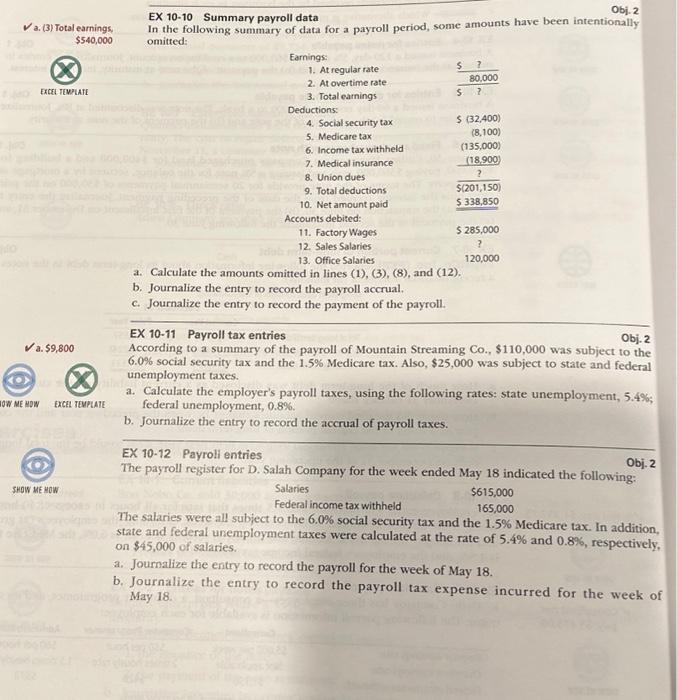

Question: finace help asap ! EX 10-10 Summary payroll data a. (3) Totaleamings, In the following summary of data for a payroll period, some amounts have

EX 10-10 Summary payroll data a. (3) Totaleamings, In the following summary of data for a payroll period, some amounts have been intentionally $540,000 omitted: a. Calculate the amounts omitted in lines (1), (3), (8), and (12). b. Journalize the entry to record the payroll accrual. c. Journalize the entry to record the payment of the payroll. EX 10-11 Payroll tax entries According to a summary of the payroll of Mountain Streaming Co., $110,000 was subject to the 6.0% social security tax and the 1.5% Medicare tax. Also, $25,000 was subject to state and federal unemployment taxes. a. Calculate the employer's payroll taxes, using the following rates: state unemployment, 5.4\%; federal unemployment, 0.8%. b. Journalize the entry to record the accrual of payroll taxes. EX 10-12 Payroll entries The payroll register for D. Salah Company for the week ended May 18 indicated the following: The salaries were all subject to the 6.0% social security tax and the 1.5% Medicare tax. In addition, state and federal uremployment taxes were calculated at the rate of 5.4% and 0.8%, respectively, on $45,000 of salaries. a. Journalize the entry to record the payroll for the week of May 18. b. Journalize the entry to record the payroll tax expense incurred for the week of May 18

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts