Question: finance Answer 11-15 show all work clearly and circle answer 11. Which one of the following can be defned as a benenit-cost ratio? A) B)

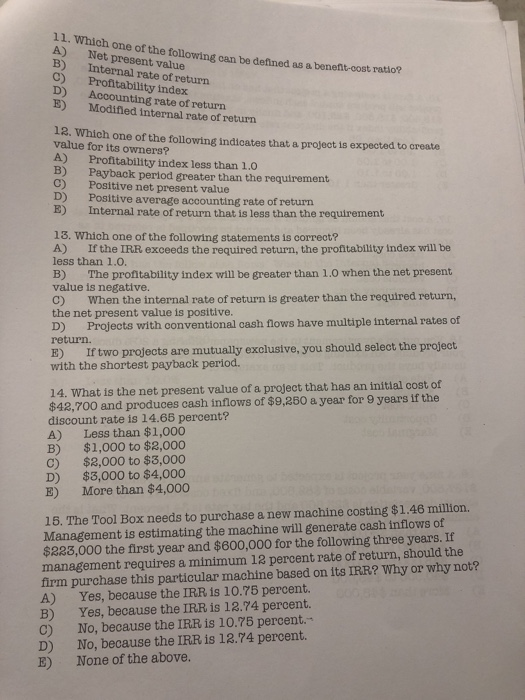

11. Which one of the following can be defned as a benenit-cost ratio? A) B) C) D) E) Net present value Internal rate of return Profitability index Accounting rate of return Modified internal rate of return 12. Which one of the following indicates that a project is expected to create value for its owners? A) Profitability index less than 1.0 C) D) E) Payback period greater than the requirement Positive net present value Positive average accounting rate of return Internal rate of return that is less than the requirement 13. Which one of the following statements is correct? A) If the IRR exceeds the required return, the profitability index will be less than 1.0. B) The profitability index will be greater than 1.0 when the net present value is negative. C) When the internal rate of return is greater than the required return, the net present value is positive. D) Projects with oonventional cash flows have multiple internal rates of return. B) If two projects are mutually exclusive, you should select the project with the shortest payback period. 14. What is the net present value of a project that has an initial cost of $42,700 and produces cash inflows of $9,250 a year for 9 years if the discount rate is 14.65 percent? A) Less than $1,000 B) $1,000 to $2,000 C) $2,000 to $3,000 D) $%3,000 to $4,000 E) More than $4,000 15. The Tool Box needs to purchase a new machine costing $1.46 million. Management is estimating the machine will generate cash inflows of $333,000 the first year and $600,000 for the following three years. If management requires a minimum 12 percent rate of return, should the firm purchase this particular machine based on its IRR? Why or why not? A) Yes, because the IRR is 10.75 percent. B) Yes, because the IRR is 12.74 percent. C) No, because the IRR is 10.75 percent.- D) No, because the IRR is 12.74 percent. E) None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts