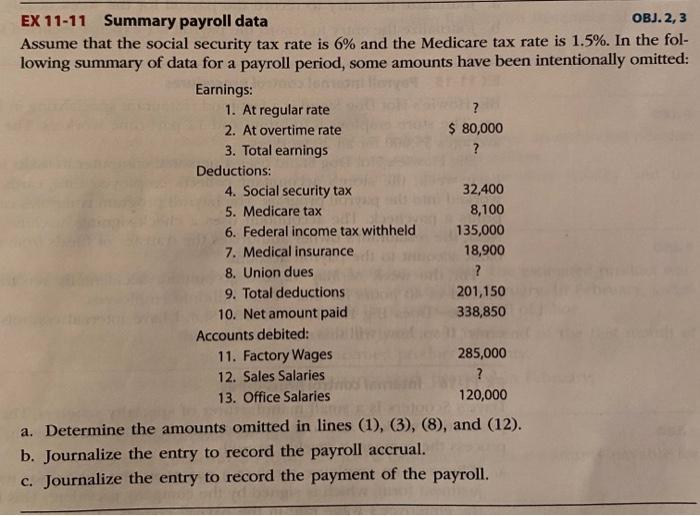

Question: OBJ. 2,3 EX 11-11 Summary payroll data Assume that the social security tax rate is 6% and the Medicare tax rate is 1.5%. In the

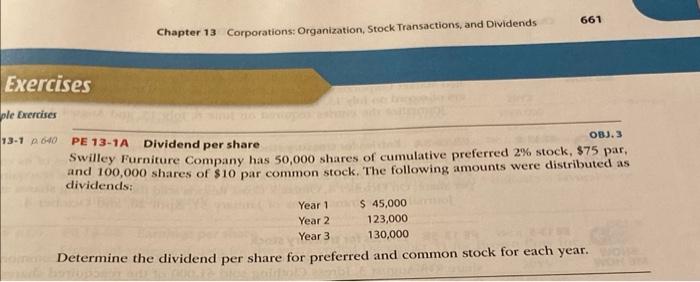

EX 11-11 Summary payroll data OBJ. 2,3 Assume that the social security tax rate is 6% and the Medicare tax rate is 1.5%. In the following summary of data for a payroll period, some amounts have been intentionally omitted: a. Determine the amounts omitted in lines (1), (3), (8), and (12). b. Journalize the entry to record the payroll accrual. c. Journalize the entry to record the payment of the payroll. Chapter 13 Corporations: Organization, Stock Transactions, and Dividends 661 ises PE 13-1A Dividend per share 08. 3 Swilley Furniture Company has 50,000 shares of cumulative preferred 2% stock, $75 par, and 100,000 shares of $10 par common stock. The following amounts were distributed as dividends: Determine the dividend per share for preferred and common stock for each year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts