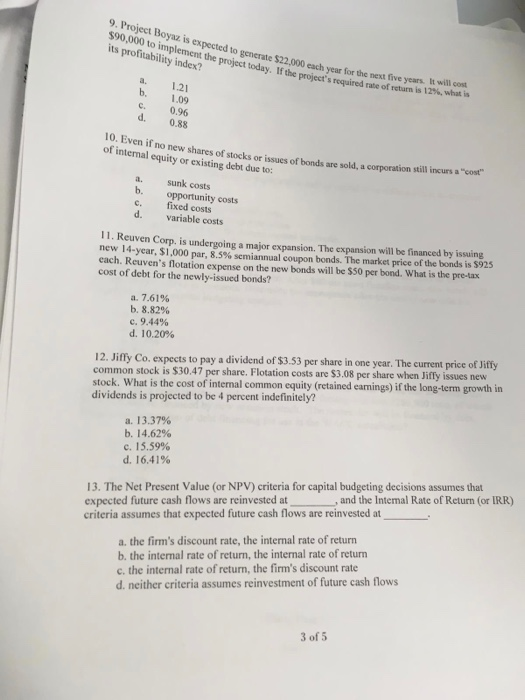

Question: final answer please $90,000 to implement the project today. If the project's required rate of return is its profitability index? five years. It will cost

$90,000 to implement the project today. If the project's required rate of return is its profitability index? five years. It will cost is 12%, what is a. 1.21 b. 109 1.09 c. 0.96 d. 0.88 Even if no new shares of stocks or issues of bonds are sold, a corporation still incurs a "cost of internal equity or existing debt due to: a. sunk costs b. opportunity costs c fixed costs d variable costs 11. Reuven Corp. is undergoing a major expansion. The expansion will be financed by issuing new 14-year, $1,000 par, 85% semiannual coupon bonds. The market price of the bonds is s925 each. Reuven's flotation expense on the new bonds will be $50 per bond. What is the pre-tax cost of debt for the newly-issued bonds? a. 7.61% b. 8.82% c. 9.44% d. 10.20% 12. Jiffy Co. expects to pay a dividend of $3.53 per share in one year. The current price of Jiffy common stock is $30.47 per share. Flotation costs are $3.08 per share when Jiffy i stock. What is the cost of internal common equity (retained eamings) if the long-term growth in dividends is projected to be 4 percent indefinitely? a. 13.37% b. 14.62% c. 15.59% d. 16.41% 13. The Net Present Value (or NPV) criteria for capital budgeting decisions assumes that expected future cash flows are reinvested at , and the Intemal Rate of Return (or IRR) criteria assumes that expected future cash flows are reinvested at a the firm's discount rate, the internal rate of return b. the internal rate of return, the internal rate of return c. the internal rate of return, the firm's discount rate d. neither criteria assumes reinvestment of future cash flows 3 of 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts