Question: Final Exam Review i Saved Help Save & Exit Submit Check my work 2 Helen Ming receives a travel allowance of $210 each week from

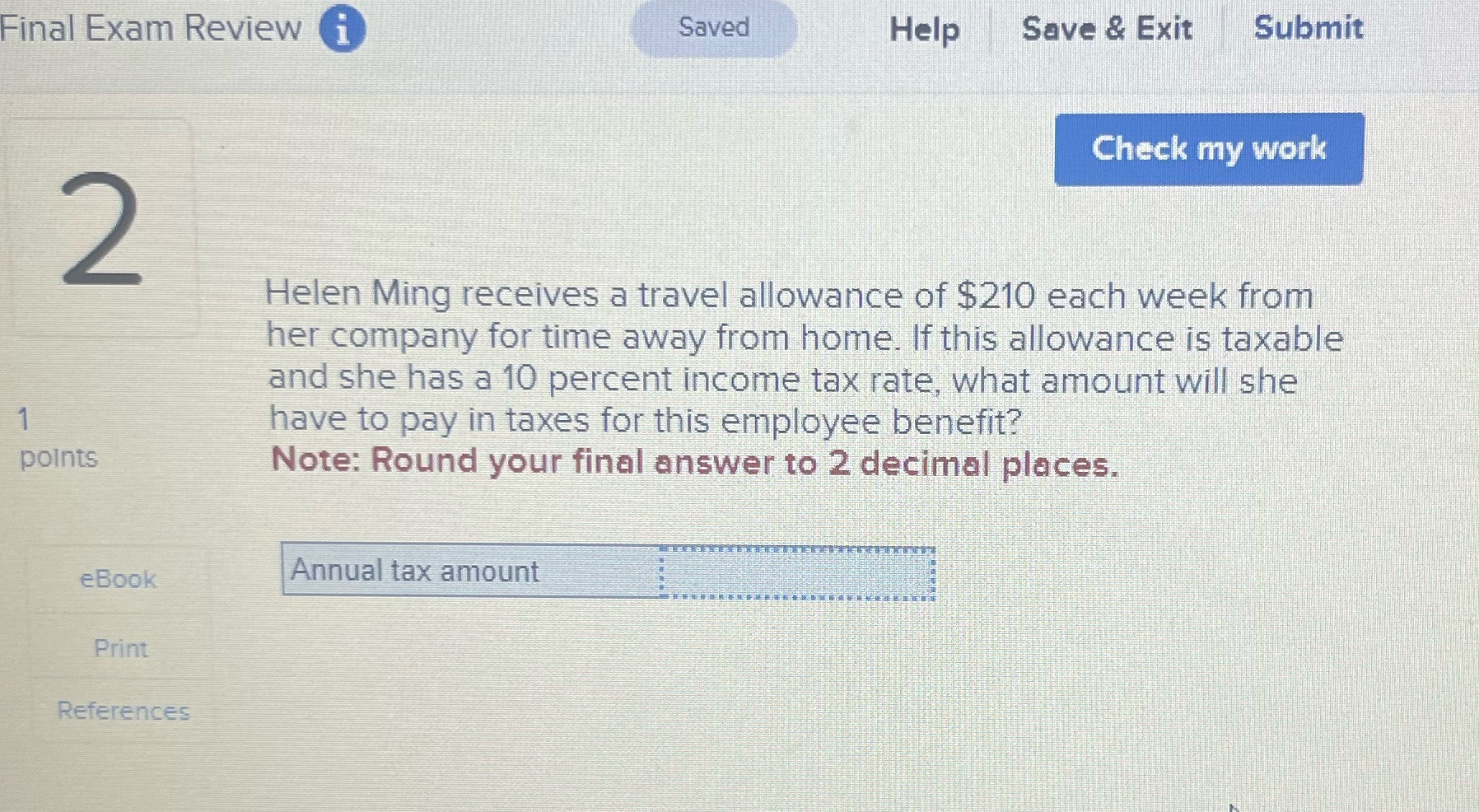

Final Exam Review i Saved Help Save & Exit Submit Check my work 2 Helen Ming receives a travel allowance of $210 each week from her company for time away from home. If this allowance is taxable and she has a 10 percent income tax rate, what amount will she have to pay in taxes for this employee benefit? points Note: Round your final answer to 2 decimal places. eBook Annual tax amount Print References

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts