280 2nd quarter $7,280 3rd quarter $7,280 N/A $262,000.44 $94,000.40 Weekly 401(k) Deduction Federal Income Tax $533 $533 $533 5% of gross pay 4% of gross pay N/A 2% of gross pay Weekly Charitable Contribution The first three quarters of the year have passed, and all payroll-related activity has been p of 9/30/2019. Quarterly payroll data for each of the four employees is as follows: $10 $5 $451.36 $15 N/A State Social Income Tax Security Tax Tax $345.80 $345.80 $345.80 azwestern.edu Medicare 401(k) accounted for as Deduction $105.56 $364 $105.56 $364 $105.56 $364 Charitable Cont. $130 $130 $130 William Finnegan Gross Federal Earnings Income Tax $9,360 $403 $403 $403 Quarter 1st quarter 2nd quarter $9,360 3rd quarter $9,360 Medicare 401(k) Charitable Deduction Cont. $374.40 $65 $374.40 $65 $65 State Social Income Tax Security Tax Tax $449.28 $580.32 $449.28 $580.32 $449.28 $580.32 $135.72 $135.72 $135.72 $374.40 Stacey Jones Gross Quarter Federal Earnings Income Tax 1st quarter $65,500.11 $15,655.90 2nd quarter $65,500.11 $15,655.90 3rd quarter $65,500.11 $15,655.90 Francine Stewart Gross Federal Earnings Income Tax Quarter 1st quarter So 2nd quarter so 3rd quarter $1,807.70 8 8 $0 $148.80 State Income Tax $3,274.96 $3,274.96 $4,061.07 $3,274.96 $117.66 Social Security Tax $4,061.07 $88.58 Medicare Tax $949,78 State Social Income Tax Security Tax Tax 50 so so SO SO so $26.21 $112.08 401(k) Deduction Cont. $195 $195 $195 so $949.78 so $949.78 so Medicare 401(k) Charitable so Charitable Deduction Cont $0 $0 50 Note that all tax payments and filings are made on the due date. Based on the data provided here, you will complete the following 1. Establish an employee earnings record for each of the company's four employees. Complete the top portion of each record. 2. Establish and complete the payroll register for each weekly pay period in the fourth quarter. When calculating federal income tax withholding, use the withholding tables where possible, and refer to the percentage method only when necessary. Note that as of November 25, Stacey Jones requests that her federal withholding allowances decrease from two to one (Ampersand, Inc, makes this change). Additionally, for simplicity, calculate the state income tax withholding as 5% of each employee's taxable pay (which is the same as taxable pay for FWT). Recall that state income tax withholding would ordinarily be calculated using the applicable state's withholding tables. Payroll checks are remitted to the employees in the same order (Hough, Finnegan, Jones, Stewart) each pay period and are written from a bank account that is used solely for these payments. The first payroll check written in October is check #4711. ketat vestir Note that all charitable contributions are deemed to be made on the final day of each pay period. The following information will be required for the completion of these records for the two employees who are compensated via an hourly wage: Weekly Hours Worked Weekly Start Maggie Date Hough 40 September 30 October 7 October 14 October 21 October 28 November 4 November 11 WARNING! 42 38 40 43.5 40 39 William Finnegan 44 37 40 46.5 42 45 40 Weekly Start Maggie William Date Hough Finnegan November 18 November 25 December 2 December 9 December 16 December 23 41 0 0 0 0 OP 34.5 40 41 43.5 NOTE! Recall from the Form 941 Rounding considerations should not be calculated based on the total axable Instead, to avoid rounding discrepancies, tax for each employee by adding the individual taxes across each pay period. 42.5 40 The above dates are weekly start dates. Refer to a calendar to determine the weekly end dates and associated pay dates keep in mind that tax liability and payment amounts are determined based on the weekly pay dates. 3. Complete an employee earnings record for the 4th quarter for each of the four employees. Divide the voluntary deductions from the payroll register appropriately across the associated columns within t employee earnings records. If directed to do so by your instructor, record the necessary journal each pay period. ries for the same amount 4. Complete Form 941 for both the 3rd and 4th quarters. Assume that the employees earned during each pay period of the 3rd quarter and that there were four, four, and five pay periods during the months of July, August, and September, respectively. Note that based on the lookback period, the company is a monthly depositor. Assume that all necessary deposits were made on a timely basis and that the employer made deposits equal to the total amount owed for each quarter. Although Vermont quarterly state payroll forms are also filed by Ampersand, Inc., you will not complete these. If directed to do so by your instructor, record the necessary journal entries associated with each Form 941 (including those required for any tax payments made). section that quarter- and year-end tax figures earnings for the respective quarter or year. mpak or UYAR figures within Part 2 of Form 941 should be determined 5. Complete Form 940 for Ampersand, Inc. Note that FUTA payments are made only when required (i.e., if the employer is permitted to postpone the payment of these taxes, it will do so until a point in time when payment must be remitted). If directed to do so by your instructor, record the necessary journal entry associated with Form 940. 6. Calculate total SUTA tax owed by the employer. Although Ampersand, Inc., will file state forms in which this figure is reported, you are required to calculate only the total amount owed for the year. 7. Complete Copy A of Form W-2 for each of the four employees. State wages were the same as federal wages subject to federal withholding tax for each of the four employees, and the state identification number for Ampersand, Inc., is the same as its federal Employer Identification Number. 8. Complete Form W-3 for Ampersand, Inc. Note that the company files the paper version of the form and selects "None apply" in the Kind of Employer section.

Expert Answer:

Answer rating: 100% (QA)

Given facts Four Employee 1 Hunter Cranston 2 Allison Haris... View the full answer

Related Book For

Posted Date:

Students also viewed these accounting questions

-

During 2019 four individuals are employed by Ellipses Corp. These employees are as follows: Social Federal W/H State W/H Marital Name Address Security # Allowances Allowances Status Hunter Cranston...

-

The following payroll liability accounts are included in the ledger of Eikleberry Company on January 1, 2011. FICA Taxes Payable .............$ 662.20 Federal Income Taxes Payable .........1,254.60...

-

The following payroll liability accounts are included in the ledger of Nordlund Company on January 1, 2011. FICA Taxes Payable ..............$ 760.00 Federal Income Taxes Payable ..........1,204.60...

-

Hi, the task is to critically evaluated two or more types of market segmentation, and applied to own organisations customer base. The guidance says to start with a general explanation of the topic -...

-

What specific words are characteristics of the different types of audit reports?

-

Use the information provided in the table to answer the following questions. Assume that there were no changes in any other asset or liability accounts. December 2 0 2 2 Net Income: $ 2 0 0 0...

-

Suppose that linear regression is used to estimate factorial effects for a $2^{k}$ design by doubling the estimated regression coefficients. a. When is it possible to estimate the standard error of...

-

Section 404 of the SarbanesOxley Act requires auditors of a public company to analyze and report on the effectiveness of the clients internal controls over financial reporting. Describe the...

-

E3.9 (LO 1, 3) (Multiple-Step Statement with Retained Earnings Statement) Presented below is information related to Ivan Calderon Corp. for the year 2025. Net sales Cost of goods sold Selling...

-

The following summarized data (amounts in millions) are taken from the September 26, 2020, and September 28, 2019, comparative financial statements of Apple Incorporated, a company that designs,...

-

For all source material used in the analysis, you will paraphrase and not use direct quotation marks but will instead paraphrase. What this means is that you will put the ideas of an author or...

-

A die is a small cube with sides marked with one to six spots on each side arranged so that the opposite sides of the cube have spots adding up to seven. A die can be held so that one, two, or three...

-

Pie Corporation acquired 75 percent of Slice Companys ownership on January 1, 20X8, for $96,000. At that date, the fair value of the noncontrolling interest was $32,000. The book value of Slices net...

-

Draw up M. Kellys statement of financial position as at 30 June 2012 from the following items: Capital Equipment Accounts payable Inventory Accounts receivable Cash at bank 10,200 3,400 4,100 3,600...

-

How many corks are in the barrel? Outline a procedure that would find the answer without actually counting the number of corks.

-

When will the balance in the intercorporate investment account be the same if the investment is carried at fair value, or if the equity method of accounting is used?

-

Write a paper on the Impact of Artificial Intelligence on Employment

-

An access route is being constructed across a field (Figure Q8). Apart from a relatively firm strip of ground alongside the field's longer side AB, the ground is generally marshy. The route can...

-

Portofino Company made purchases on account from three foreign suppliers on December 15, 2009, with payment made on January 15, 2010. Information related to these purchases is as follows: Portofino...

-

The Vanguard Group is an investment firm with more than 50 different mutual funds in which the public may invest. Among these funds are 13 international funds that concentrate on investments in...

-

In selecting an accounting policy for a transaction, which of the following is the first level within the hierarchy of guidance that should be considered? a. The most recent pronouncements of other...

-

From the following trial balance of G. Foot after his first year's trading, you are required to draw up a statement of profit or loss for the year ending 30 June 2016. A statement of financial...

-

At the beginning of the financial year on 1 April 2017, a company had a balance on plant account of 372,000 and on provision for depreciation of plant account of 205,400. The company's policy is to...

-

(a) Distinguish between capital and revenue expenditure. (b) Drake Ltd took delivery of a computer network on 1 July 2016, the beginning of its financial year. The list price of the equipment was...

Study smarter with the SolutionInn App