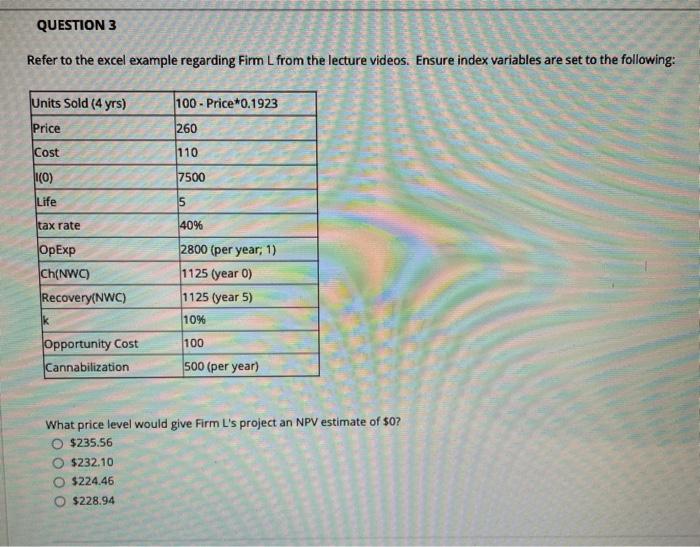

Question: FINANCE HELP PLEASE QUESTION 3 Refer to the excel example regarding Firm L from the lecture videos. Ensure index variables are set to the following:

QUESTION 3 Refer to the excel example regarding Firm L from the lecture videos. Ensure index variables are set to the following: 100 - Price*0.1923 Units Sold (4 yrs) Price 260 Cost 110 (0) 7500 Life 5 tax rate 40% OpExp Ch(NYC) RecoveryNWC) 2800 (per year, 1) 1125 (year 0) 1125 (year 5) K 10% 100 Opportunity Cost Cannabilization 500 (per year) What price level would give Firm L's project an NPV estimate of $0? $235.56 $232.10 O $224.46 $228.94 QUESTION 3 Refer to the excel example regarding Firm L from the lecture videos. Ensure index variables are set to the following: 100 - Price*0.1923 Units Sold (4 yrs) Price 260 Cost 110 (0) 7500 Life 5 tax rate 40% OpExp Ch(NYC) RecoveryNWC) 2800 (per year, 1) 1125 (year 0) 1125 (year 5) K 10% 100 Opportunity Cost Cannabilization 500 (per year) What price level would give Firm L's project an NPV estimate of $0? $235.56 $232.10 O $224.46 $228.94

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts