Question: Finance 1. Consider assets A and B with expected returns of E(RA)=15% and E(RB)=10% and standard deviations of12% and 14%. The correlation coefficient between A

Finance

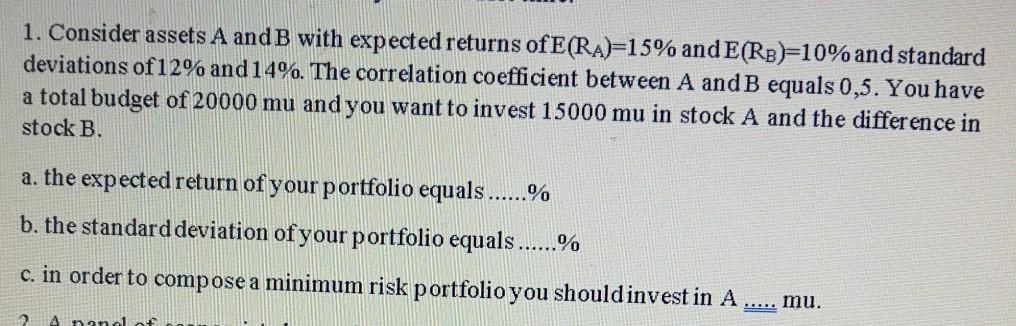

1. Consider assets A and B with expected returns of E(RA)=15% and E(RB)=10% and standard deviations of12% and 14%. The correlation coefficient between A and B equals 0,5. You have a total budget of 20000 mu and you want to invest 15000 mu in stock A and the difference in stock B. a. the expected return of your portfolio equals ......% b. the standard deviation of your portfolio equals......% c. in order to compose a minimum risk portfolio you shouldinvest in A mu. 2A nanol

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts