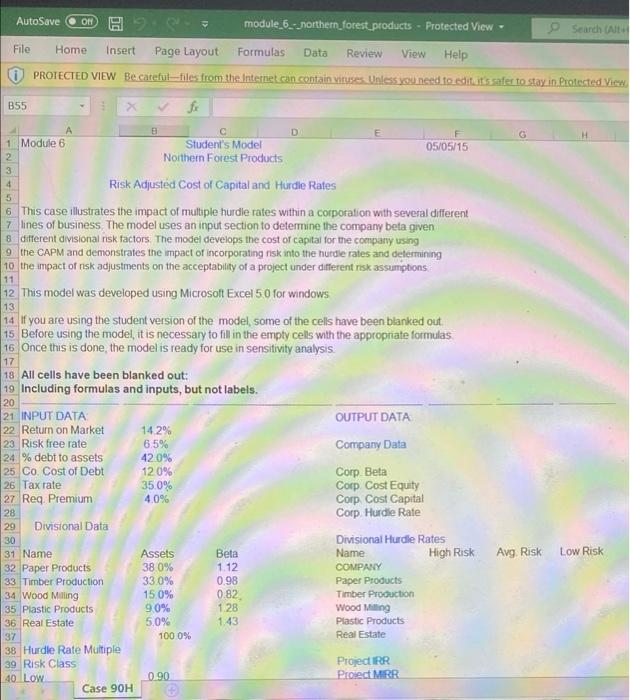

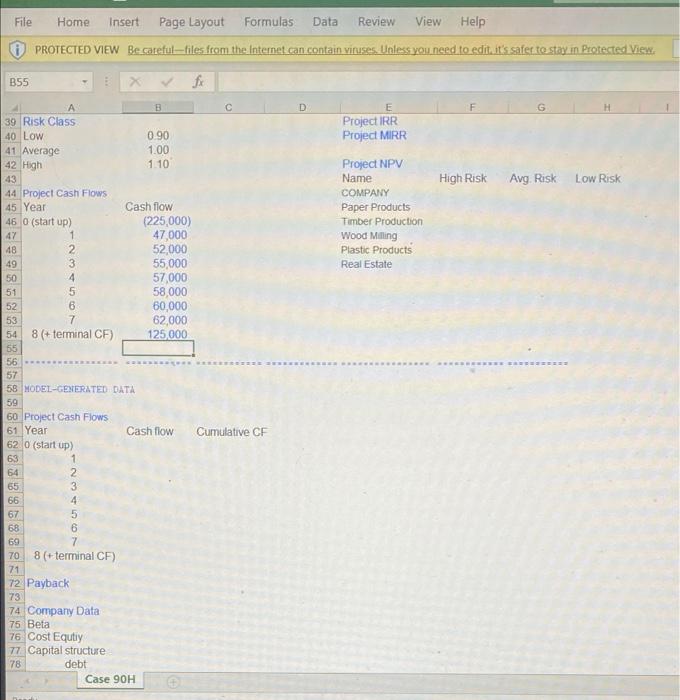

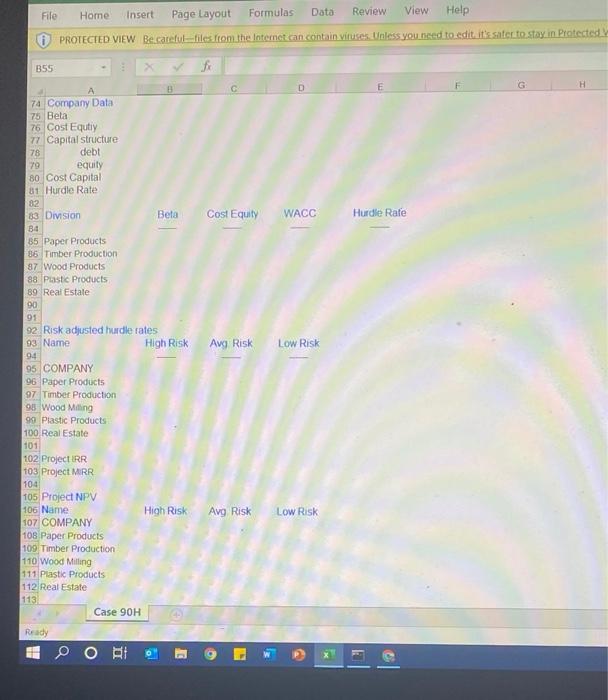

Question: Finance excel problem Please just fill out tbe OUTPUT data side , CUMULATIVE CF column, & the PROJECT NPV section at the bottom. I figured

AutoSave 01 HD module_6_-_horthern_forest products - Protected View Search Alte File Home Insert Page Layout Formulas Data Review View Help PROTECTED VIEW Be careful--files from the Internet can contain viruses. Unless you need to edit it's safer to stay in Piatected View B55 fo G 11 17 A D 1 Module 6 Student's Model 05/05/15 2 Northern Forest Products 3 4 Risk Adjusted Cost of Capital and Hurdle Rates 5 6 This case illustrates the impact of multiple hurdle rates within a corporation with several different 7 lines of business The model uses an input section to determine the company beta given 8 different divisional risk factors. The model develops the cost of capital for the company using 9 the CAPM and demonstrates the impact of incorporating risk into the hurdle rates and determining 10 the impact of risk adjustments on the acceptability of a project under different risk assumptions 12 This model was developed using Microsoft Excel 5.0 for windows 13 14 If you are using the student version of the model, some of the cells have been blanked out 15 Before using the model, it is necessary to fill in the empty cells with the appropnate formulas 16 Once this is done, the model is ready for use in sensitivity analysis. 18 All cells have been blanked out: 19 Including formulas and inputs, but not labels. 20 21 INPUT DATA OUTPUT DATA 22 Return on Market 142 23. Risk free rate 6.5% Company Data 24 % debt to assets 420% 25 Co. Cost of Debt 12.0% Corp. Beta 26 Tax rate 35.0% Corp Cost Equity 27 Req Premium 4.0% Corp Cost Capital Corp. Hurdle Rate 29 Divisional Data 30 Divisional Hurdle Rates 31 Name Assets Beta Name High Risk 32 Paper Products 38.0% 1.12 COMPANY 33 Timber Production 330% 0.98 Paper Products 34 Wood Milling 15.0% 0.82 Timber Production 35 Plastic Products 9.0% 1.28 Wood Miting 36 Real Estate 5,0% 1.43 Plastic Products 37 100 0% Real Estate 38 Hurdle Rate Multiple 39 Risk Class Project IPR 40 Low 0.90 Project MRR Case 90H 28 Avg. Risk Low Risk File Home Insert Page Layout Formulas Data Review View Help PROTECTED VIEW Be careful-files from the Internet can contain viruses. Unless you need to edit it's safer to stay in Protected View B55 fe D F G E Project IRR Project MIRR High Risk Avg. Risk Low Risk Project NPV Name COMPANY Paper Products Timber Production Wood Milling Plastic Products Real Estate B 39 Risk Class 40 Low 090 41 Average 1.00 42 High 1.10 43 44 Project Cash Flows 45 Year Cash flow 46 O (start up) (225,000) 47 1 47,000 48 2 52,000 49 3 55,000 50 4 57,000 51 5 58,000 52 6 60,000 53 7 62,000 54 8 (+ terminal CF) 125,000 55 56 57 58 MODEL-GENERATED DATA 59 60 Project Cash Flows 61 Year Cash flow Cumulative CF 62 0 (start up) 63 1 64 2 65 3 66 4 67 5 68 6 69 7 70 8 (+ terminal CF) 71 72 Payback 73 74 Company Data 75 Beta 76 Cost Equtly 77 Capital structure 78 debt Case 90H ON IN Home Insert Page Layout File Formulas Dato Review View Help PROTECTED VIEW Be careful-files from the Internet can contain viruses. Unless you need to edit. it's sater to stay in Protected B55 D E G H Cost Equity WACC Hurdle Rate Avg Risk Low Risk 74 Company Data 75 Bela 76 Cost Equtiy 77 Capital structure 78 debt 79 equity 80 Cost Capital 81 Hurdle Rate 82 83 Division Beta 34 85 Paper Products 36 Timber Production 87 Wood Products 88 Plastic Products 89 Real Estate 00 91 92 Risk adjusted hurdle rates 93 Name High Risk 94 95 COMPANY 96 Paper Products 97 Timber Production 90 Wood Mailing 99 Plastic Products 100 Real Estate 101 102 Project IRR 103 Project MRR 104 105 Project NPV 106 Name High Risk 107 COMPANY 108 Paper Products 109 Timber Production 110 Wood Milling 111 Plastic Products 112 Real Estate 113 Case 90H Ready HO OBI Avg. Risk Low Risk AutoSave 01 HD module_6_-_horthern_forest products - Protected View Search Alte File Home Insert Page Layout Formulas Data Review View Help PROTECTED VIEW Be careful--files from the Internet can contain viruses. Unless you need to edit it's safer to stay in Piatected View B55 fo G 11 17 A D 1 Module 6 Student's Model 05/05/15 2 Northern Forest Products 3 4 Risk Adjusted Cost of Capital and Hurdle Rates 5 6 This case illustrates the impact of multiple hurdle rates within a corporation with several different 7 lines of business The model uses an input section to determine the company beta given 8 different divisional risk factors. The model develops the cost of capital for the company using 9 the CAPM and demonstrates the impact of incorporating risk into the hurdle rates and determining 10 the impact of risk adjustments on the acceptability of a project under different risk assumptions 12 This model was developed using Microsoft Excel 5.0 for windows 13 14 If you are using the student version of the model, some of the cells have been blanked out 15 Before using the model, it is necessary to fill in the empty cells with the appropnate formulas 16 Once this is done, the model is ready for use in sensitivity analysis. 18 All cells have been blanked out: 19 Including formulas and inputs, but not labels. 20 21 INPUT DATA OUTPUT DATA 22 Return on Market 142 23. Risk free rate 6.5% Company Data 24 % debt to assets 420% 25 Co. Cost of Debt 12.0% Corp. Beta 26 Tax rate 35.0% Corp Cost Equity 27 Req Premium 4.0% Corp Cost Capital Corp. Hurdle Rate 29 Divisional Data 30 Divisional Hurdle Rates 31 Name Assets Beta Name High Risk 32 Paper Products 38.0% 1.12 COMPANY 33 Timber Production 330% 0.98 Paper Products 34 Wood Milling 15.0% 0.82 Timber Production 35 Plastic Products 9.0% 1.28 Wood Miting 36 Real Estate 5,0% 1.43 Plastic Products 37 100 0% Real Estate 38 Hurdle Rate Multiple 39 Risk Class Project IPR 40 Low 0.90 Project MRR Case 90H 28 Avg. Risk Low Risk File Home Insert Page Layout Formulas Data Review View Help PROTECTED VIEW Be careful-files from the Internet can contain viruses. Unless you need to edit it's safer to stay in Protected View B55 fe D F G E Project IRR Project MIRR High Risk Avg. Risk Low Risk Project NPV Name COMPANY Paper Products Timber Production Wood Milling Plastic Products Real Estate B 39 Risk Class 40 Low 090 41 Average 1.00 42 High 1.10 43 44 Project Cash Flows 45 Year Cash flow 46 O (start up) (225,000) 47 1 47,000 48 2 52,000 49 3 55,000 50 4 57,000 51 5 58,000 52 6 60,000 53 7 62,000 54 8 (+ terminal CF) 125,000 55 56 57 58 MODEL-GENERATED DATA 59 60 Project Cash Flows 61 Year Cash flow Cumulative CF 62 0 (start up) 63 1 64 2 65 3 66 4 67 5 68 6 69 7 70 8 (+ terminal CF) 71 72 Payback 73 74 Company Data 75 Beta 76 Cost Equtly 77 Capital structure 78 debt Case 90H ON IN Home Insert Page Layout File Formulas Dato Review View Help PROTECTED VIEW Be careful-files from the Internet can contain viruses. Unless you need to edit. it's sater to stay in Protected B55 D E G H Cost Equity WACC Hurdle Rate Avg Risk Low Risk 74 Company Data 75 Bela 76 Cost Equtiy 77 Capital structure 78 debt 79 equity 80 Cost Capital 81 Hurdle Rate 82 83 Division Beta 34 85 Paper Products 36 Timber Production 87 Wood Products 88 Plastic Products 89 Real Estate 00 91 92 Risk adjusted hurdle rates 93 Name High Risk 94 95 COMPANY 96 Paper Products 97 Timber Production 90 Wood Mailing 99 Plastic Products 100 Real Estate 101 102 Project IRR 103 Project MRR 104 105 Project NPV 106 Name High Risk 107 COMPANY 108 Paper Products 109 Timber Production 110 Wood Milling 111 Plastic Products 112 Real Estate 113 Case 90H Ready HO OBI Avg. Risk Low Risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts