Question: Excel problem .. I have no clue what Im doing , please specificy what youre answering. PROTECTED VIEW Be careful files from the Internet.can contain

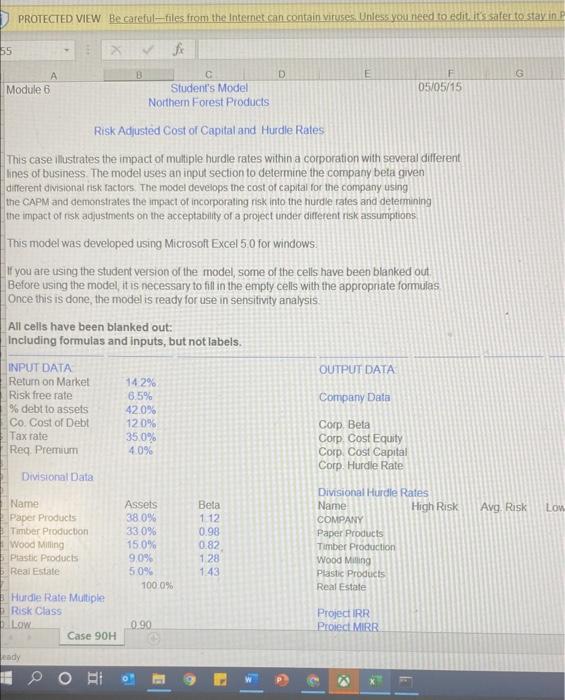

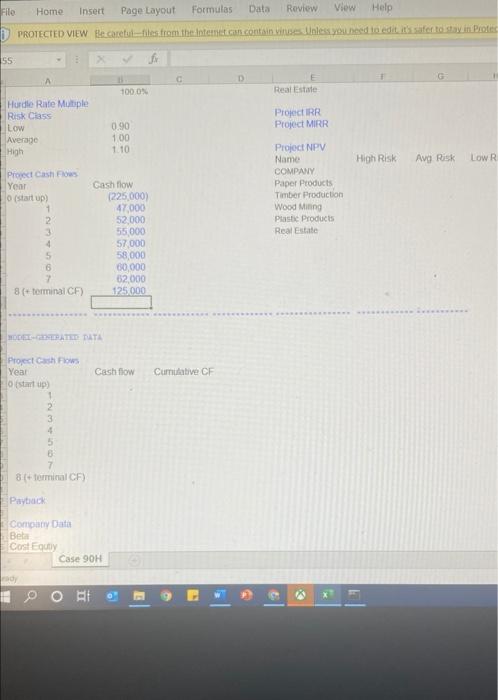

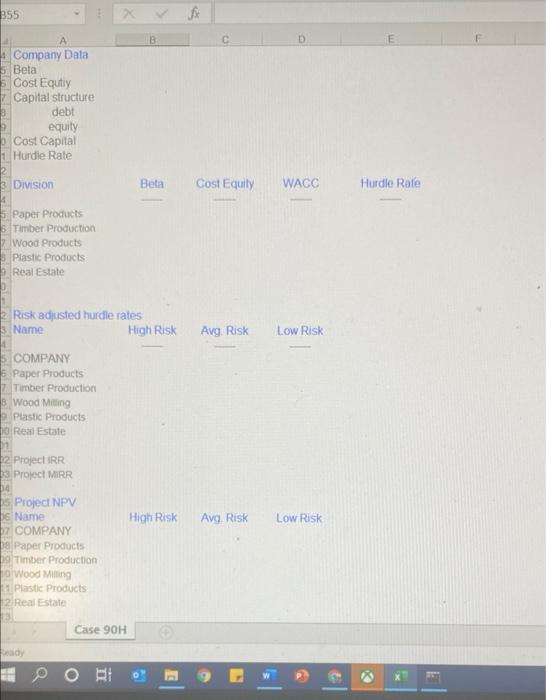

PROTECTED VIEW Be careful files from the Internet.can contain viruses. Unless you need to edit it's alerto stay in P 65 f B D E G Module 6 C Student's Model Northern Forest Products 05/05/15 Risk Adjusted Cost of Capital and Hurdle Rates This case illustrates the impact of multiple hurdle rates within a corporation with several different lines of business. The model uses an input section to determine the company beta given different divisional risk factors. The model develops the cost of capital for the company using the CAPM and demonstrates the impact of incorporating risk into the hurdle rates and determining the impact of risk adjustments on the acceptability of a project under different risk assumptions This model was developed using Microsoft Excel 5.0 for windows. Il you are using the student version of the model, some of the cells have been blanked out. Before using the model it is necessary to fill in the empty cells with the appropriate formulas Once this is done, the model is ready for use in sensitivity analysis All cells have been blanked out: Including formulas and inputs, but not labels OUTPUT DATA Company Data INPUT DATA Return on Market Risk free rate % debt to assets Co. Cost of Debt Tax rate Reg. Premium 14.2% 6.5% 420% 120% 350% 4.0% Corp. Beta Corp Cost Equity Corp Cost Capital Corp. Hurdle Rate Divisional Data Avg. Risk LOW Name Paper Products Timber Production Wood Milling Plastic Products Real Estate Assets 38.0% 330% 15.0% 9.09 50% 100.0% Beta 1.12 0.98 0.82 1.28 143 Divisional Hurdle Rates Name High Risk COMPANY Paper Products Timber Production Wood Miling Plastic Products Real Estate Hurdle Rate Multiple Risk Class LOW Case 90H 0.90 Project IRR Proiect MIRR eady OBI File Homo Insert Page Layout Formulas Data Review View Help D PROTECTED VIEW Be carefulfiles from the Internet can contain viruses Unless you need to edit afer to stay in Protes SS > A D 100 ON Real Estate Hurdle Rate Multiple Risk Class LOW Average High Project IRR Project MIRR 0.90 100 1 10 High Risk Avg Risk LowR Proiect Cash Year o start up) Project NPV Name COMPANY Paper Products Timber Production Wood Mining Plastic Products Real Estate Cashflow (225.000) 47.000 52.000 55.000 57000 58,000 00.000 52.000 125.000 8( terminal CF) MODERATED DATA Cash flow Cumulative CH Project Cash Flow Year startup 1 2 3 4 5 7 8( terminal CF) Payback Company Date Bet Cost Euty Case 90H 0 post 355 B D E Company Data Beta Cost Equtiy Capital structure debt equity Cost Capital Hurdle Rate Division Beta Cost Equity WACC Hurdle Rate Paper Products Timber Production Wood Products Plastic Products Real Estate Avg. Risk Low Risk Risk adjusted hurdle rates Name High Risk COMPANY 5. Paper Products Timber Production 8 Wood Miling Plastic Products 10 Real Estate 01 12. Project IRR 13 Project MRR 14 15 Project NPV 6 Name High Risk 17 COMPANY Paper Products Timber Production Olwood Miling 1 Plastic Products 12 Real Estate Avg. Risk Low Risk Case 90H Ready PROTECTED VIEW Be careful files from the Internet.can contain viruses. Unless you need to edit it's alerto stay in P 65 f B D E G Module 6 C Student's Model Northern Forest Products 05/05/15 Risk Adjusted Cost of Capital and Hurdle Rates This case illustrates the impact of multiple hurdle rates within a corporation with several different lines of business. The model uses an input section to determine the company beta given different divisional risk factors. The model develops the cost of capital for the company using the CAPM and demonstrates the impact of incorporating risk into the hurdle rates and determining the impact of risk adjustments on the acceptability of a project under different risk assumptions This model was developed using Microsoft Excel 5.0 for windows. Il you are using the student version of the model, some of the cells have been blanked out. Before using the model it is necessary to fill in the empty cells with the appropriate formulas Once this is done, the model is ready for use in sensitivity analysis All cells have been blanked out: Including formulas and inputs, but not labels OUTPUT DATA Company Data INPUT DATA Return on Market Risk free rate % debt to assets Co. Cost of Debt Tax rate Reg. Premium 14.2% 6.5% 420% 120% 350% 4.0% Corp. Beta Corp Cost Equity Corp Cost Capital Corp. Hurdle Rate Divisional Data Avg. Risk LOW Name Paper Products Timber Production Wood Milling Plastic Products Real Estate Assets 38.0% 330% 15.0% 9.09 50% 100.0% Beta 1.12 0.98 0.82 1.28 143 Divisional Hurdle Rates Name High Risk COMPANY Paper Products Timber Production Wood Miling Plastic Products Real Estate Hurdle Rate Multiple Risk Class LOW Case 90H 0.90 Project IRR Proiect MIRR eady OBI File Homo Insert Page Layout Formulas Data Review View Help D PROTECTED VIEW Be carefulfiles from the Internet can contain viruses Unless you need to edit afer to stay in Protes SS > A D 100 ON Real Estate Hurdle Rate Multiple Risk Class LOW Average High Project IRR Project MIRR 0.90 100 1 10 High Risk Avg Risk LowR Proiect Cash Year o start up) Project NPV Name COMPANY Paper Products Timber Production Wood Mining Plastic Products Real Estate Cashflow (225.000) 47.000 52.000 55.000 57000 58,000 00.000 52.000 125.000 8( terminal CF) MODERATED DATA Cash flow Cumulative CH Project Cash Flow Year startup 1 2 3 4 5 7 8( terminal CF) Payback Company Date Bet Cost Euty Case 90H 0 post 355 B D E Company Data Beta Cost Equtiy Capital structure debt equity Cost Capital Hurdle Rate Division Beta Cost Equity WACC Hurdle Rate Paper Products Timber Production Wood Products Plastic Products Real Estate Avg. Risk Low Risk Risk adjusted hurdle rates Name High Risk COMPANY 5. Paper Products Timber Production 8 Wood Miling Plastic Products 10 Real Estate 01 12. Project IRR 13 Project MRR 14 15 Project NPV 6 Name High Risk 17 COMPANY Paper Products Timber Production Olwood Miling 1 Plastic Products 12 Real Estate Avg. Risk Low Risk Case 90H Ready

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts