Question: final answer please Use the following information for Questions 4 -s is considering a new inventory system, Project A, that will cost 5750,000 The generate

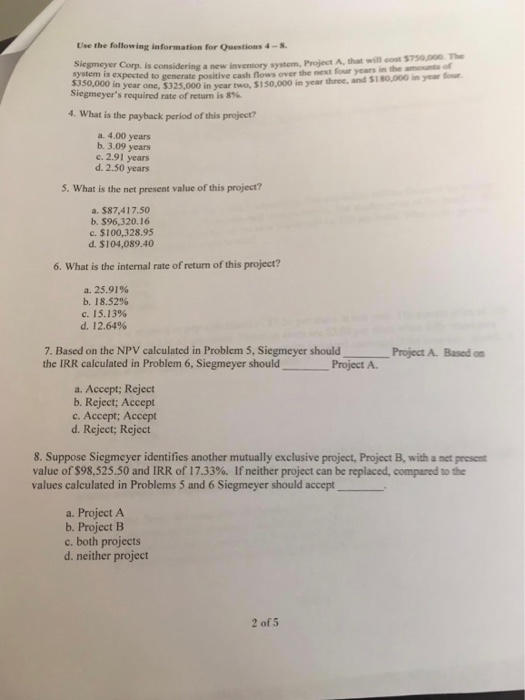

Use the following information for Questions 4 -s is considering a new inventory system, Project A, that will cost 5750,000 The generate positive cash flows over the next four years in the amounts of is expected to p 5350,000 in y Siegmeyer's required rate of return is 8%. ear one, $325,000 in year two, $1 50,000 in year three, and $1 80,000 in year Sour 4. What is the payback period of this project? a. 4.00 years b. 3.09 years c. 2.91 years d. 2.50 years 5. What is the net present value of this project? a. $87,417.50 b. $96,320.16 c. $100,328.95 d. $104,089.40 6. What is the internal rate of return of this project? a. 25.91% b. 18.52% C. 15.13% d. 12.64% 7. Based on the NPV calculated in Problem 5, Siegmeyer should the IRR calculated in Problem 6, Siegmeyer should Project A. Project A. Based on a. Accept; Reject b. Reject; Accept c. Accept; Accept d. Reject; Reject 8. Suppose Siegmeyer identifies another mutually exclusive project, Project B, with a net present value of $98,525.50 and IRR of 17.33%. If neither project can be replaced, compared to the values calculated in Problems 5 and 6 Siegmeyer should accept a. Project A b. Project B c. both projects d. neither project 2 of 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts