Question: Finance help Morris - Meyer Mining Company must install $ 1 . 5 million of new machinery in its Nevada mine It can obtain a

Finance help

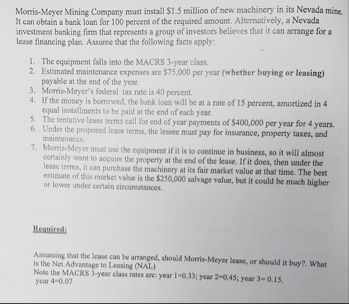

MorrisMeyer Mining Company must install $ million of new machinery in its Nevada mine It can obtain a bank loan for percent of the required amount. Altematively, a Nevada investment banking firm that represents a group of investors believes that it can arrange for a lease financing plan. Assume that the following facts apply:

The equipment falls into the MACRS year class.

Estimated maintenance expenses are $ per year whether buying or leasing payable at the end of the year.

MorrisMeyer's federal tax rate is perceet.

If the money is borrowed, the bank loan will be at a rate of percent, amortized in equal instalimerts to be prid ast the end of each year.

The tentative lease terms call for end of year puyments of $ per year for years.

Under the proposed lease lerms, the lessee must pay for insurance, property taxes, and maimenance.

MorrisMeyer must use the equipment if it is to continue in basiness, so it will almost ecralinty war to asquire the property ar the end of the lease. If it does, then under the lease terms, it can purchase the machinery at its fair masket value at that time. The bers estimate of this market value is the $ salvage value, but it could be moch higher

or lower inder certain circumstances. or lower under certain circumstances.

Bequired:

Assuming that the lease can be arranged, should MorrisMeyer lease, or should it bwy Whar is the Net Advantage to Leasing NAL

Note the MACRS year class rates are: year ; year ; y ear year

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock