Question: Final Case Project I. Given the following data on proposed capital budgeting project. Economic life of project in years. Price of New Equipment Fixed

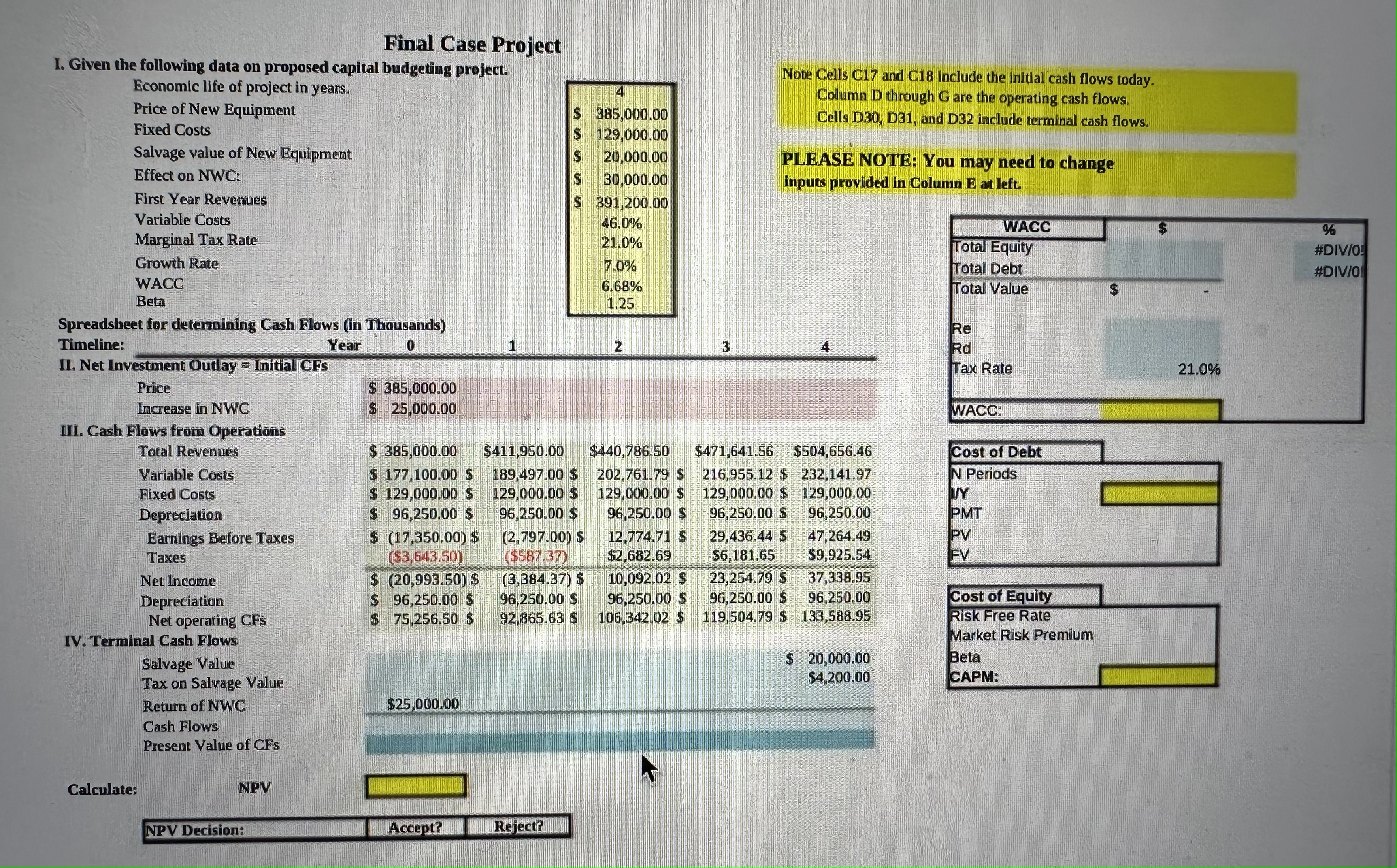

Final Case Project I. Given the following data on proposed capital budgeting project. Economic life of project in years. Price of New Equipment Fixed Costs Salvage value of New Equipment Effect on NWC: First Year Revenues Variable Costs Marginal Tax Rate Growth Rate WACC Beta 4 $ 385,000.00 $ 129,000.00 $ 20,000.00 S 30,000.00 $ 391,200.00 46.0% 21.0% 7.0% 6.68% 1.25 Note Cells C17 and C18 include the initial cash flows today. Column D through G are the operating cash flows. Cells D30, D31, and D32 include terminal cash flows. PLEASE NOTE: You may need to change inputs provided in Column E at left. WACC Total Equity Total Debt Total Value Spreadsheet for determining Cash Flows (in Thousands) Timeline: II. Net Investment Outlay = Initial CFs Price Increase in NWC III. Cash Flows from Operations Total Revenues Variable Costs Fixed Costs Depreciation 0 Year 2 3 $ 385,000.00 $25,000.00 Re Rd Tax Rate 21.0% WACC Earnings Before Taxes Taxes $ 385,000.00 $ 177,100.00 S $ 129,000.00 $ $ 96,250.00 $ $ (17,350.00) $ ($3,643.50) Net Income Depreciation IV. Terminal Cash Flows Salvage Value Tax on Salvage Value Return of NWC Cash Flows Present Value of CFs $ (20,993.50) $ $ 96,250.00 $ Net operating CFs $ 75,256.50 S $411,950.00 189,497.00 $ 129,000.00 $ 96,250.00 $ (2,797.00) $ ($587.37) (3,384.37) $ 96,250.00 $ 92.865.63 $ $440,786.50 202.761.79 $ 129,000.00 $ 96,250.00 S 12.774.71 S $2,682.69 10,092.02 $ 96,250.00 S 106.342.02 $ $471,641.56 $504,656.46 216,955.12 $ 232,141.97 129,000.00 $ 129,000.00 96,250.00 S 96,250.00 29,436.44 $ 47,264.49 $6,181.65 $9,925.54 23,254.79 $ 37,338.95 96,250.00 $ 96,250.00 119,504,79 $ 133,588.95 Cost of Debt N Periods Y PMT PV FV Cost of Equity $ 20,000.00 $4,200.00 Risk Free Rate Market Risk Premium Beta CAPM: $25,000.00 Calculate: NPV NPV Decision: Accept? Reject? % #DIV/0 #DIVIO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts